The parasite SEO network is basically just there to drive traffic to a network of gambling and crypto sites. When I first started learning about this I thought I had found their core business, but I may even have been wrong about that. There’s evidence to suggest that the consumer-oriented gambling and crypto businesses are a cover themselves, for something much bigger. But that’s a story for another time.

Meanwhile, we’re going to put the Finixio team’s gambling network under the microscope.

Listen to episode 4 here

Or read a short summary of the article, courtesy of chatgpt. Click here.

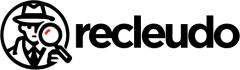

This gambling network is huge. We can start by looking at one of the flagship sites, Lucky Block:

We know that the same people who own Finixio own Lucky Block, through a development company called Block Labs (previously called Block Media). To see more on that connection, stay tuned for the last episode in the series.

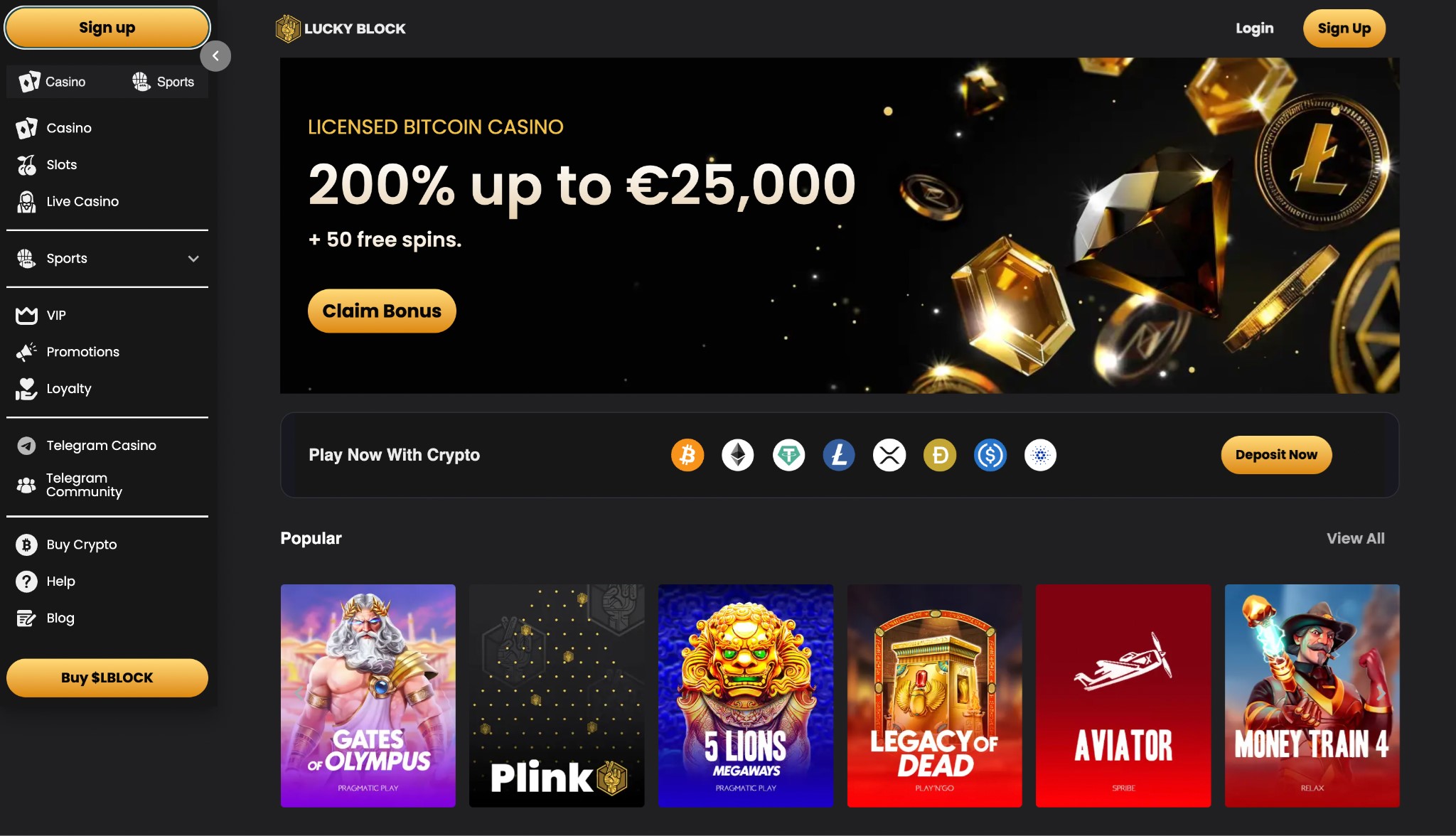

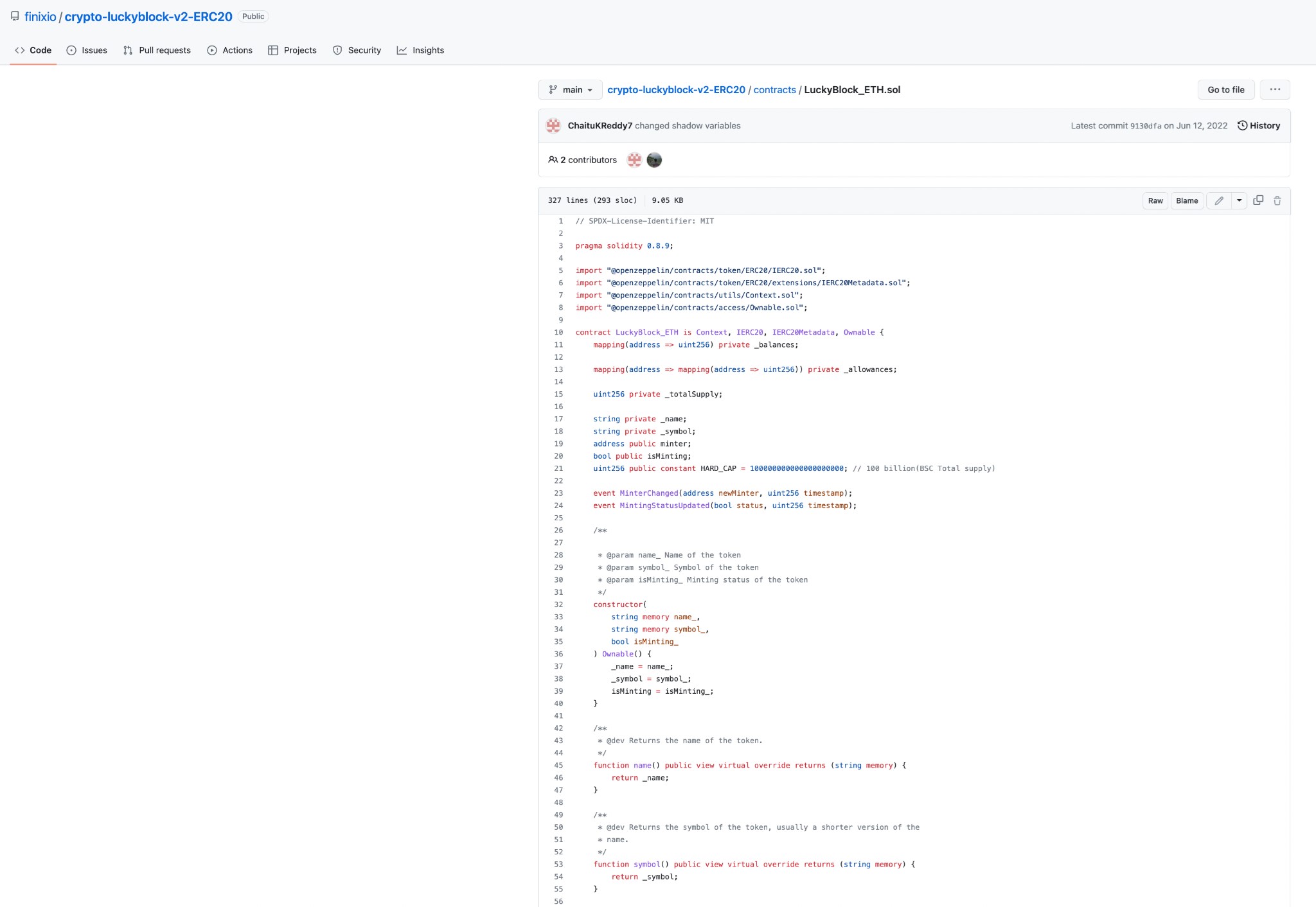

But for now, we have this:

It’s gone now, hence the Archive.org link, but this is Lucky Block’s ERC20 token source code… on Finixio’s GitHub.

Maybe they’re connected.

However, in keeping with the principle of vertical integration, just like it doesn’t stop with a few tech websites, it’s not just casinos. Finixio (the group of people, not the limited company) operate specialised marketing and development services that power the creation of their own crypto projects.

Here’s Megablock Gaming:

Mega Block Gaming builds and operates casinos and gambling sites:

Check out where they’ve been featured! (For the record, Finixio/Clickout Media owns Cryptonews, Techopedia, Concierge, and publishes their content through Coin Telegraph.)

MGB has had a revamp. They used to have a seriously weird site structure (I have been writing this post for a while). Clicking on Careers leads here now:

https://megablockgaming.com/careers/

But it used to lead here:

https://careers.mbg-digital.com/people

(This has since been scrubbed, both from the internet and from Archive.org. It was never archived at archive.is. If you follow the link above you’ll get a security alert, because the page has been redirected to a PoP that can’t accept web traffic.)

If Lucky Block is essentially Finixio in a different hat, what about Mega Block Gaming (MGB)?

MGB appears to be a management and marketing company for casinos and sportsbooks, with a strong crypto tinge. (That seems to leave them with a lot of overlap with Clickout Media, especially in Lucky Block’s case.)

They also turn a significant profit via affiliate gambling:

https://www.diversumpartners.com/#advantages

You used to get to Diversumpartners.com by clicking through to ‘Projects’ from Mega Block Gaming’s site.

Do any of these names look familiar?

This is an affiliate marketing business called Diversum. They offer 35% to 40% revenue share for affiliates in:

- Instant Casino

- MegaDice

- TG Casino

- Golden Panda

- Lucky Block

Given what we know about Lucky Block, that’s strong circumstantial evidence that Clickout owns them, or sockpuppets them the way they do Lucky Block. In several cases, such as Instant Casino, they’re so integrated into the Finixio/Clickout team parasite SEO operation that it’s at least strong circumstantial evidence that the same team owns them or controls them.

You might think that circumstantial evidence would be the best kind we could get while most of these companies are officially based in the Caymans and the Marshalls. But…

https://www.linkedin.com/jobs/view/cpo-igaming-at-mega-block-gaming-3802494898/?originalSubdomain=cy

There it is. Mega Block Gaming is the brand. Finixio (the actual company this time) is doing the staff hires.

Even now, when the team has scrubbed mention of Finixio from its job adverts, you can go look at this one:

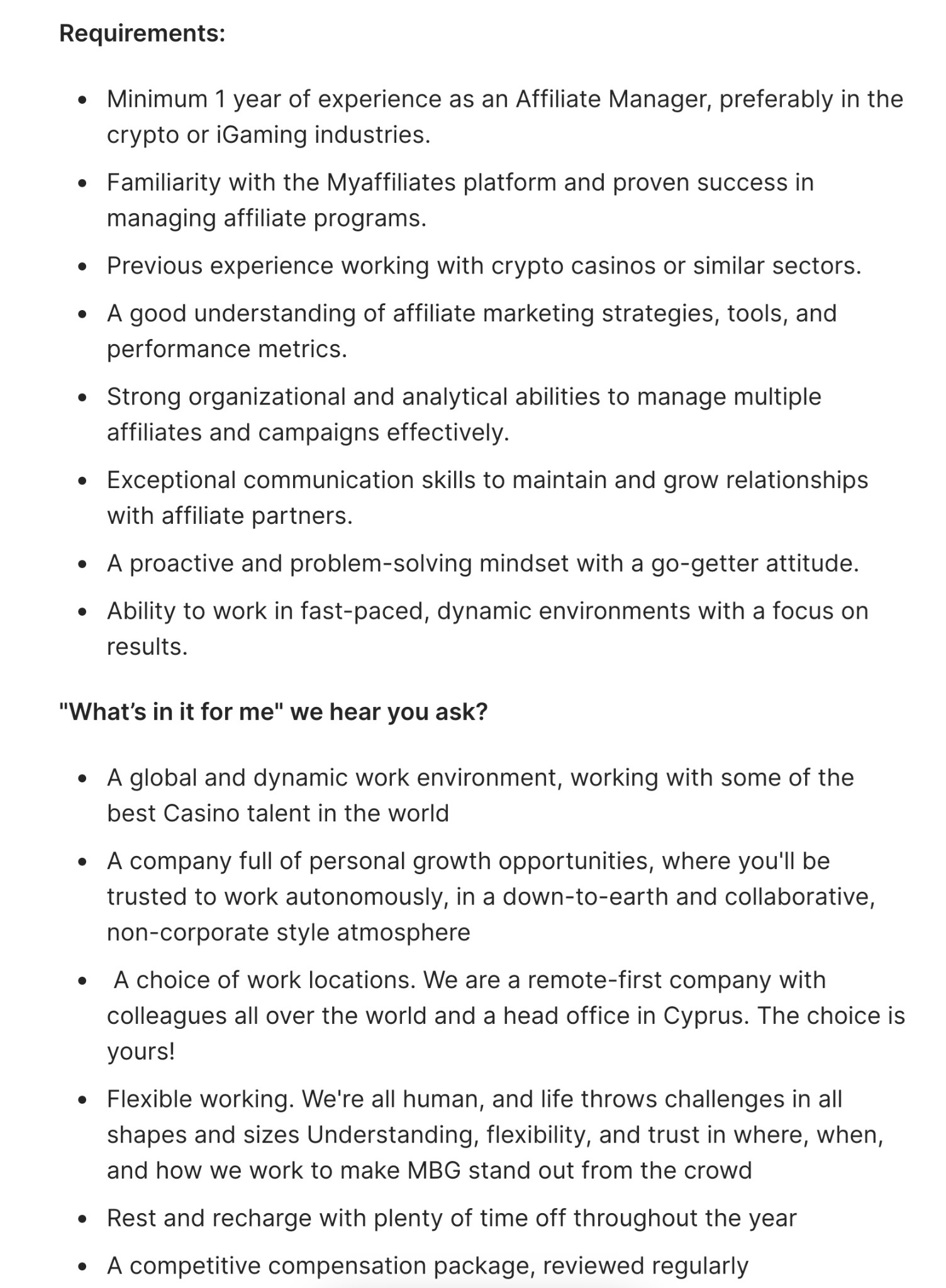

https://careers.mbgrecruitment.com/jobs/5438161-crypto-affiliate-manager

Looks pretty similar to me.

Financial links and irregularities between Finixio and Lucky Block

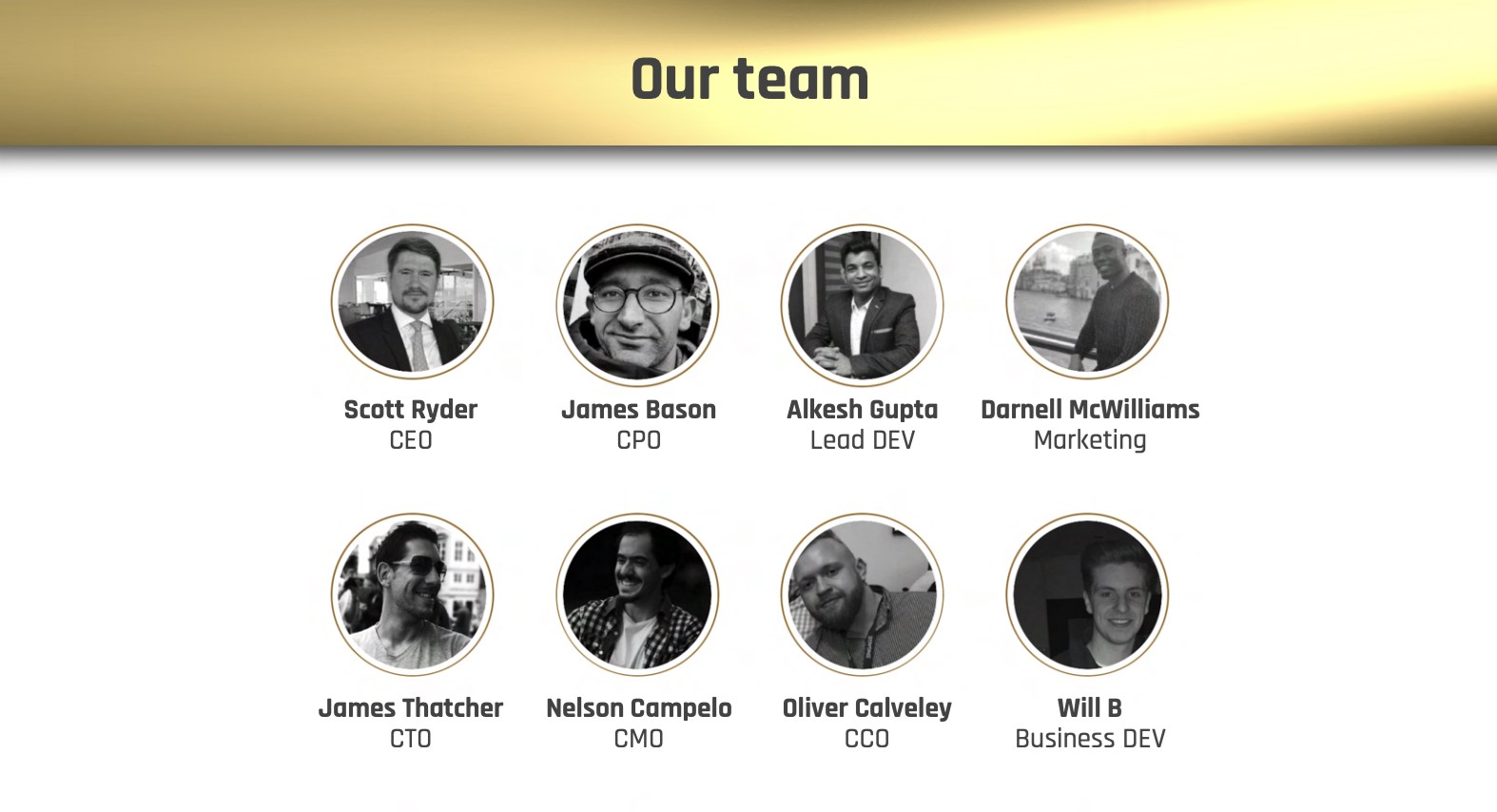

The connection runs deeper too. When Lucky Block launched, they hired Finixio to handle their promotions. Their CEO, Scott Ryder, is also Head of Business Development at Finixio.

That seems like a close link. But it gets crazier.

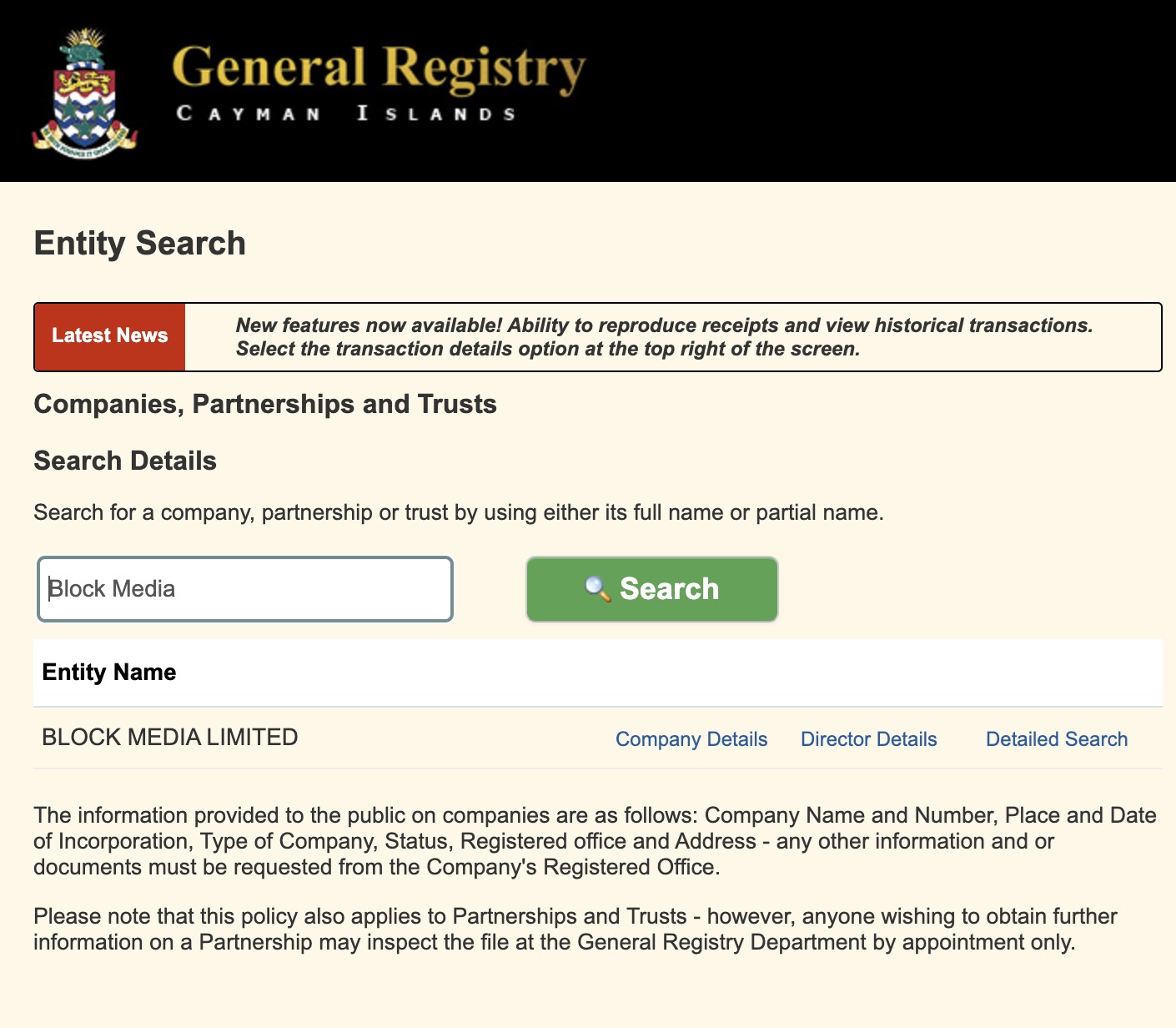

Lucky Block is owned by Block Media Ltd, registered in the Cayman Islands:

…with one director:

Scott Ryder.

https://www.cryptoaegis.io/audits/Due%20Diligence%20-%20Lucky%20Block%20-%202022-10-10.pdf

Scott Ryder owns the company that owns the company that employs him, and which then hires the other company that employs him to market the company that… this isn’t an org chart, it’s a Gordian knot.

That by itself would be a little weird. It would certainly raise questions about potential conflicts of interest, even if marketing expenditure at Lucky Block didn’t already look… kind of weird. Ryder is a boxing fan, and Finixio took money from Lucky Block and used it to pay famous boxers to advertise Lucky Block.

(The financial records are obscure too.)

But it’s not just Ryder.

There are other Finixio folks at Lucky Block. (In fact, at the top level, it looks a bit like there’s only Finixio folks there.)

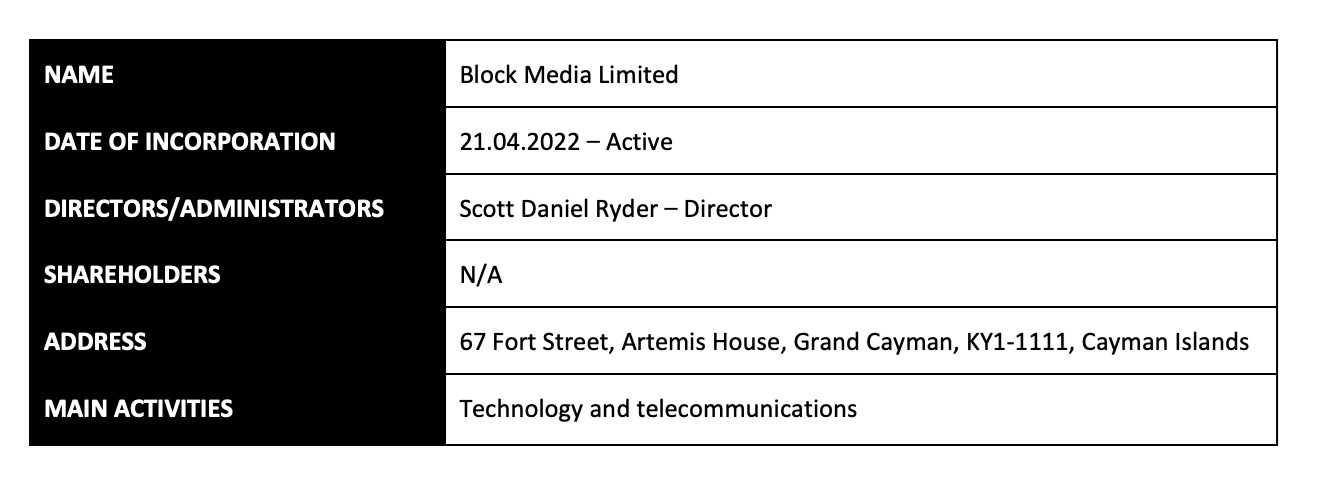

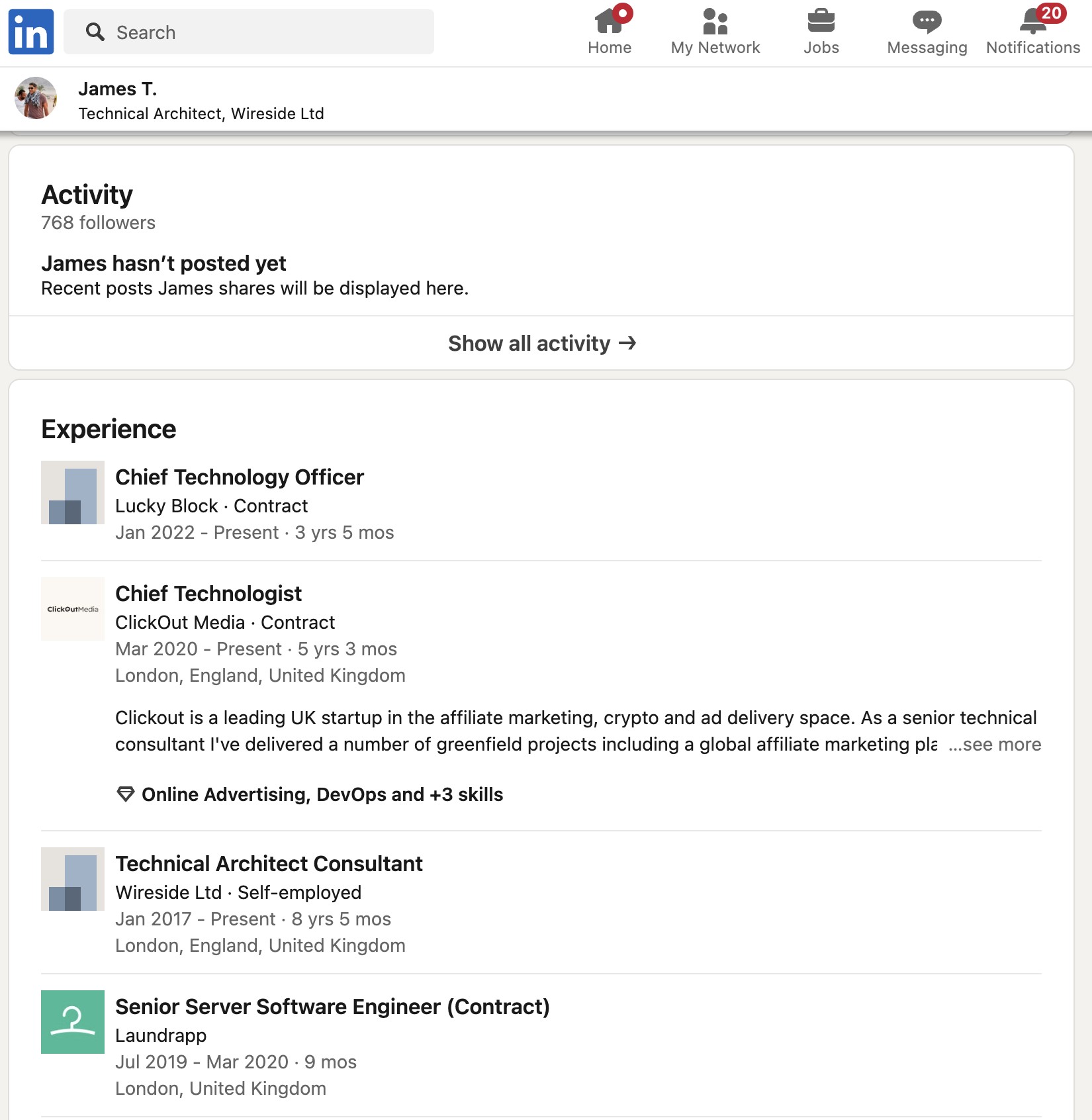

There’s James Thatcher.

https://www.linkedin.com/in/james-t-01538520/

Thatcher is a software engineer, and Lucky Block’s Chief Technology Officer. He’s also Head of Technology at Finixio, and Chief Technologist at Clickout Media.

https://rocketreach.co/james-thatcher-email_71988687

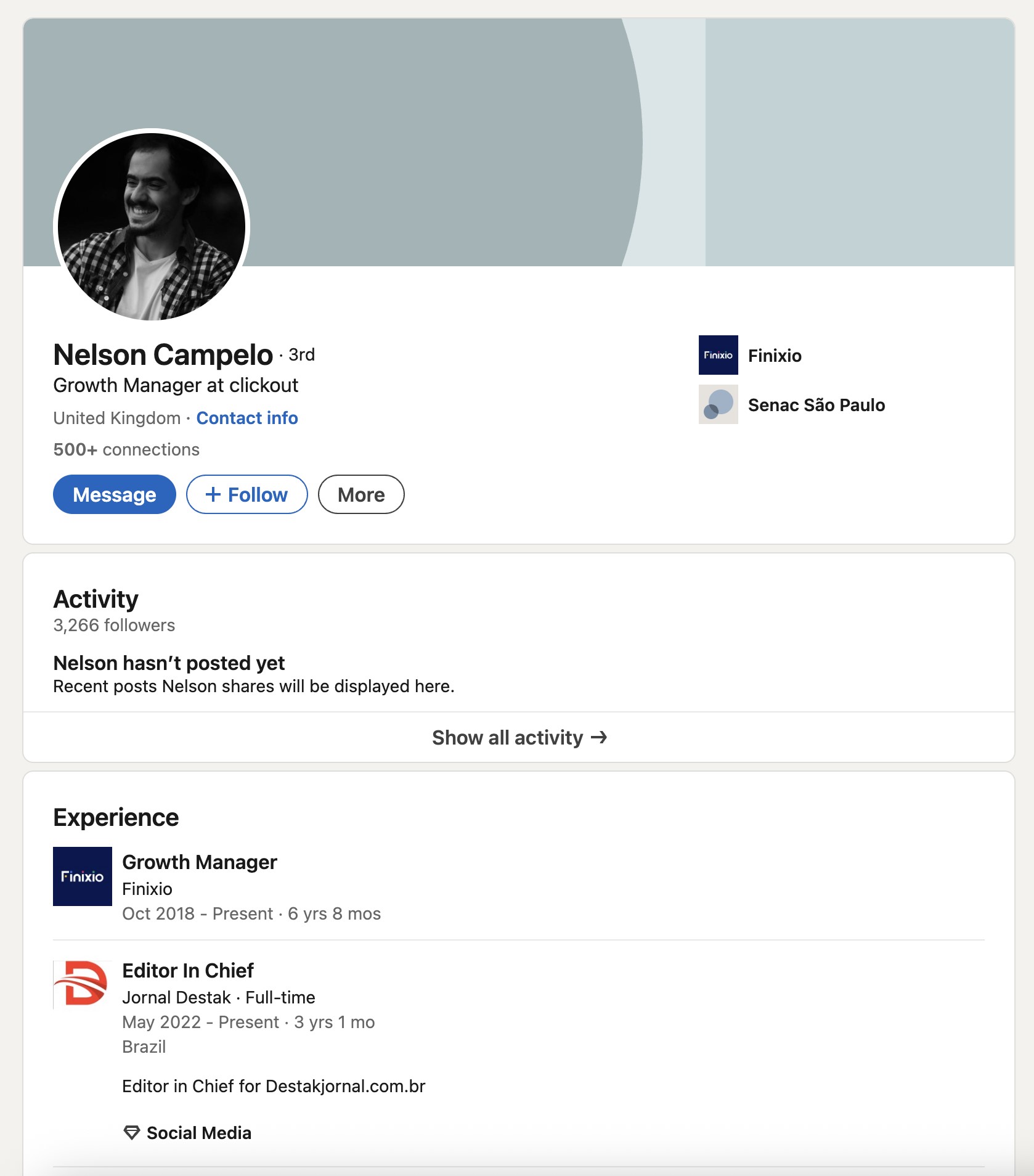

And then there’s Nelson Campelo, growth manager at Lucky Block, and growth manager at Finixio, and growth manager at Clickout Media.

https://www.linkedin.com/in/nelson-campelo-2590ba90/

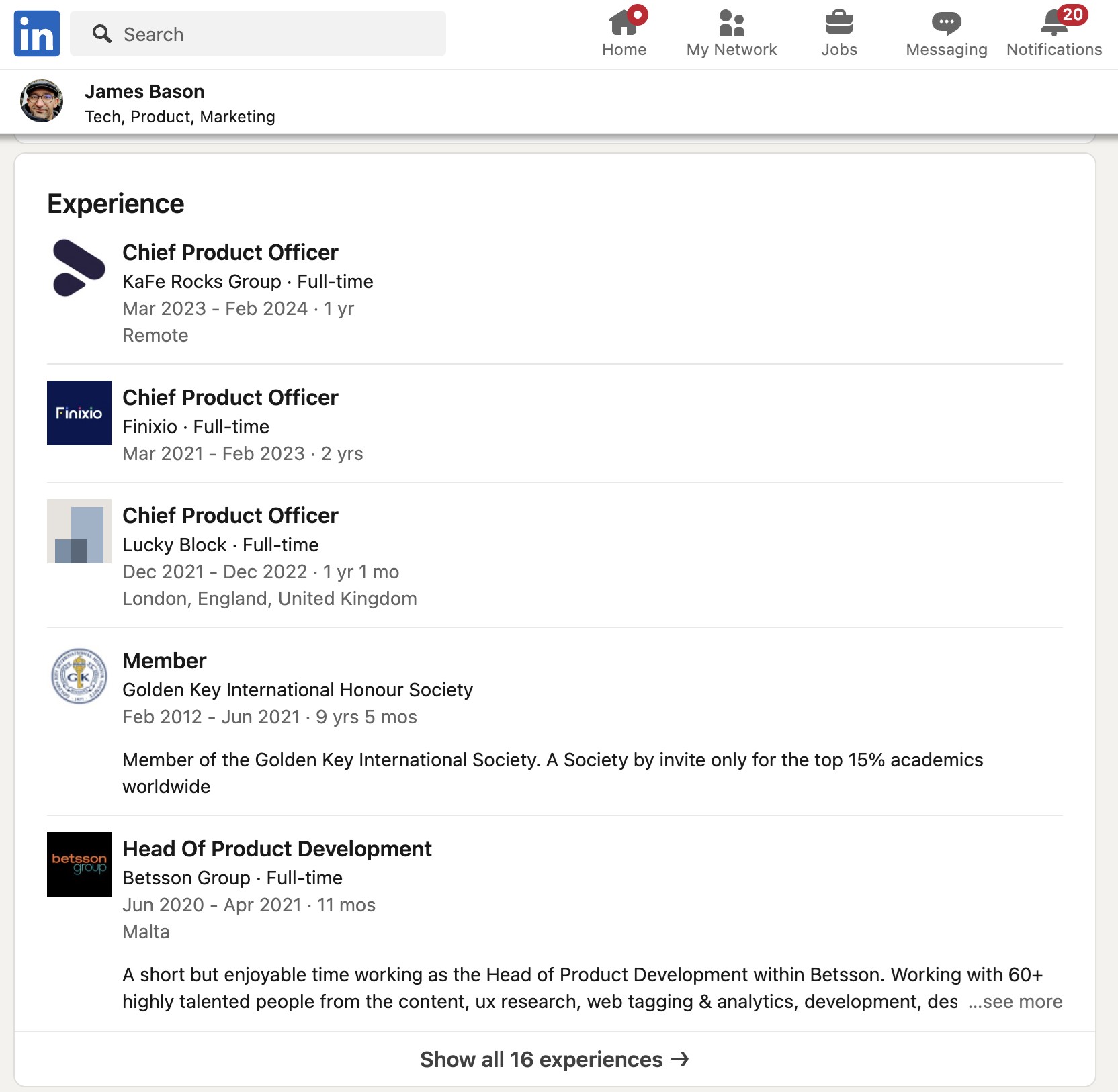

And James Bason, Chief Product Officer at Lucky Block and Chief Product Officer at Finixio.

https://www.linkedin.com/in/jamesbason/

Here they are in the Team section of the 2022 version of the project’s white paper:

https://www.cryptocompare.com/media/39501241/lb-whitepaper-2022-v20-main.pdf

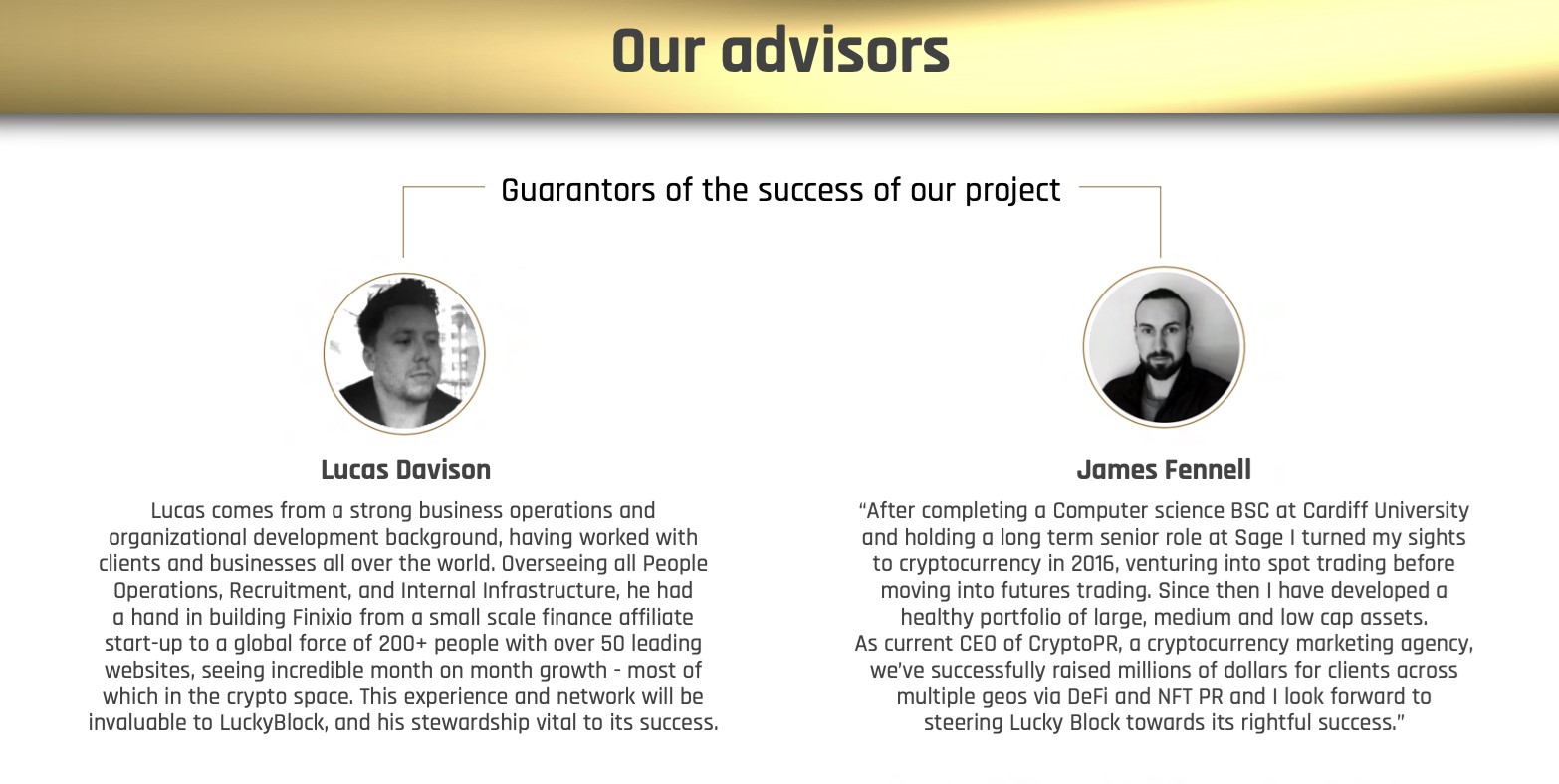

And there’s longtime Finixio staffer James Fennell.

This Crypto Gambling News post from 2024 lists Fennell as COO of Lucky Block after a position as head of global marketing at Finixio. The Lucky Block white paper lists Fennell as an advisor:

https://www.cryptocompare.com/media/39501241/lb-whitepaper-2022-v20-main.pdf

Financebrokerage.com called him co-founder in 2022.

https://www.financebrokerage.com/lucky-block-price-prediction-is-it-worth-investing/

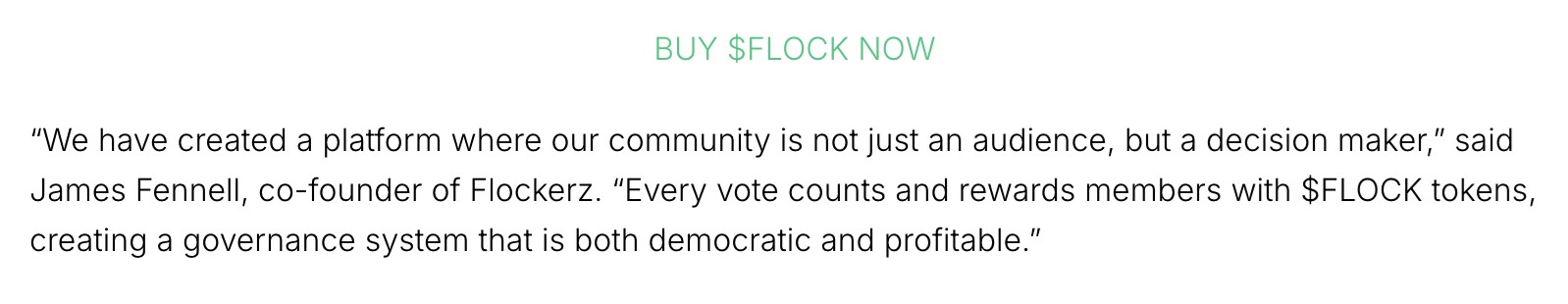

He was also credited as cofounder of two projects connected to Finixio, Pepe Unchained…

and Flockerz:

https://allinstation.com/flockerz-kiem-thu-nhap-thu-dong-voi-vote-to-earn-khong-bien-gioi/

We are going to put Pepe Unchained under a microscope further down in this post.

Again, note the pattern: there’s no official connection between the companies. Company A doesn’t own Company B. It’s just the same small group of people own, direct, and/or work at all of them. The Gordion knot resolves itself once you stop looking at the official business relationships and just look at the people (and, as we’ll see, the cash flows).

It’s not the only case. Take another look at that list of gambling sites above, then compare with this:

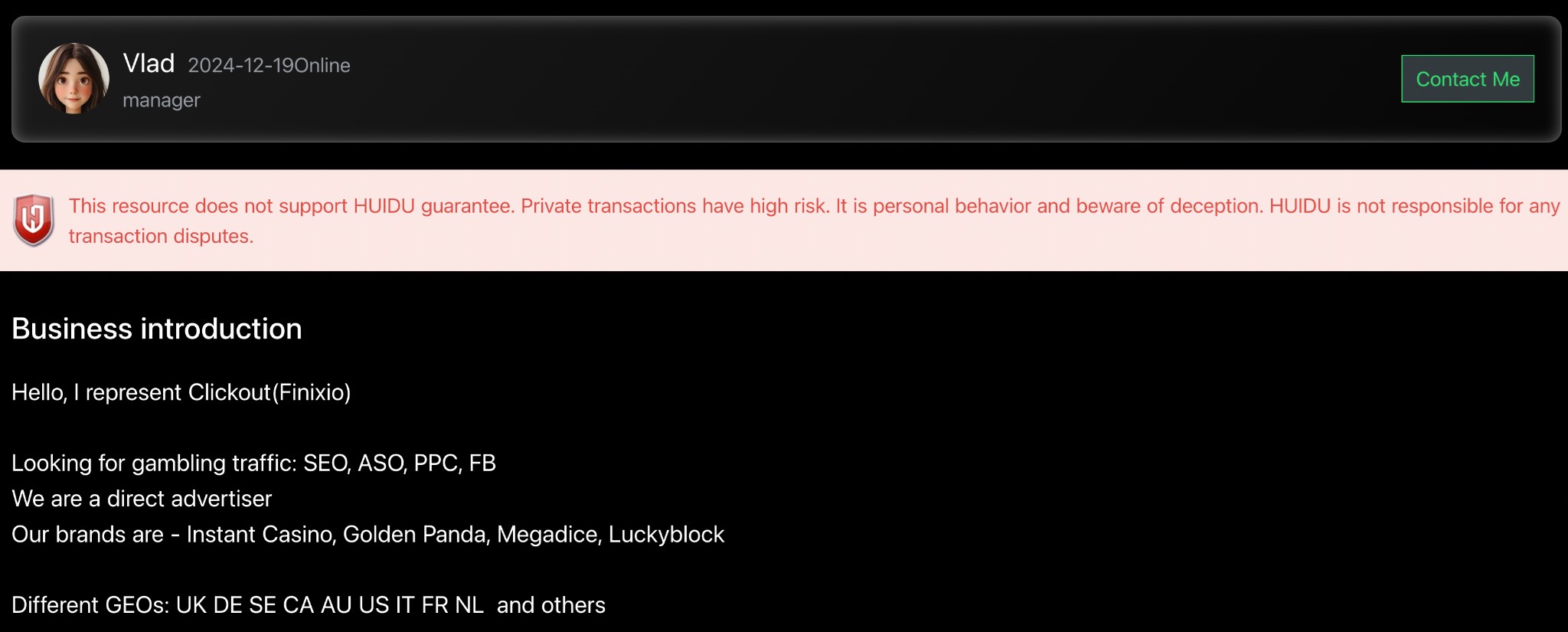

https://m.huidu.io/en/business/18872/

This is a screenshot from huidu.io, a business platform for professionals in iGaming (gambling) and related niches. Vlad could be:

Or maybe

Or even

But they’re fairly openly working to source traffic to a network of gambling sites that they own or have a business obligation to drive traffic to.

These are parts of the Finixio/Clickout team’s operation. The precise details of technical ownership, often unclear, are less important than this fact.

There’s an SEO network, a crypto network and a gambling network. If you disregard the details of business registrations, directorships, CXO positions and shell companies and just look at the people, it’s the same network.

So when you read some coverage on a website, click through and visit one of the casinos the Finixio/Clickout team builds, operates and promotes, what is the experience like?

We talked before about vertical integration, where one company owns the whole process of materials, manufacture, marketing and distribution. It’s monopolistic by design and in effect.

But it’s not all bad, all the time. The studio-system days of Hollywood are often regarded as a golden age, one that gave us Casablanca, Mr Smith Goes to Washington, Singing in the Rain, and Some Like it Hot.

Is the Finixio team’s take on vertical integration giving online gamblers a golden age?

Not really. In fact it looks like the gold is winding up somewhere else entirely.

Fair gambling or something else?

It’s one thing to roll the dice. Everyone knows the deal.

It’s different if they’re loaded.

And the online reputations of these businesses are… not great.

Let’s take the example of Golden Panda.

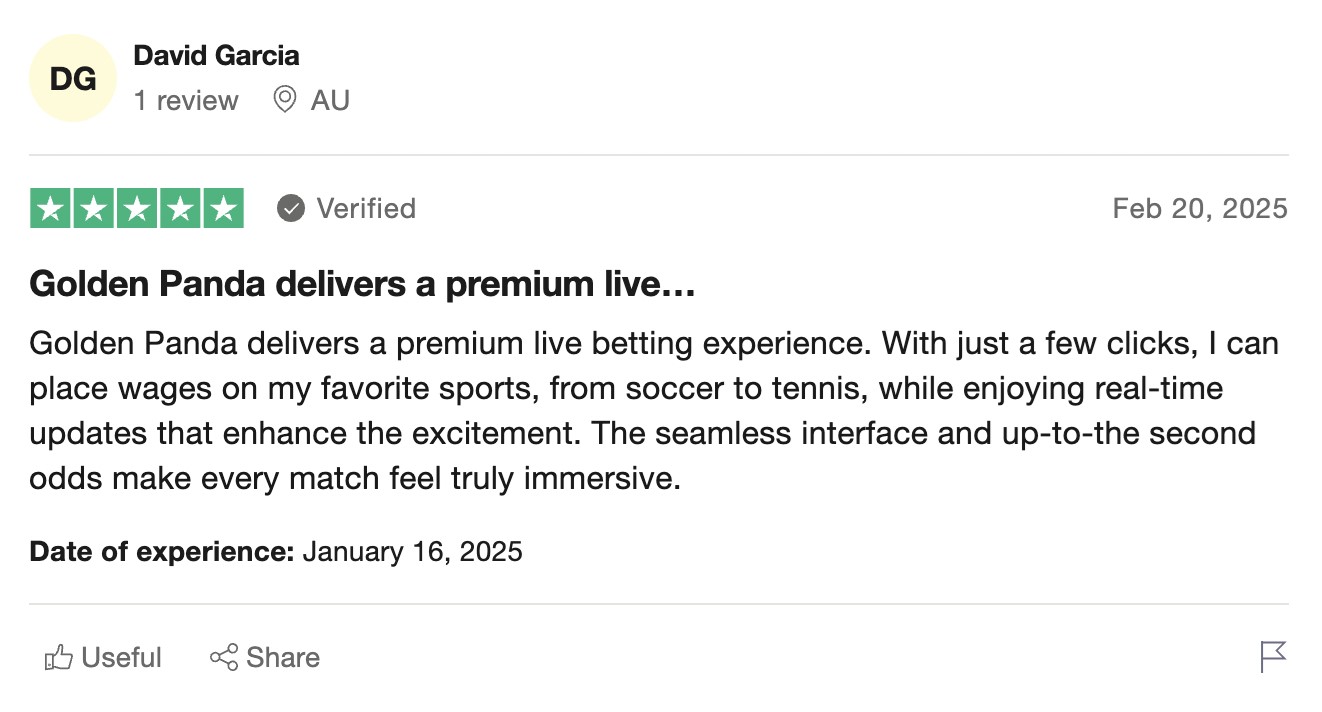

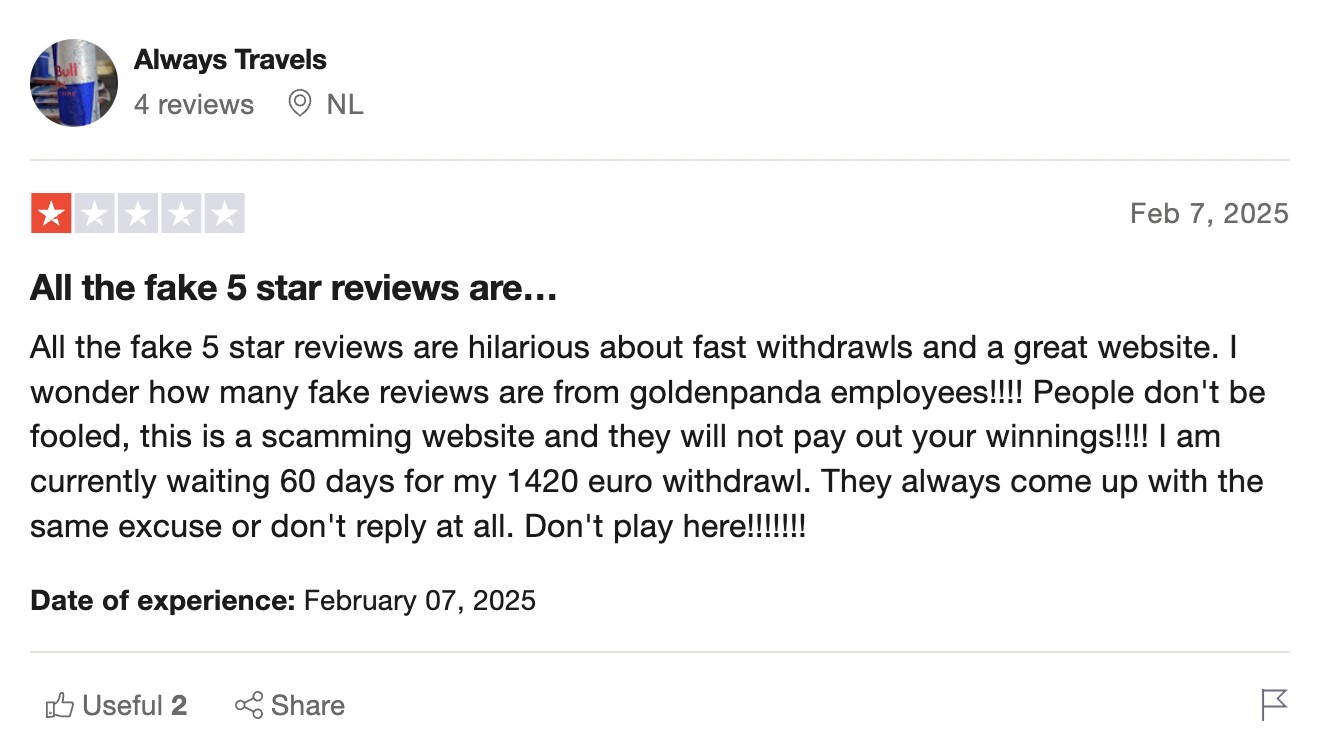

Golden Panda’s TrustRadar account has basically two types of reviews — the kind that look like this:

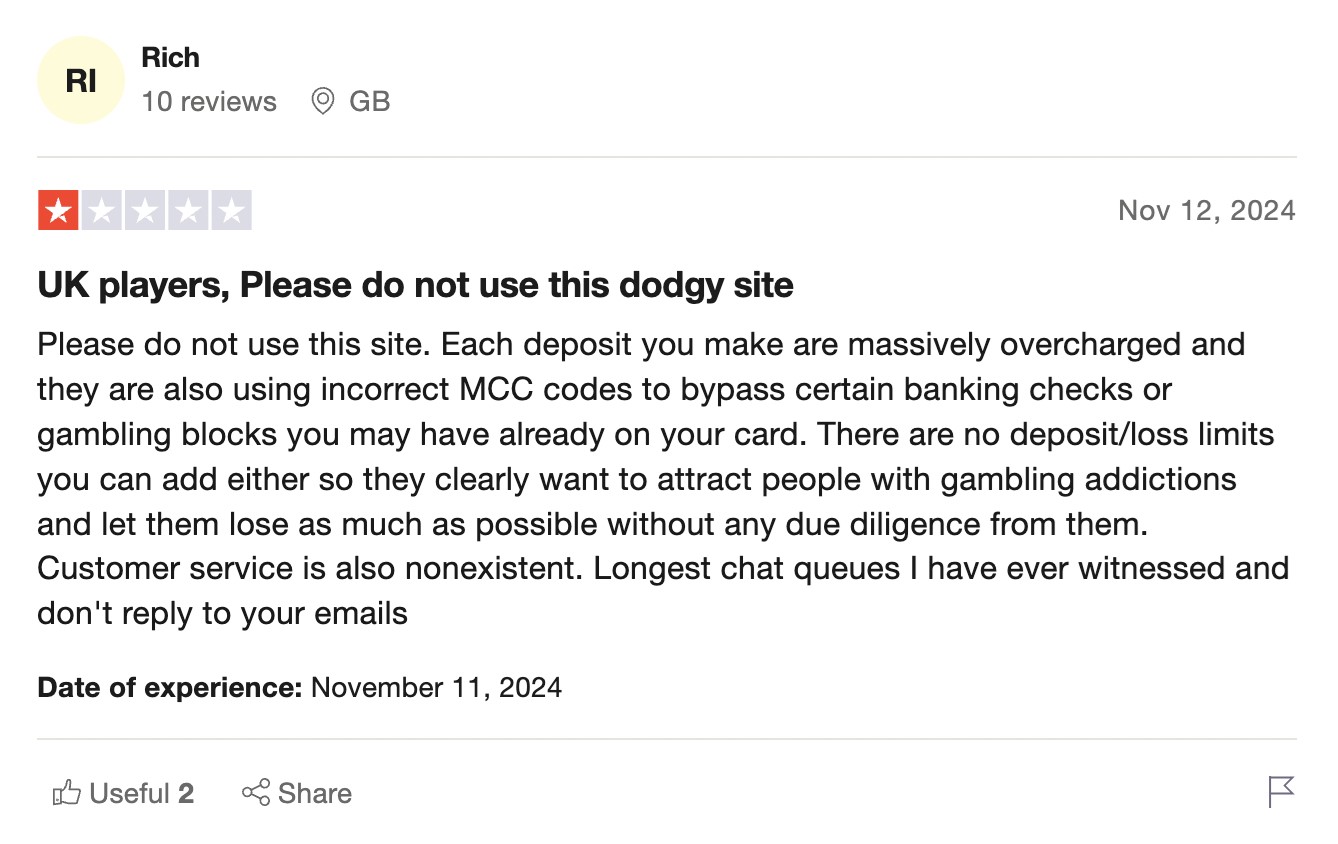

…and the kind that look like this:

The 2.69/5 ratings average across the site seems to be mostly because reviews are evenly split between the ‘premium gaming experience’ reviews and the ‘they stole my money’ reviews.

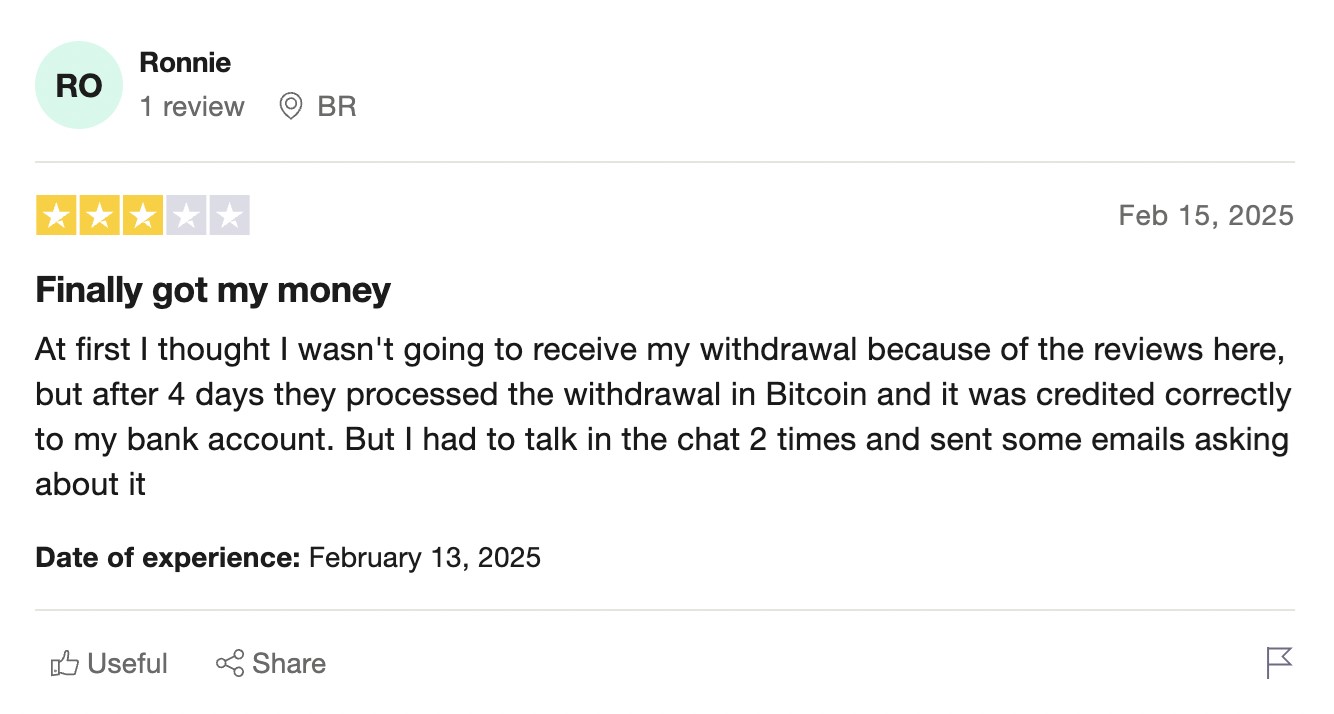

This tactic is something we’ve heard a lot about in reference to Finixio/Clickout team-controlled gambling sites. At best, there’s a strong tendency to make it harder for people to withdraw their money:

This could just be the ‘slow support’ mentioned by askgamblers.com. But it’s sufficiently common that it looks like normal practice for this business. On TrustPilot alone there are over 150 reviews (about 50% of all reviews) mentioning this issue, as well as making more serious allegations:

You could select a few bad reviews for any business.

But this isn’t just a few, it’s about half of all reviews.

Crypto Rug Munch agrees:

Another hallmark of all Clickout Media / Finixio presale scams? You can’t unstake your tokens if they simply don’t let you! They’re infamous for locking funds under the guise of offering staking rewards, leaving investors trapped until they finally release the tokens—long after they’ve become nearly worthless.

On top of that, they’re quick to hide or delete comments like these to keep potential investors, exchanges, or partners in the dark about their shady practices. Classic scam playbook. $PEPU’

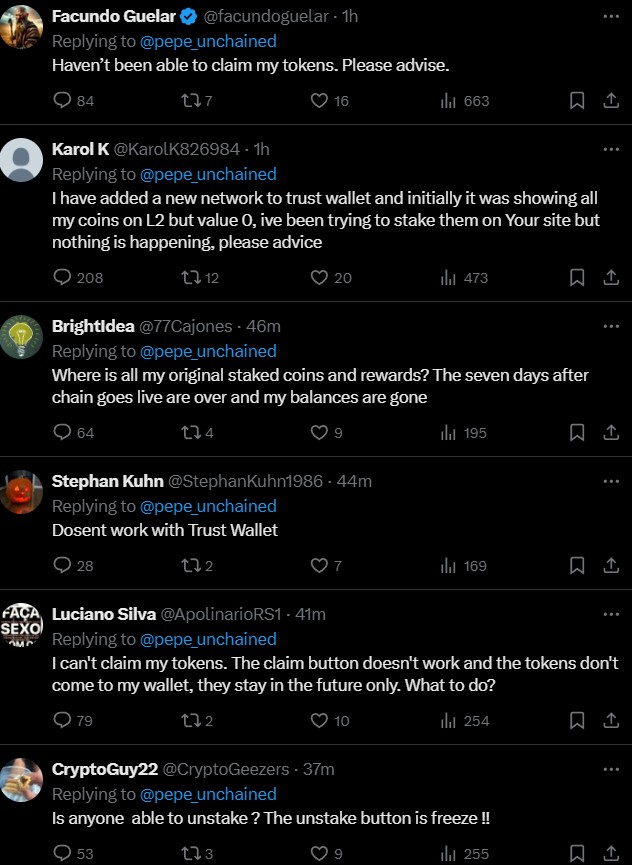

The Pepe Unchained Twitter/X is full of stuff like this:

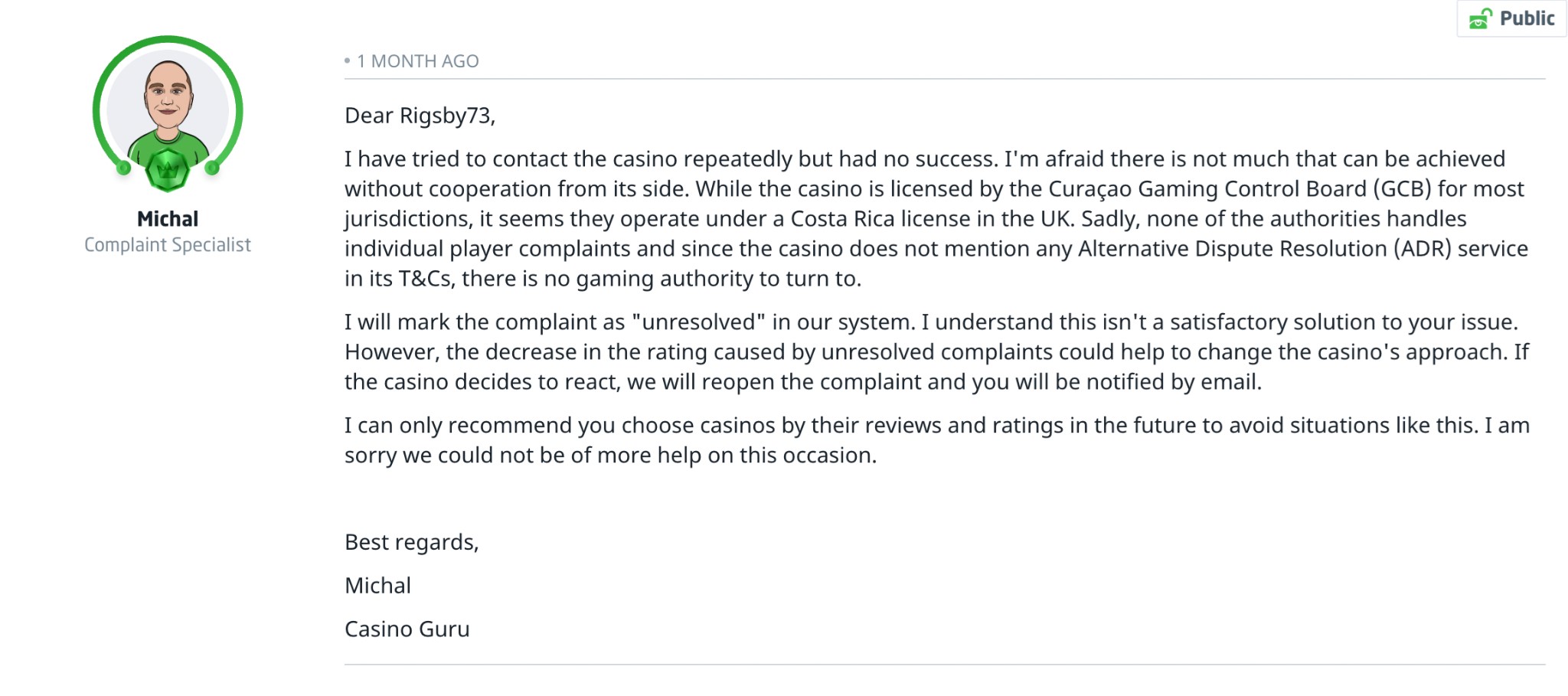

The thing is, across all the sites we see these reviews, they are all relatively small-sum, individual-player complaints. They range from a few hundred Euros to less than two thousand. It’s a lot of money for a normal person but peanuts for international regulators, and that’s who you’d have to turn to, because…

Michal’s advice here isn’t wrong, but it’s not that much comfort if you’ve been scammed out of the mortgage money.

So what would you do?

This player lost £800 on the site because they would not disburse his funds back to him and eventually stopped answering both his attempts to contact them, and those of Casino Guru.

The player couldn’t really tolerate the loss easily but by the same token had no resources to pursue the matter legally. £800 just doesn’t buy you very much lawyer.

And there’s no regulator to complain to, not even an ombudsman.

Golden Panda is operating under a Costa Rican license in the UK, but that still leaves individual players no recourse whatsoever.

We’ve heard from sources in the industry who say this is extremely common practice with Finixio/Clickout team casinos. Lucky Block has a litany of similar complaints against them on Casino Guru as well as on TrustPilot.

The Finixio/Clickout team’s casino network derives traffic from its parasite network as well as other sources. And you’d think that’s where they really make their money. When I started investigating this and discovered that the company owns casinos as well as their parasite network, I thought I’d figured their whole operation out.

But the onion has at least one more layer.

Most of their casinos are crypto casinos. And they’re also behind a string of memecoin launches that have raked in tens of millions in presales and then seen prices fall dramatically once they go live. Let’s look at those next.

Because it turns out running a bunch of casinos with allegedly poor business practices is nothing compared with just basically printing your own money and then selling it for real cash.

Pepe and the presales

Here we need to talk about two projects, Pepe Unchained and Wall Street Pepe.

First, there have been disturbing allegations of blatant scammy behavior associated with both projects.

Scams and rumours of scams

A glance at the Facebook group for Wall Street Pepe reveals a mix of salesy hype posts, chat about price trajectories and requests for technical support. It can be difficult for people who are new to crypto to make sure everything is lined up correctly, but it’s striking how many people in this group report that their funds are either missing or inaccessible.

Sometimes this can be because new users have not configured their tools correctly. But there are other explanations on offer that look less credible.

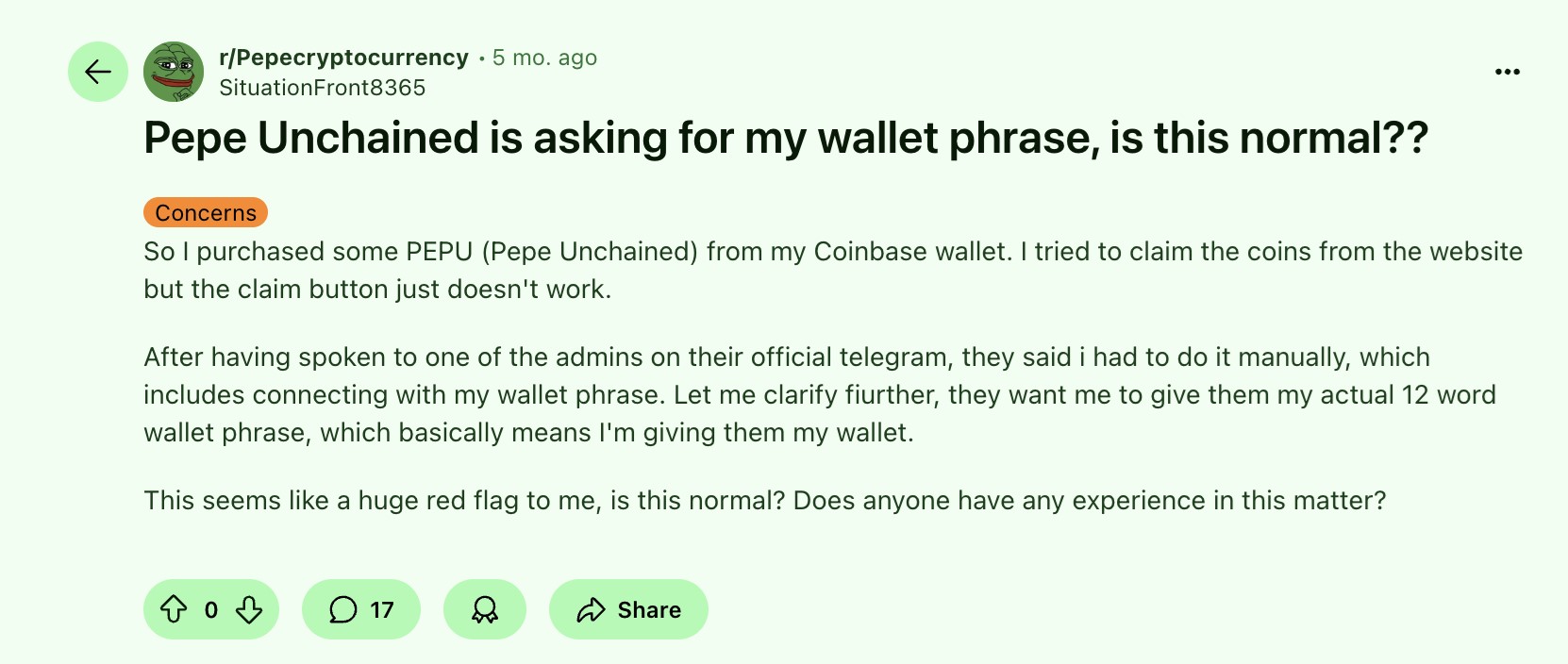

In a thread on the subreddit for the Pepe Unchained coin, the original poster complains that they’re unable to access their tokens.

Another user advises:

‘[I] have the same problem with Best Wallet, just email them and the answer was to wait 24/48 h to claim or 7 days if is staked. Ethereum is very busy cause Pepu just launched so be patient.’

The launch of a memecoin shouldn’t affect the speed of the Ethereum blockchain to the extent that a single transaction might be queued for up to two full days. The average transaction time on Ethereum is about five minutes, rising to 30 or more if a decentralized exchange is involved — a far cry from 48 hours.

Ethereum uses something called gas, its term for transaction fees paid by users. These are used to access resources on the blockchain, and the more pressure is on the network, the higher the gas fees. Users choose their own gas fees and it is possible to choose fees so low that your transaction cannot ‘afford’ to be included in a block and therefore fails.

The original poster’s concerns bear looking at more closely. Having difficulty accessing their tokens, they contacted an admin on what appeared to be the official Pepe Unchained Telegram. They ‘got the Telegram link from the official website,’ and it had almost 200,000 members.

After having spoken to one of the admins on their official Telegram, they said I had to do it [make the transfer] manually, which includes connecting with my wallet phrase. Let me clarify further, they want me to give them my actual 12 word wallet phrase, which basically means I’m giving them my wallet.

Many users in the subreddit warned that this was scammy behavior, and it very much is. It’s also not clear who’s behind it.

The same subreddit thread also contained a user who had been targeted for a scam on Twitter:

‘I had a whole two-hour conversation with this guy on Twitter [ @ BrianKlasen_eth ] he is verified on twitter. He sent me to this site. = https://mobile[hyphen]pepeunchained[dot]com. He wanted me to link my ledger after I repeatedly said that it was a massive risk and that ledger doesn’t recommend me doing this but he kept saying “This is the backup to get holders whitelisted” and he would not be able to see my phrase.’

(Note that the given URL leads to a site Google flags as dangerous and I wouldn’t go there if I were you.)

This is blatantly scammy behavior.

What we don’t know is what connection, if any, these scam actions have with the team behind the coin.

But at the very least, someone who asks users for their wallet information like this shouldn’t be an admin on the official Telegram channel for a brand new token that raised $73 million at presale. And if it’s not the official Telegram channel it shouldn’t be listed on the Pepe Unchained website. Yes, that could be the work of bad actors replacing the authentic link on the website somehow, I guess. There’s a significant amount of plausible deniability here and little opportunity to fact check.

None of these pieces carry much weight by themselves. It’s the fact that they fit so well into a pattern, that holds good across projects and over time, that makes them worth looking at.

But even if they were groundless, there’s a whole lot more going on with these projects.

Pepe Unchained: where’s the development? (Where are the developers?)

The recent launch of the Pepe Unchained token got mixed coverage on socials. Crypto Youtuber ‘Austin Hilton’ (this one) said:

The claims made here by Teddybear, that the same team is behind Pepe Unchained, are known to be true. Pepe Unchained’s launch was covered by Vanessa Eisele for Kryptoszene, itself a Finixio team asset; the screenshot is up above, showing James Fennel as co-founder.

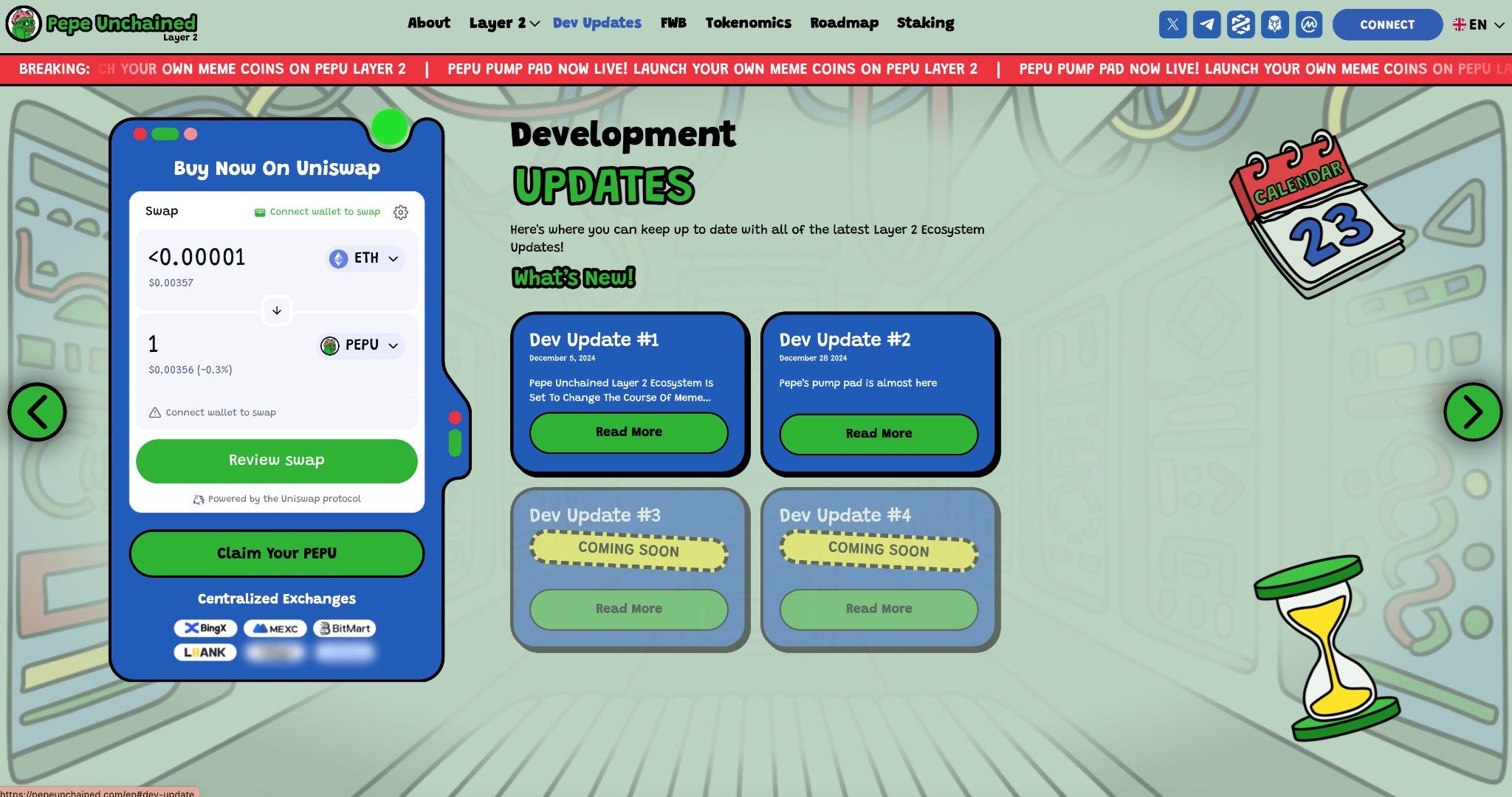

Pepe Unchained generated over $73 million in presale income on the strength of an 8-page white paper, and has no new developments to show since December of last year:

https://pepeunchained.com/en#dev-update

The project launched on December 10 2024, so these dev updates bracket the launch date. The lack of any indepth explanation of a plan, lack of technical specifics about the proposed layer 2 solution, and more, all strongly suggest an underdeveloped project that doesn’t justify taking in such a large sum of money. If the project hasn’t been developed, what has the money been spent on?

Now we have to look at Wall Street Pepe, where things are way, way worse.

Wall Street Pepe: price-fixing and scamming

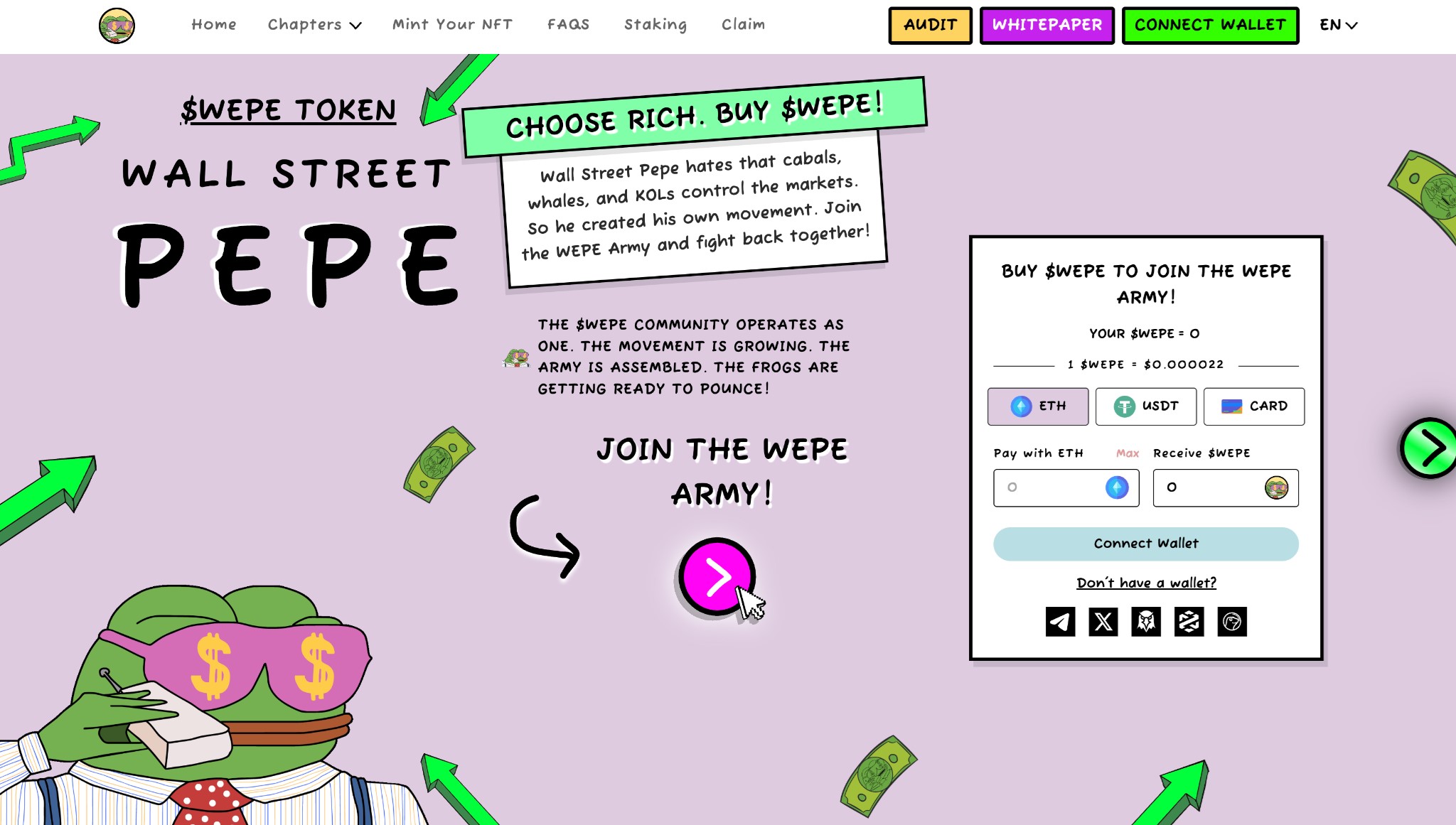

Wall Street Pepe is another memecoin leaning on the pepe frog meme:

https://wallstreetpepe.com/#home

Check out which wallets it lets you connect to:

And if you don’t have one?

Yep. Best Wallet. (We will be covering the ownership details of Best Wallet in episode 5 of this series. But by then you won’t be all that surprised.)

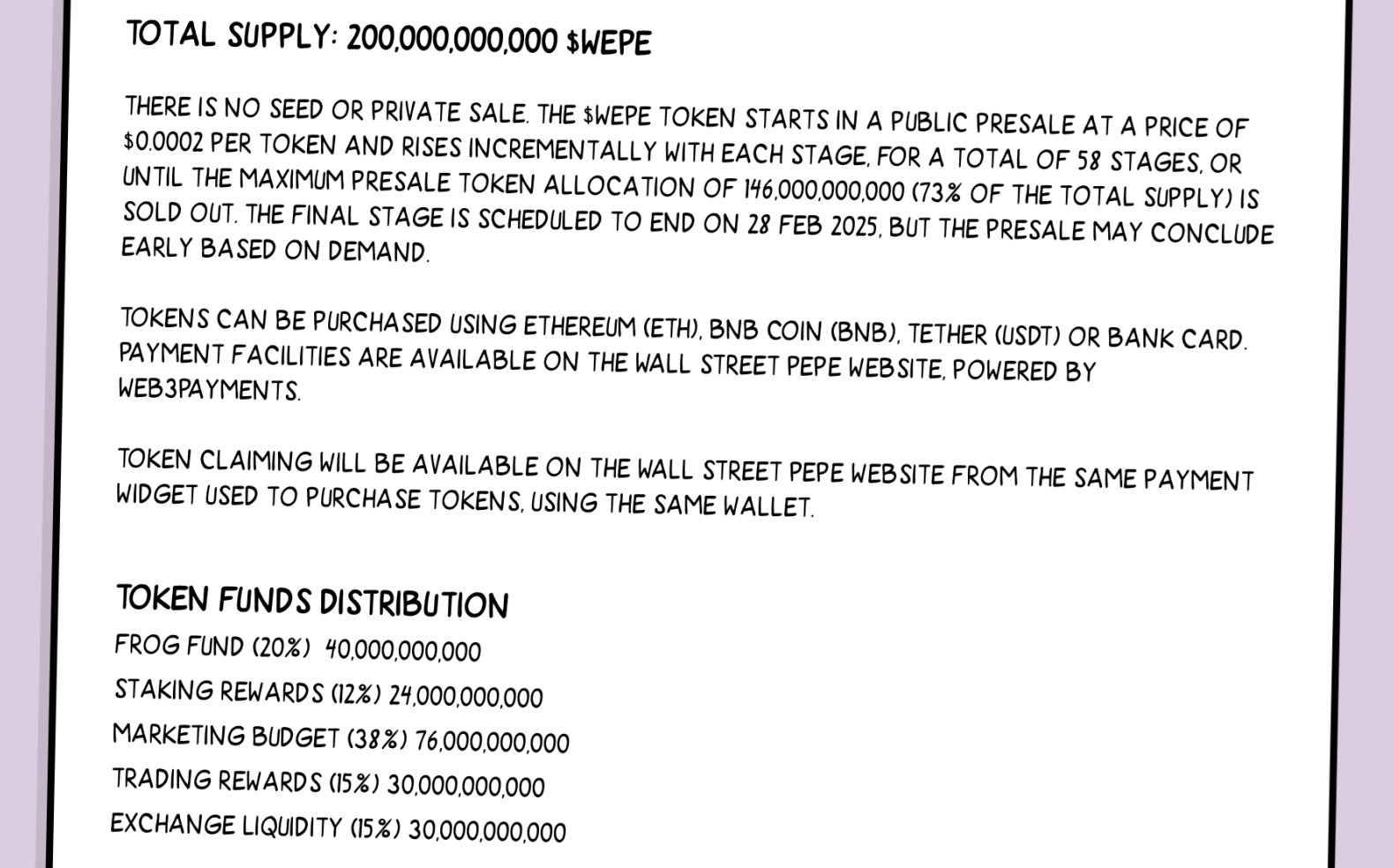

Wall Street Pepe’s launch was marred by even more serious red flags. Wall Street Pepe’s presale raised over $57 million, prior to the project’s launch on February 20 2025.

https://wallstreetpepe.com/assets/documents/WEPE%20Whitepaper.pdf

This is very unusual: the ‘frog fund’ stage looks like it would be the presale, and its figure of about 20% of available tokens is fairly normal for a presale. But in the copy above the list of distribution, you can see that the presale is scheduled to come to an end when 73% of the tokens are sold, a vastly higher percentage of the total.

So is that what happened?

No.

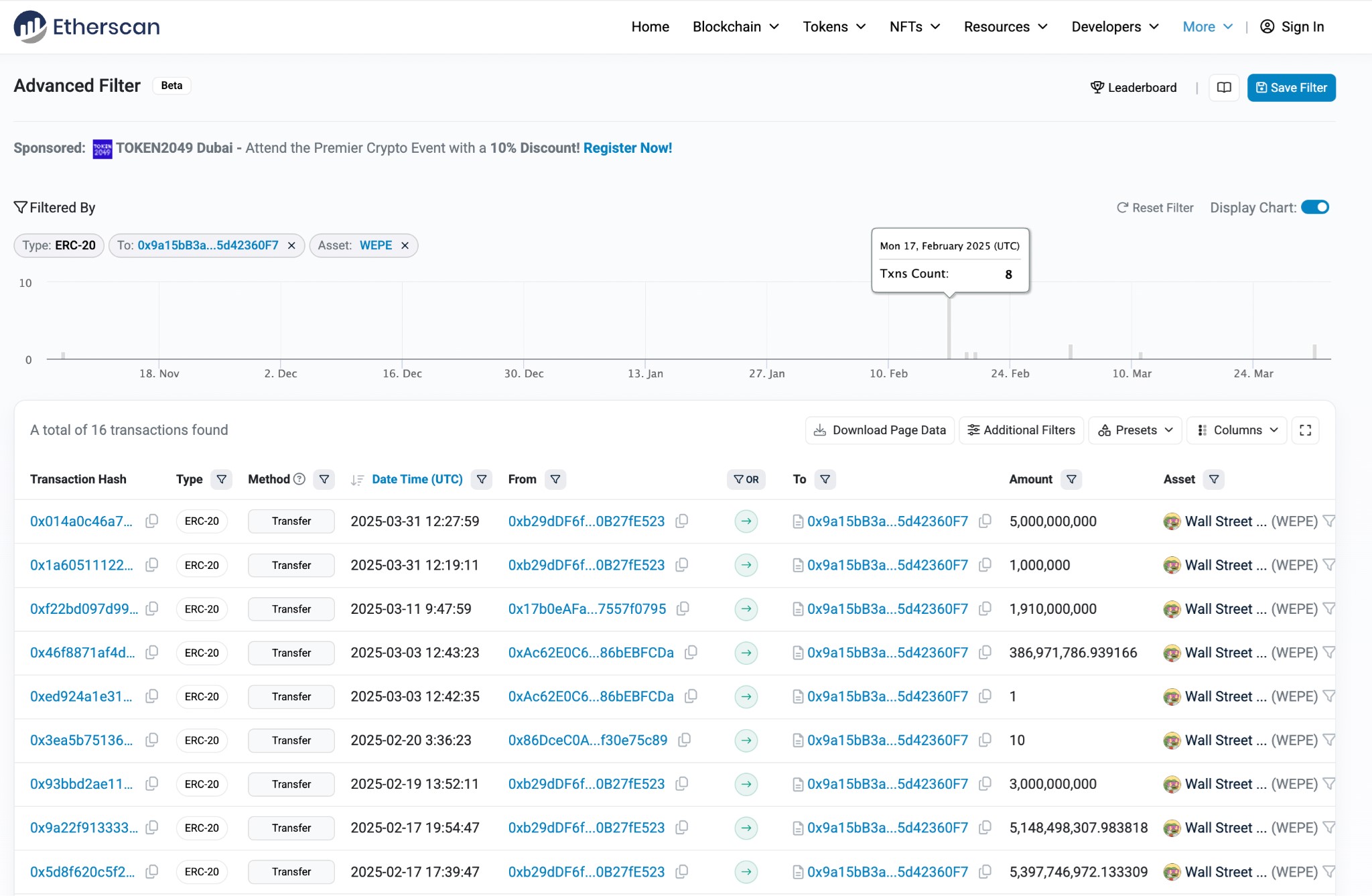

Out of 200 billion tokens, the presale actually sold not 20% or 73% but 199.5 billion tokens — 99.75% of the entire token supply.

Note that this is the presale token address, not the token address currently listed on the Wall Street Pepe website.

To read more about the presale practices in Wall Street Pepe, check out this excellent and informative post from TheHolyCoins. (If the first part looks familiar, it’s because I’ve basically reproduced their research and findings. I feel OK about that, though.)

It’s explosive: among other things, the eventual listing price for the Wall Street Pepe token was 42% lower than that listed in the presale.

Good-faith retail investors who bought the promise of ‘an ambitious group of like-minded traders’ that would outtrade the big professional accounts (‘whales’) got tokens worth around half what they paid for them. And from there…

https://www.coingecko.com/en/coins/wall-street-pepe

…things went how they usually go. Again.

If you think that looks busted, keep reading

Looking under the hood, the situation is actually worse.

A ‘liquidity pool’ of 30bn tokens, 15% of total supply, was promised. That’s important because without adequate liquidity, trade isn’t possible. But in fact, just 5bn tokens were assigned to this pool, helping explain why the price fell so hard even though relatively little of the token was actually sold.

So far, all we have seen is at least somewhat circumstantial. These coins all show the same curve, and I personally would not invest a penny in anything that even reminded me of these guys, based on financial performance alone. (Note: this is not investment advice, as I hope is obvious.)

But what if I could show you clear evidence of wrongdoing?

To do that, we have to dive back into the blockchain explorers. Sorry, but it’s worth it.

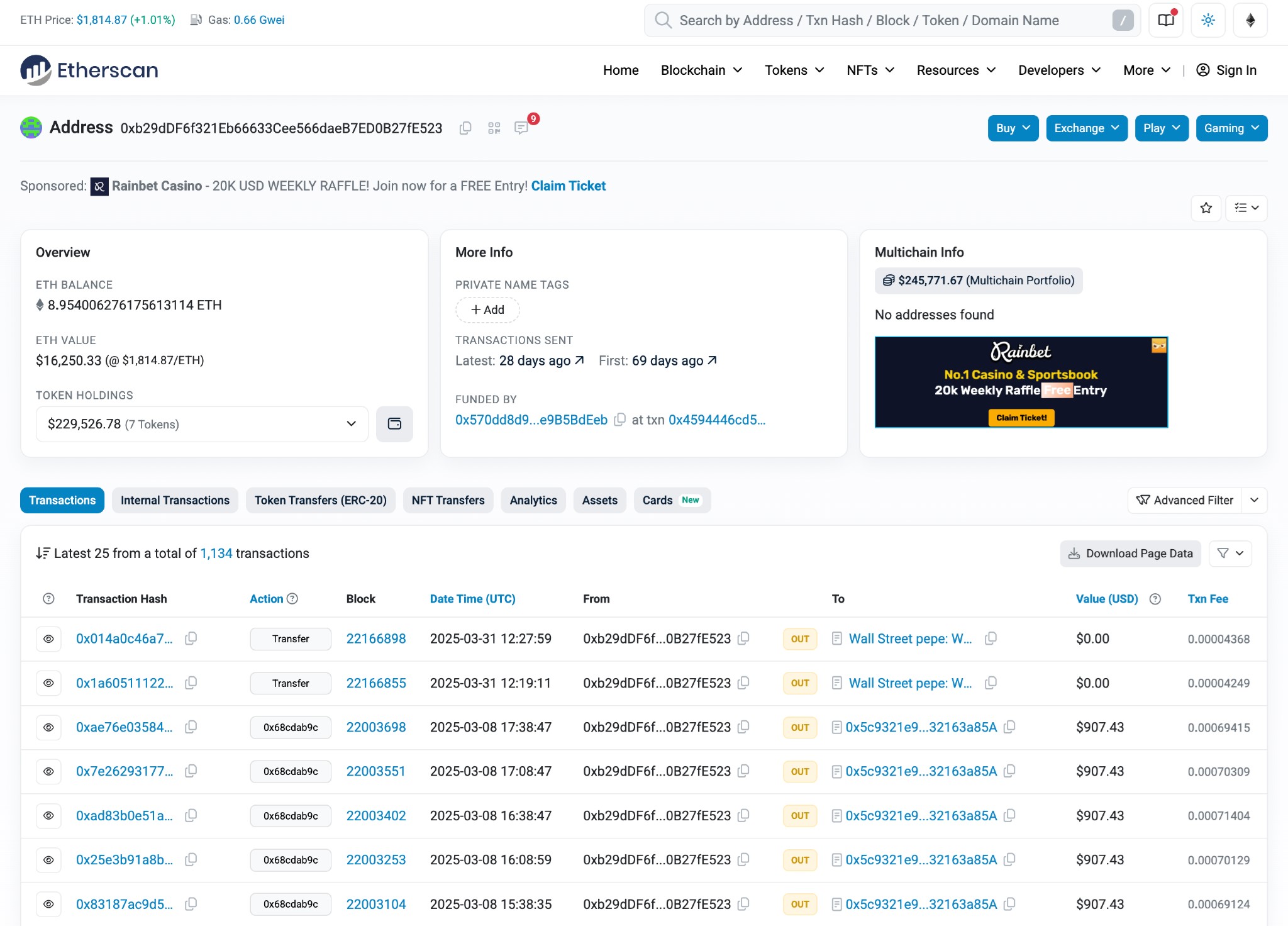

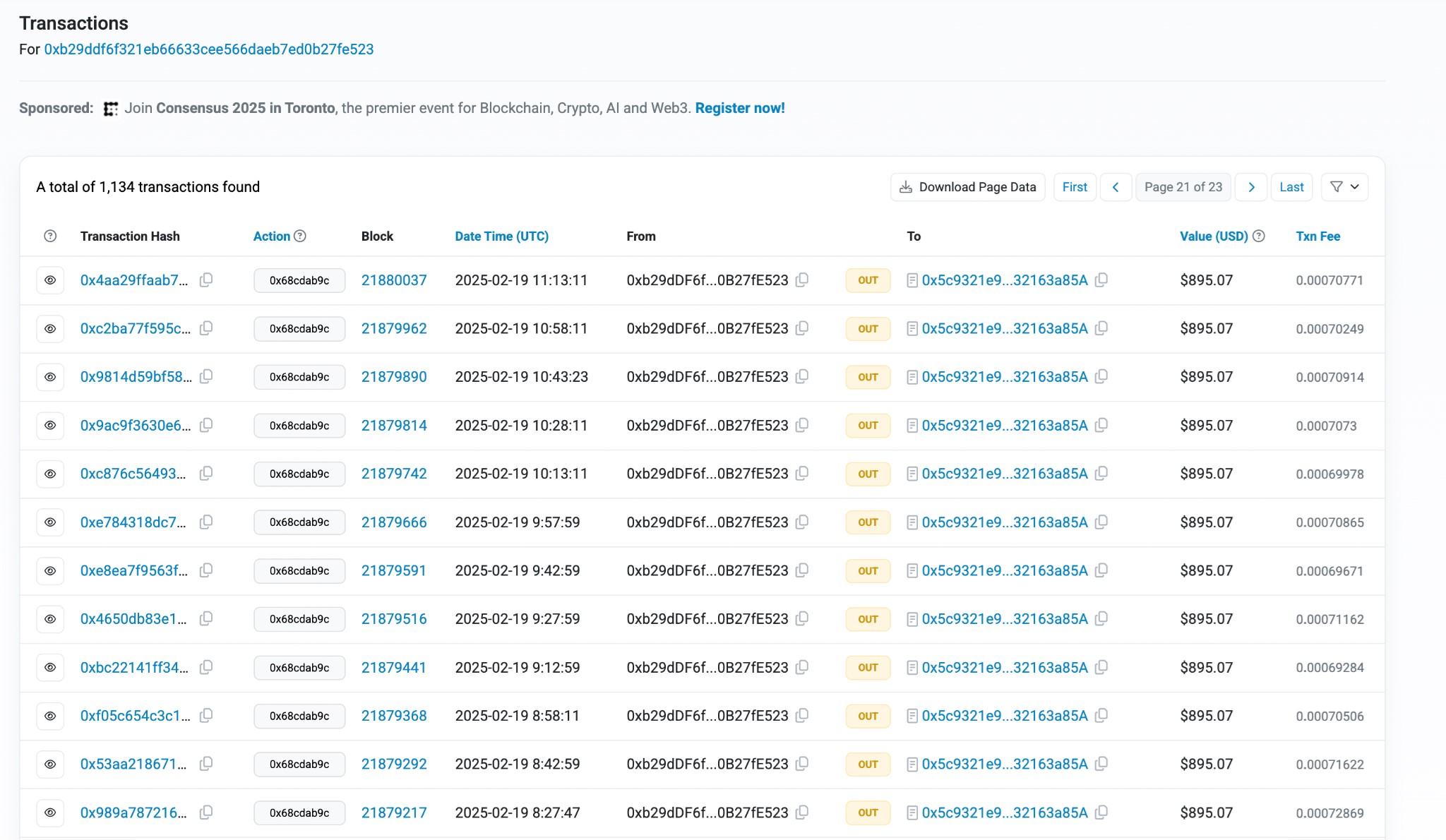

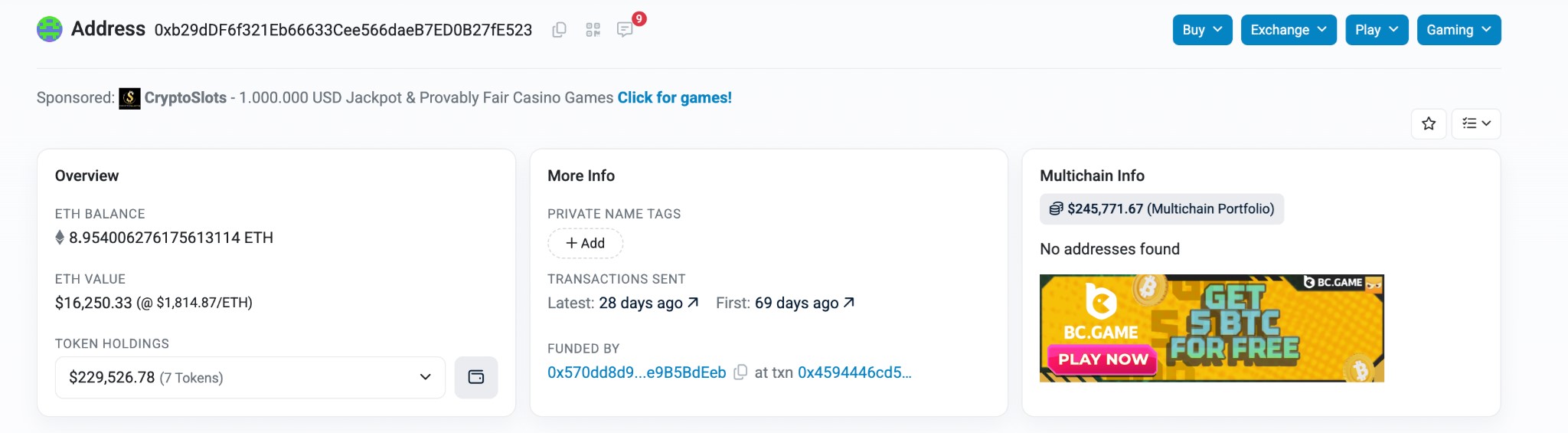

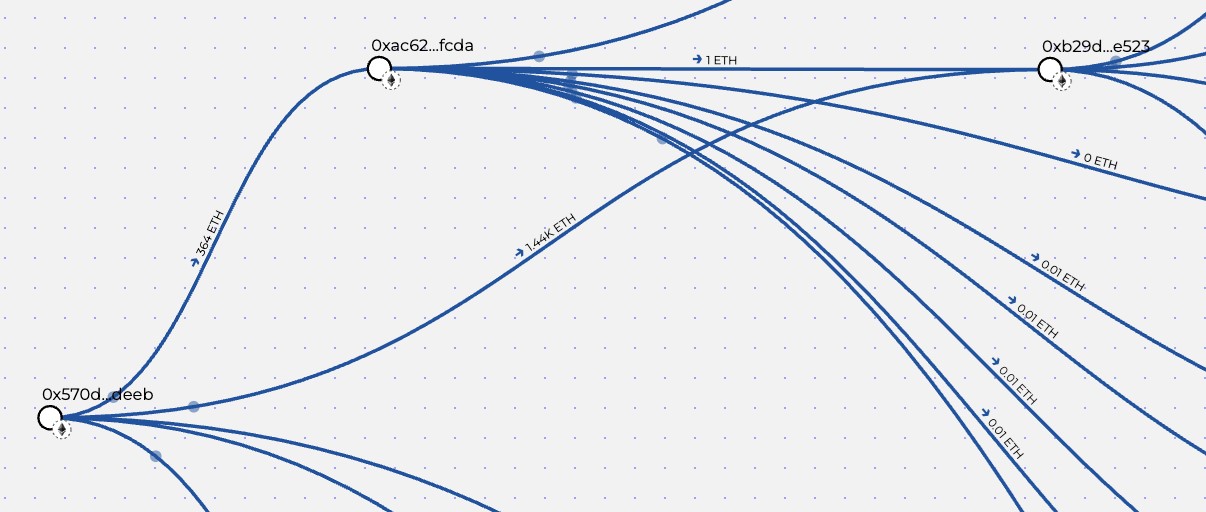

This wallet address, 0xb29ddf6f321eb66633cee566daeb7ed0b27fe523, is the address of a wallet that made significant purchases in the early days of Wall Street Pepe, in the brief blip when the price actually rose.

Check out those $907.43 transactions. When you see several transactions right next to each other and for identical sums, it looks a bit like a bot or a planned buy.

These trades took place around the 8th of March this year:

https://www.coingecko.com/en/coins/wall-street-pepe

There are dozens of them, all for identical sums. Check it out yourself: https://etherscan.io/address/0xb29ddf6f321eb66633cee566daeb7ed0b27fe523

The dollar amounts fluctuate depending on how far the price of the token has fallen but they’re all the same as each other, nonetheless.

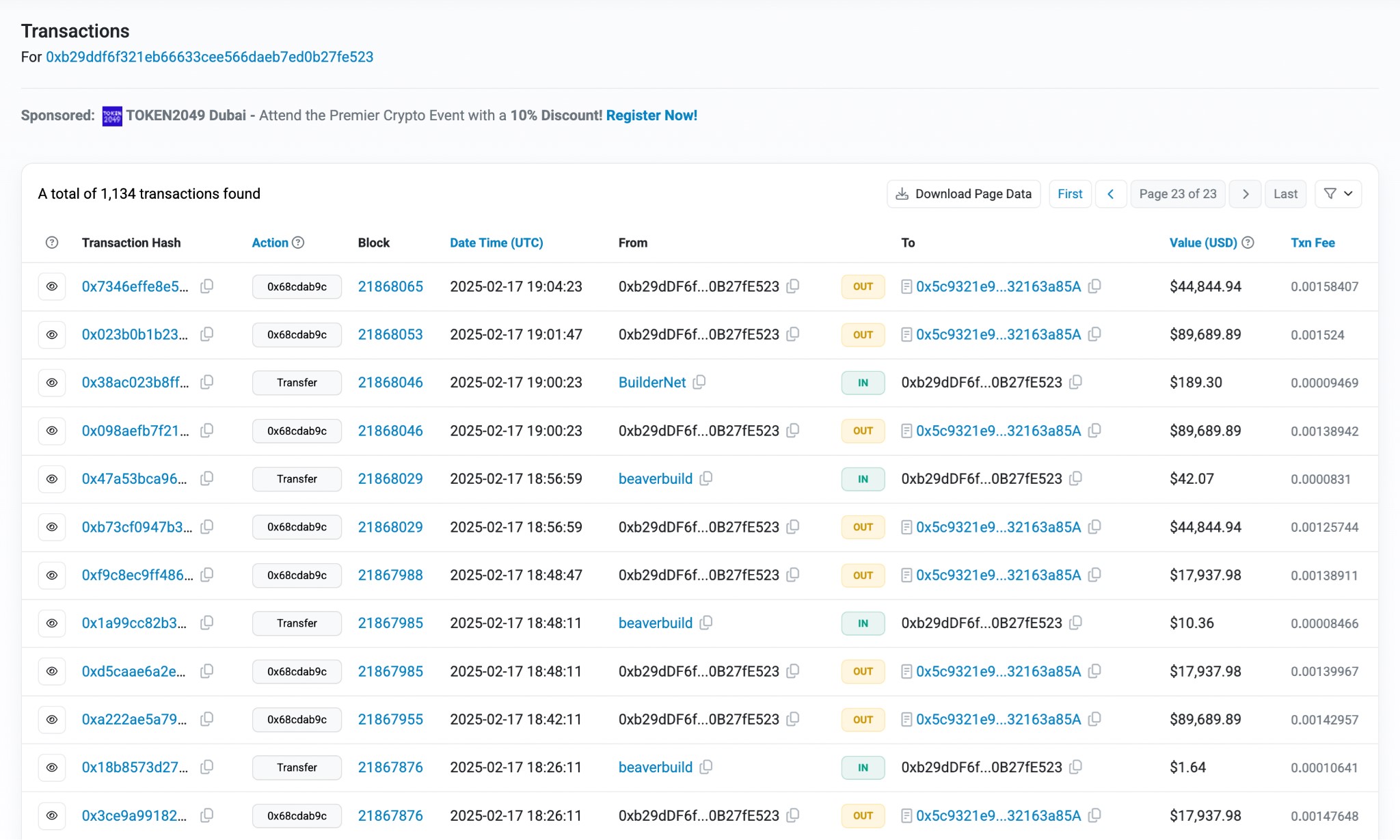

Go back to the start of the Wall Street Pepe token sale and the sums involved are…

…bigger.

These are from February 17 this year, when the Wall Street Pepe price was doing this:

https://www.coingecko.com/en/coins/wall-street-pepe

This is after a $57 million presale:

Which was breathlessly promoted in Finixio team-owned outlets like Techopedia:

(where they also suggest using BestWallet to buy it with), and later in a 99 Bitcoins post that said the token had seen price growth:

https://99bitcoins.com/price-predictions/wall-street-pepe-price-prediction/

The thing is, you can zoom in on parts of a price curve like this one and make it look like this:

Like we’ve already seen, you can then use that appearance of growth to persuade others to buy — even if the real trajectory is in the opposite direction. In the same article that graphic came from, author Dalmas Ngetich said that

‘After this small blip,’ which you can see in the CoinGecko image above immediately after the 17th of February, ‘WEPE is back, and whales are driving the latest surge.’

They sure are.

This wallet is making buys at sensitive times, one of the ‘whales’ driving price recoveries in time to be covered by Finixio team-owned outlets, lending the project a veneer of legitimacy.

Incredibly, that’s not the juicy bit.

This is.

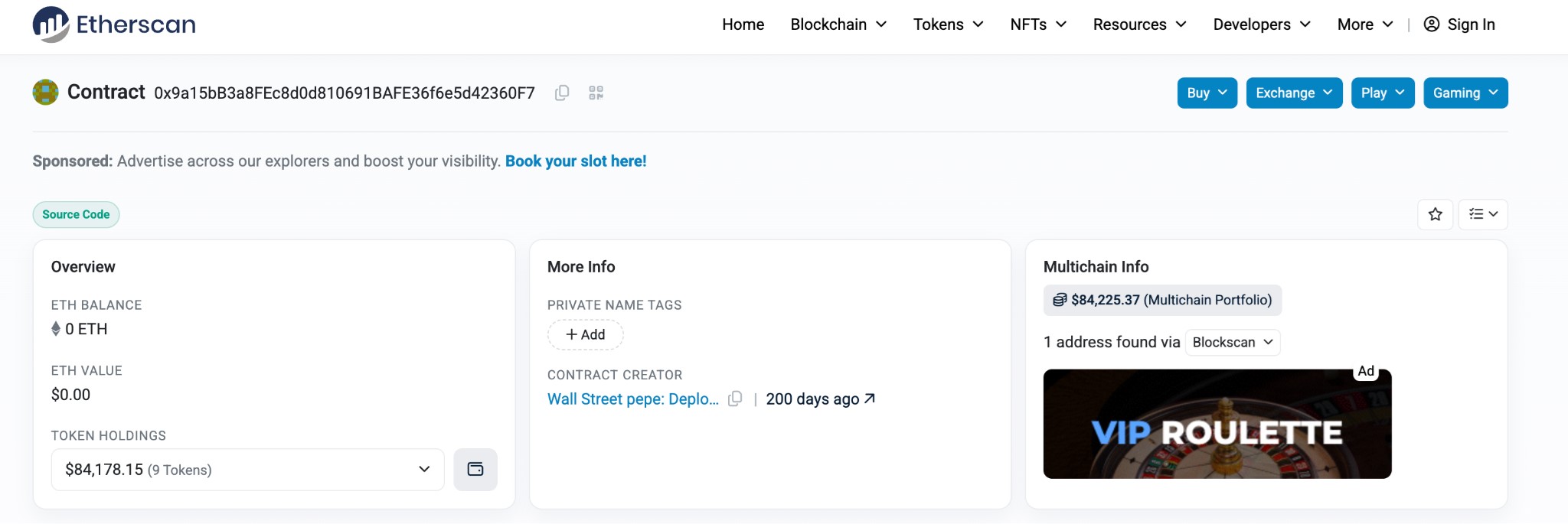

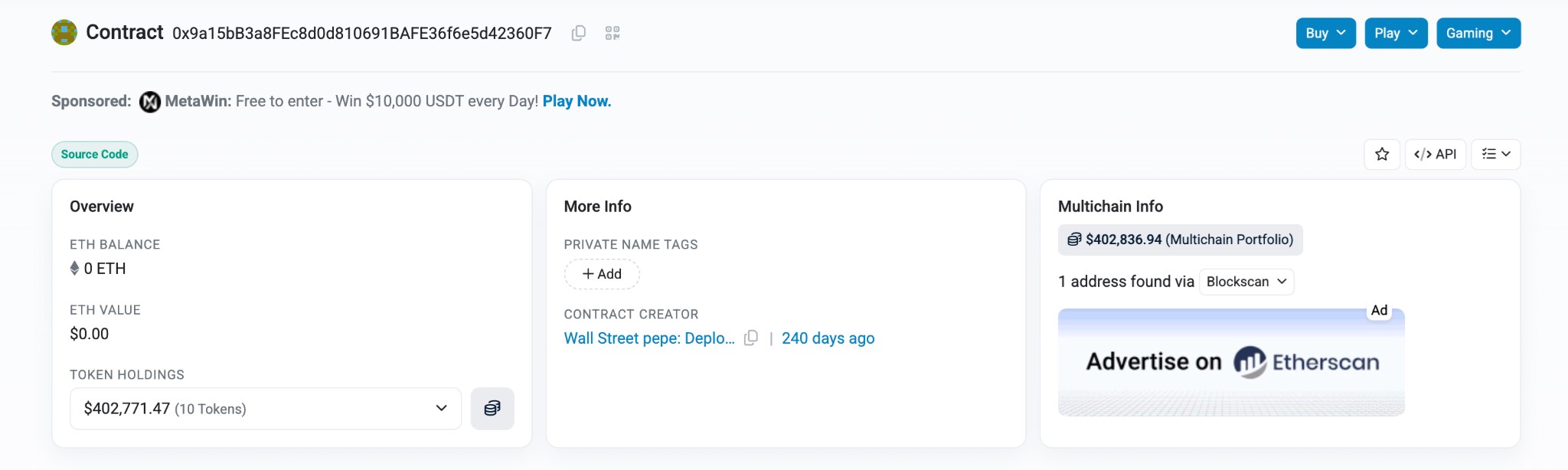

This is the sale contract address: 0x9a15bB3a8FEc8d0d810691BAFE36f6e5d42360F7

That’s like the storefront for the token.

It shouldn’t be funding the wallets that are buying from it. That’s like a store paying people to buy stuff.

And it’s not. It’s funding an intermediary. Which is funding the big buyer.

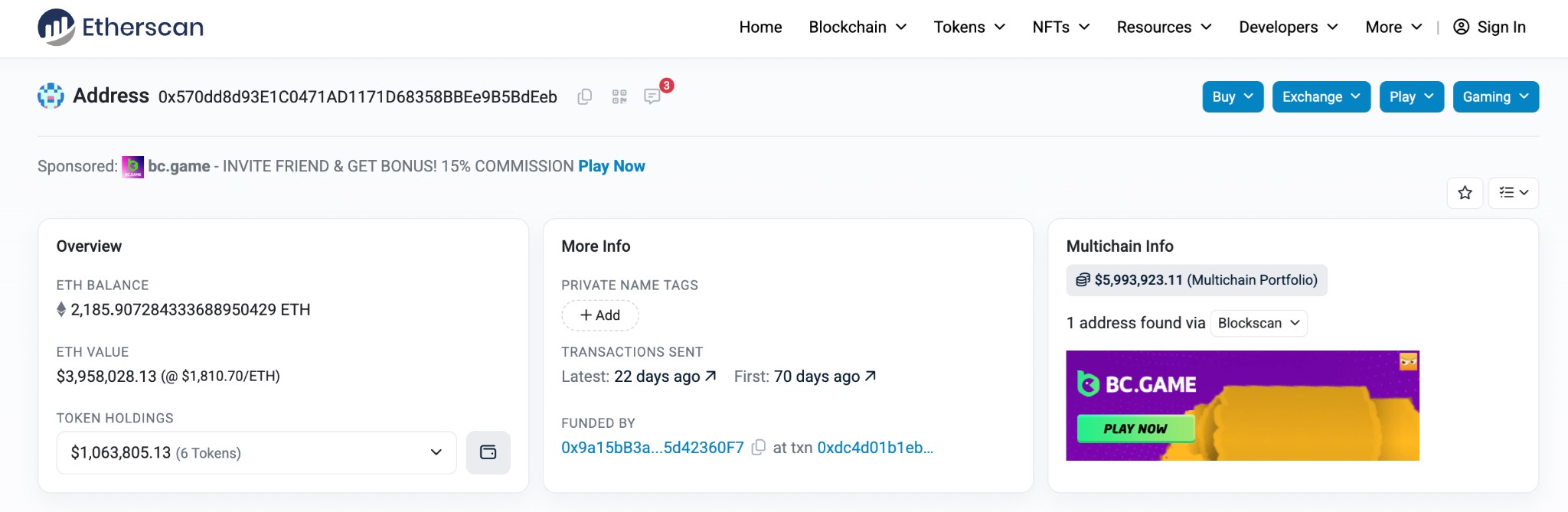

Wallet 0xb29ddf6f321eb66633cee566daeb7ed0b27fe523 (the big spender) is funded by wallet 0x570dd8d93E1C0471AD1171D68358BBEe9B5BdEeb. (Keep this address in mind.)

Which is funded by…

…the sale address.

The store is buying its own stuff, it’s just sending a guy out the back door with the cash.

Then someone else comes in the front and hands the money right back.

This is the buyer account sending all that money straight back to the sale contract.

Meanwhile, honest shoppers think the business is thriving and are tricked into buying. (Or in this case, honest investors are tricked into thinking the project has legs.)

Unlike the store’s money, however, theirs never comes back.

This strongly appears to be price manipulation.

A closer look at the Wall Street Pepe financial ecosystem

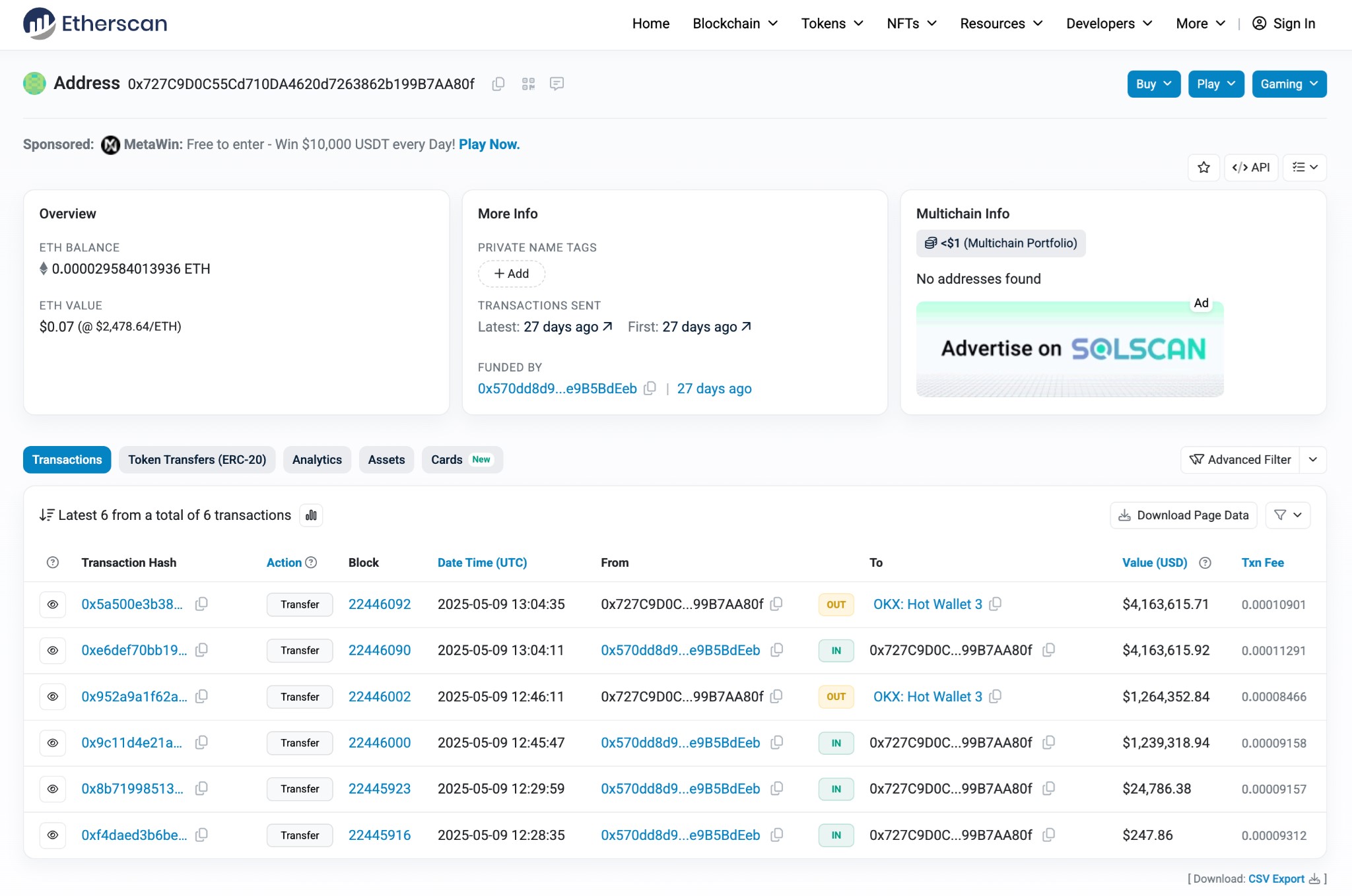

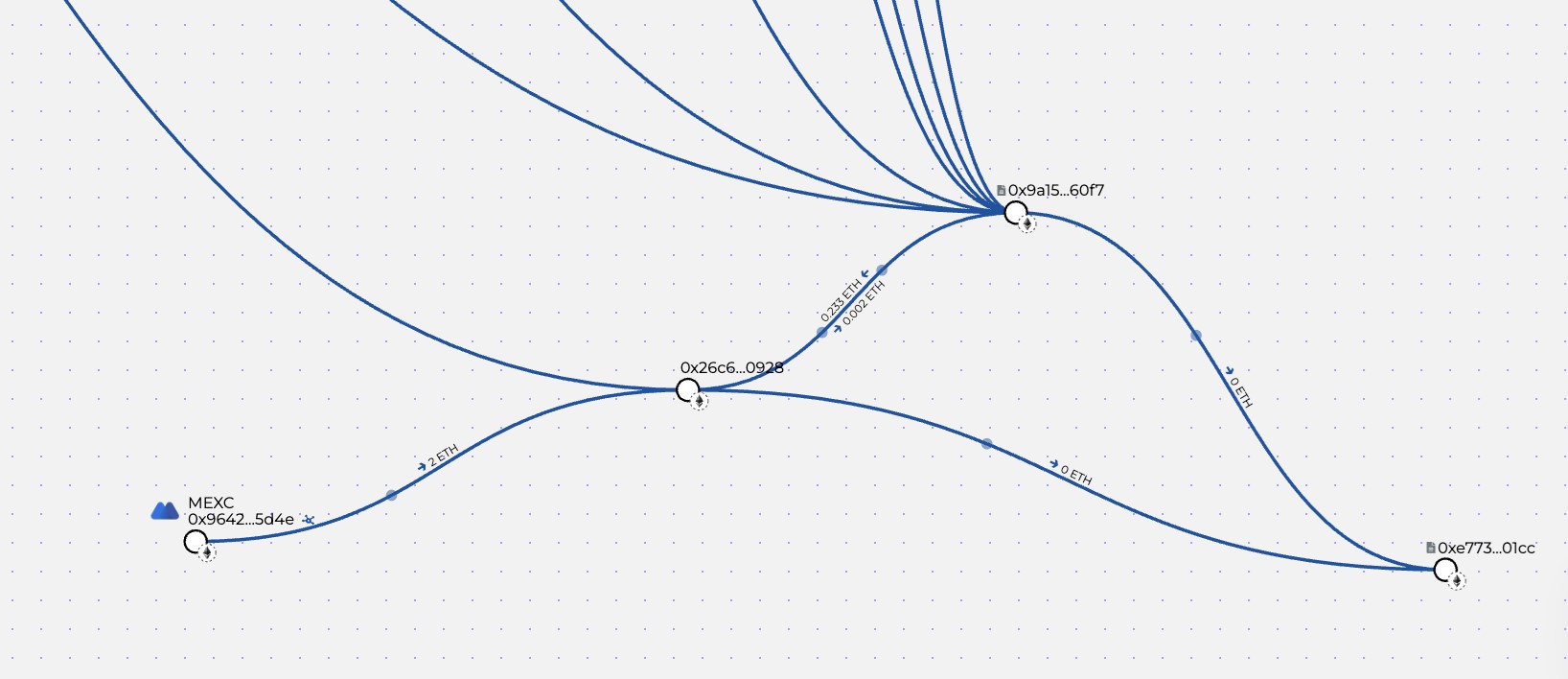

This address: 0x570dd8d93E1C0471AD1171D68358BBEe9B5BdEeb which is funding the one making the major purchases from Wall Street Pepe is also funding an exit address, 0x727C9D0C55Cd710DA4620d7263862b199B7AA80f:

Which then forwards funds to a hot wallet.

Look at those sums. This address has sent nearly six million dollars to the hot wallet address. At one end of this process, it looks like someone’s being careful to keep transaction sums per individual transaction low enough not to be noticeable. But at this end, that caution has evaporated and we’re seeing money shipped off-chain in transactions worth $4.1 million.

We’re also seeing this:

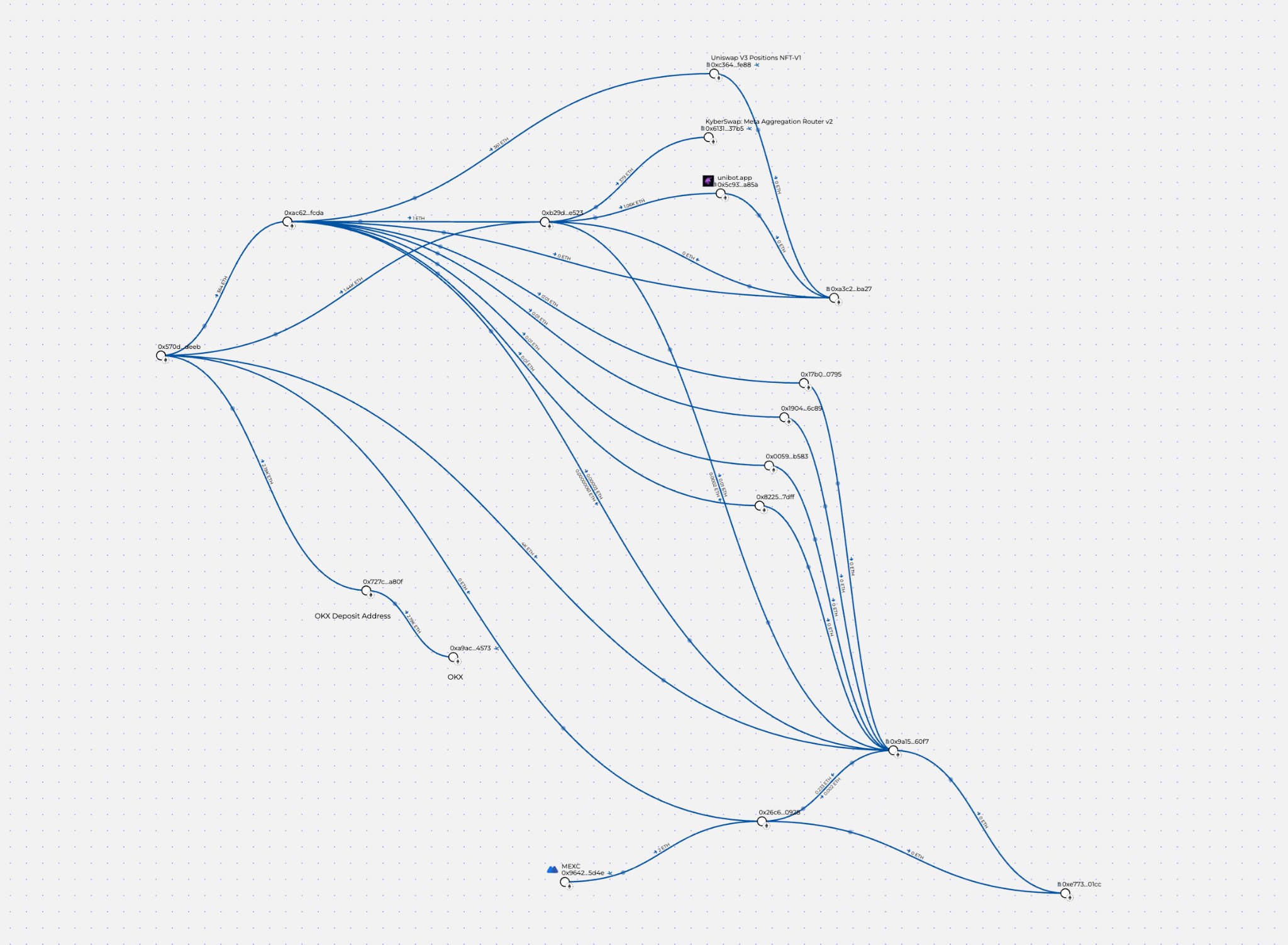

This is a screenshot from a crypto tracking and visualization tool called Breadcrumbs, which allows you to trace and visualize financial flows between different wallets. (But only if you know what you’re doing, so thanks once again to Darren Jackson for creating this visualization!)

Because it’s a big graphic you might have to zoom in a bit, and if you’re on mobile you might be better off downloading the screenshot first.

I’m going to break up some parts of it to make it clearer.

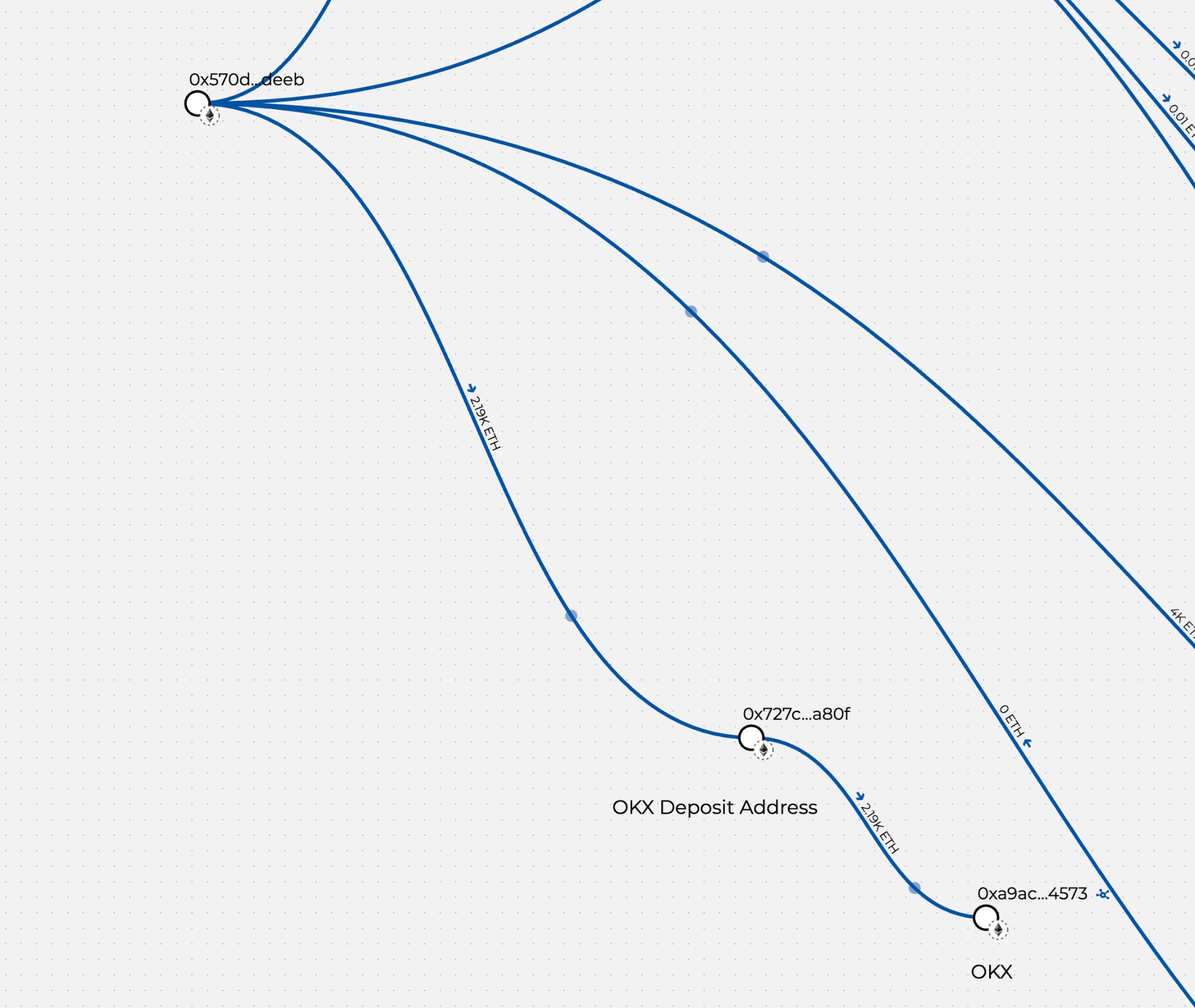

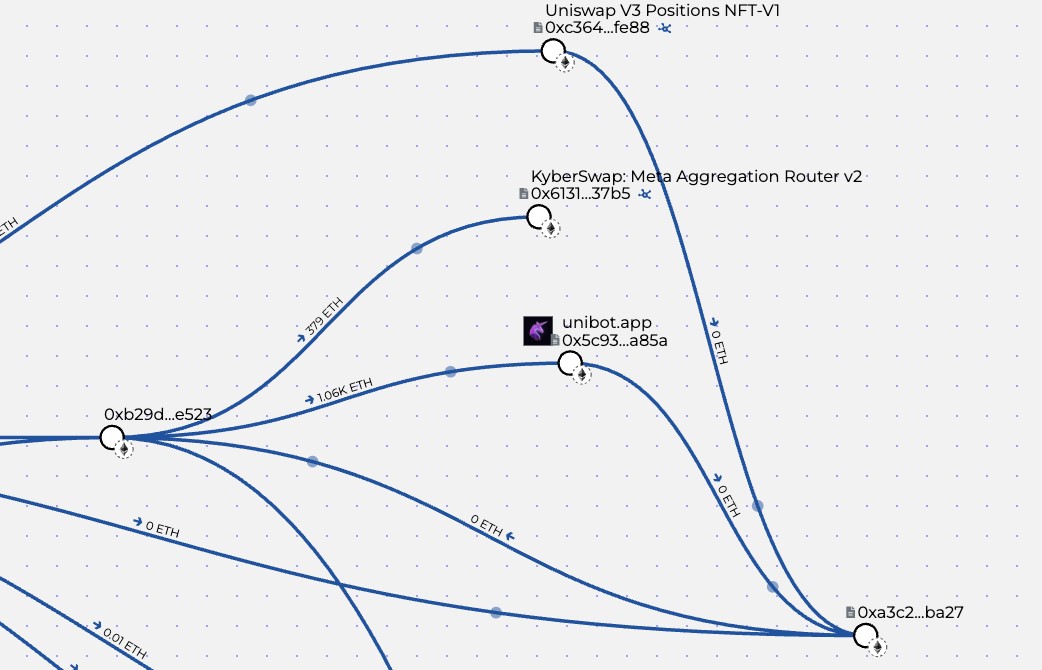

Here you can see the transaction we already found, from the …deeb address to the —a80f address and then out to the …4573 hot wallet address. This flow is 2,190 ETH which at the time of writing is about $5.5 million.

But there are other flows coming from the same wallet, and going to it.

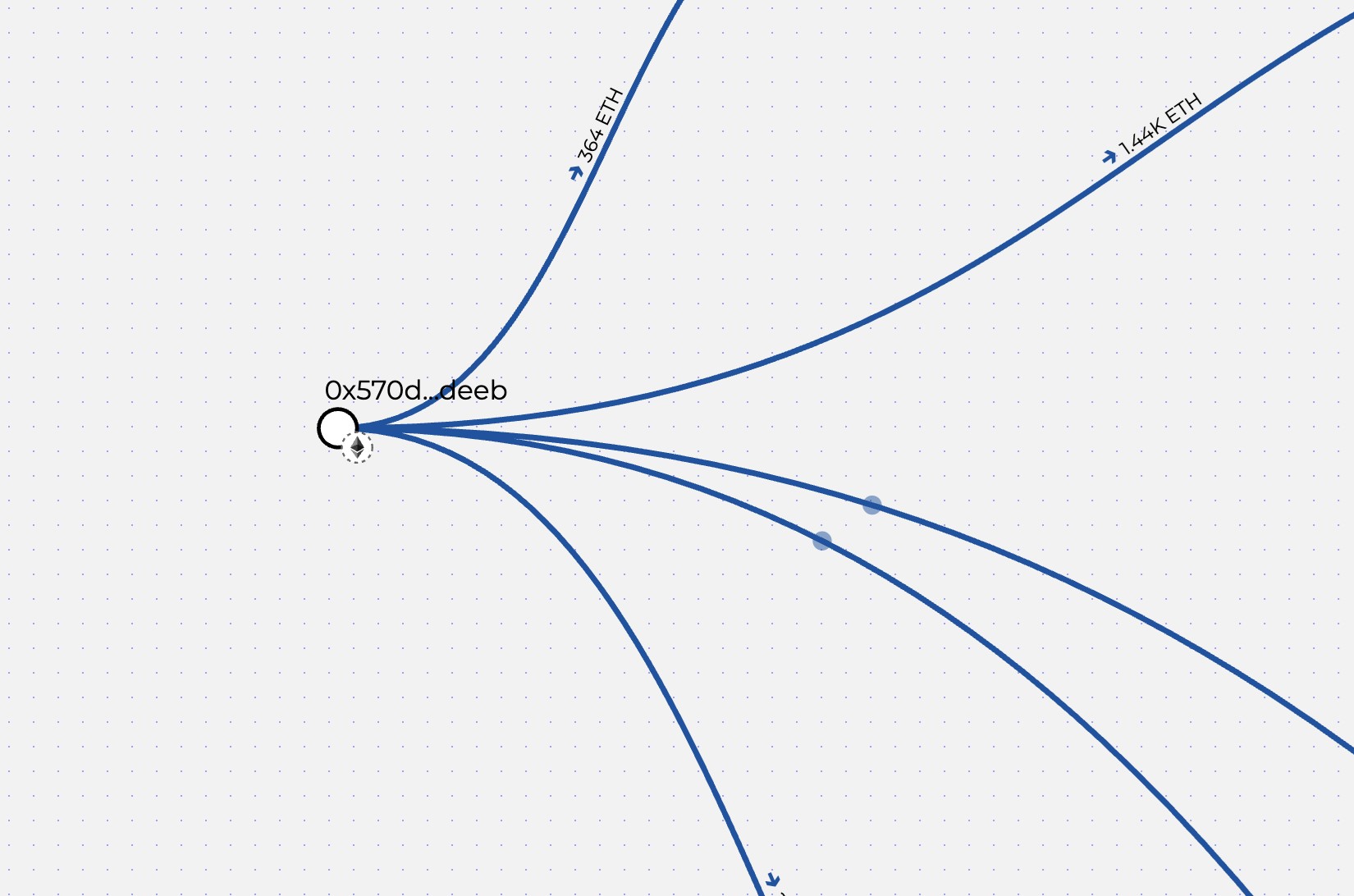

At the top, we can see 364 ETH — just under a million dollars — go to wallet …fcda, before splitting and going out to a bunch of other wallets.

We can also see 1,440 ETH, or approximately $3.6 million, going to …e523.

That’s the wallet making the major purchases on Wall Street Pepe.

Which then forwards it to…

A unibot wallet, which sends it to …ba27. Of the 364 ETH that left wallet …deeb for …fcda, 361 ETH goes to a uniswap NFT wallet, which then forwards an insignificant amount to the same …ba27 address.

The remainder winds up in this little ecosystem down here where small sums are send back and forth, some even being returned to the original funding address.

That address ending …60f7 is the contract address for Wall Street Pepe:

And the one ending …0928 is the Wall Street Pepe deployer address.

I strongly urge you to go to this link: https://www.breadcrumbs.app/reports/17410?share=18aed9ef-2d3a-4d87-a3e4-883699aeee6e

And you can see the whole thing in action. You don’t need an account.

Watch for yourself as tens of millions of dollars bounce around this network of wallets, only to vanish into untraceable exchanges.

…60f7 (Wall Street Pepe) sends about 4,000 ETH (around $10 million) to …deeb, which sends it to …a8of, which sends it to …4573 and it disappears from view.

Meanwhile much smaller sums are fed back into the system, where they circulate and come back out.

The Wall Street Pepe ecosystem can be seen to be a single loop within a part of something far larger where much greater sums are involved — and this is all happening on-chain.

Which leads us to the question: Once that money leaves the blockchain, where does it go?

And don´t even get me started on “Mind of pepe”, really don´t.

Don’t go anywhere. Read on — we found out who owns the most critical parts of the Finixio/Clickout team’s infrastructure, and we found the money too (sort of).

Stay tuned: it hasn’t even gotten wild yet.