The Finixio/Clickout team runs a network of parasite SEO websites around the world, and when I started digging into this, I thought that was what they were about.

I was wrong.

Underneath that, they control a network of crypto and gambling businesses, all woven together, all mixed in with their parasite operation. There’s dubious financial behaviour. There’s clear signs of unethical and maybe illegal gambling and crypto activities. And there’s a few million Euros that seem to have disappeared between one set of financial records and another.

Disclaimer: This post initially contained statements about Block Labs’ profits which were inaccurate. These were based on the information available to us at the time and have now been corrected.

Along the way, there’s a whole lot of businesses registered in the Caymans, Malta, the British Virgin Islands, and Bulgaria. A whole bunch of placeholder owners, local agents, and shell companies. And ultimately it all leads back to just a few people.

Finixio doesn’t own these businesses. The people who make up Finixio own them, mostly through shell companies. (This isn’t tinfoil hat stuff. Read on for the official, government-issued receipts.) But when I say ‘Finixio owns…’ or ‘Finixio does…’ I don’t mean Finixio Ltd, the registered limited company.

I mean Adam Grunwerg, Samuel Miranda, and James Fennel, along with a couple of others like Scott Ryder and Tajinder Dhanjal.

These are the constant cast: these guys turn out to be the ultimate beneficial owners of numerous gambling, crypto and parasite SEO businesses that all exist to funnel hard-to-trace money back to them. To all intents and purposes they are the ‘Finixio crew,’ even when they’re not wearing their Finixio hats.

To properly understand how they do what they do, we need to rethink how we look at their operation.

For those of my readers that prefer not to read a whole book but instead listen to it, please listen to the text to speech here.

Or, you can skip all of that and read a 500 word summary courtesy of ChatGPT

Seeing the Finixio team’s operations with both eyes open

To best understand how the Finixio team’s business operates, you need stereoscopic vision.

Through one eye, it works exactly like every other business that does online marketing. There’s top-of-funnel, mid-funnel, and bottom-of-funnel activity with different goals. Legit businesses work like this — it’s Internet marketing 101, right after Bro Just Buy Ads Trust Me.

At the top is awareness and interest. For the Finixio team, that means coverage of crypto markets, usually with mention of their own crypto projects mixed in. They’re just trying to pop up in your news feed or search results and get traffic for keywords related to crypto and gambling on the network of parasite SEO sites they own and operate.

Midfunnel is the marketing material aimed at people who are now actively considering gambling in a crypto casino or investing in a crypto coin project. This usually shows up a click or two in to their marketing network, but you can often click through to one of their products direct from the first article you open. Again, this is standard internet marketing. Some people will buy today, others not til they have read articles, watched videos and checked out white papers. Every business knows that, whether their product is software or snake oil.

Finally there’s the bottom of the funnel where sales are made and money changes hands. For the Finixio team, this is their network of casinos and their crypto projects.

Again, change the name of the product and this is just how all marketing on the internet works.

Is this the golden age of online scams?

The big difference with the Finixio team is invisible vertical and horizontal integration: unless you’ve been following our stuff, or the small number of others who have investigated it and not been silenced, you wouldn’t know that the Finixio team owns or controls all the websites that publicize their wares.

Where they don’t control the website, they control the coverage.

And you wouldn’t know that the Finixio team also owns the wares being publicized too.

So you’d read a couple of reviews of a memecoin on two different, seemingly unrelated websites that specialize in crypto, or that run general tech, gaming or gambling content. Then maybe go check out a popular, longstanding Youtube channel to learn more. All unaware that the same hand is pulling the strings on all those sites.

Now you’re ready to buy a memecoin whose value falls to near-zero in a couple of months, based on dubious information that gives a false impression. Maybe you’d like to place a bet on a gambling website, recommended by several seemingly reliable sources? It’s the same story again. You can gamble in coins they created, using their wallet, in their casinos, on the basis of their ‘news’ network’s advice.

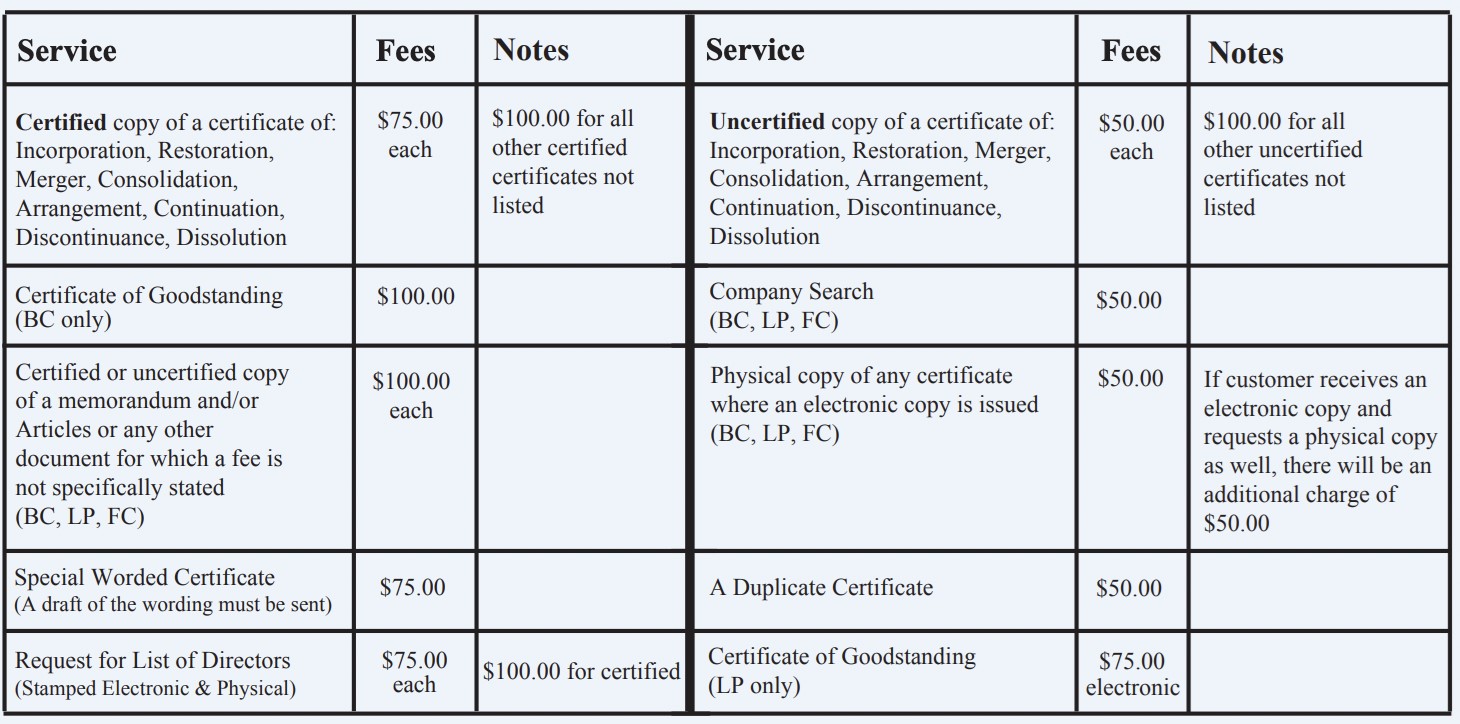

This used to be called ‘vertical integration.’ Back in the black-and-white, high-pants-and-fast-talkin’ days, Hollywood worked this way.

The studio owned the script, the stage, the talent, the cameras, the movie theaters, and the trucks that delivered the films weekly. It was efficient, productive, and offered studio executives near-total control of the industry. Which is why it’s against the law now, in the US at least. Big companies that control the environment in which they do business get broken up by the Federal Trade Commission (until about 40 years ago).

Horizontal integration means the same person owns all the newspapers, or all the trucks, or all the movie theaters. If a company has vertical and horizontal integration, they’ve got you stitched up tight: whatever you choose, you’re choosing their product.

https://virtocommerce.com/blog/vertical-vs-horizontal-integration

The Finixio team don’t own the world and they can only dream of the power and wealth of the Hollywood machine in its prime.

But in online gambling, their formula of vertical plus horizontal integration, with simple, robust, effective practices applied on repeat at every level, has made them a tough act to compete with.

So much for the view from camera A.

Peeling back the layers

Through the other eye, you have to see the Finixio team’s operation like an onion. Each time you peel away a layer, you find another underneath. It starts with the parasite SEO network; under that, there’s gambling; under that, there’s a web of crypto projects.

The core team are behind organisations that make money every step of the way.

We’ve addressed the top of the Finixio funnel already, showing how a ring of parasite SEO websites with unclear ownership exist to both drive traffic to Finixio assets in crypto and gambling. In his pioneering expose of the subject, Lars Lofgren showed how a parasite SEO operation could hollow a business within.

The Finixio team have hollowed a sector.

Now it’s time to look at the crypto and gambling side of things. This is where the real money gets made — not hundreds of thousands but tens of millions.

We’ll start with the basics about their gambling operations, in context.

The Finixio network: a (relatively) quick overview

We’ve already covered how the Finixio/Clickout Media team control a phony ecosystem of marketing sites.

The competition? We own ‘em

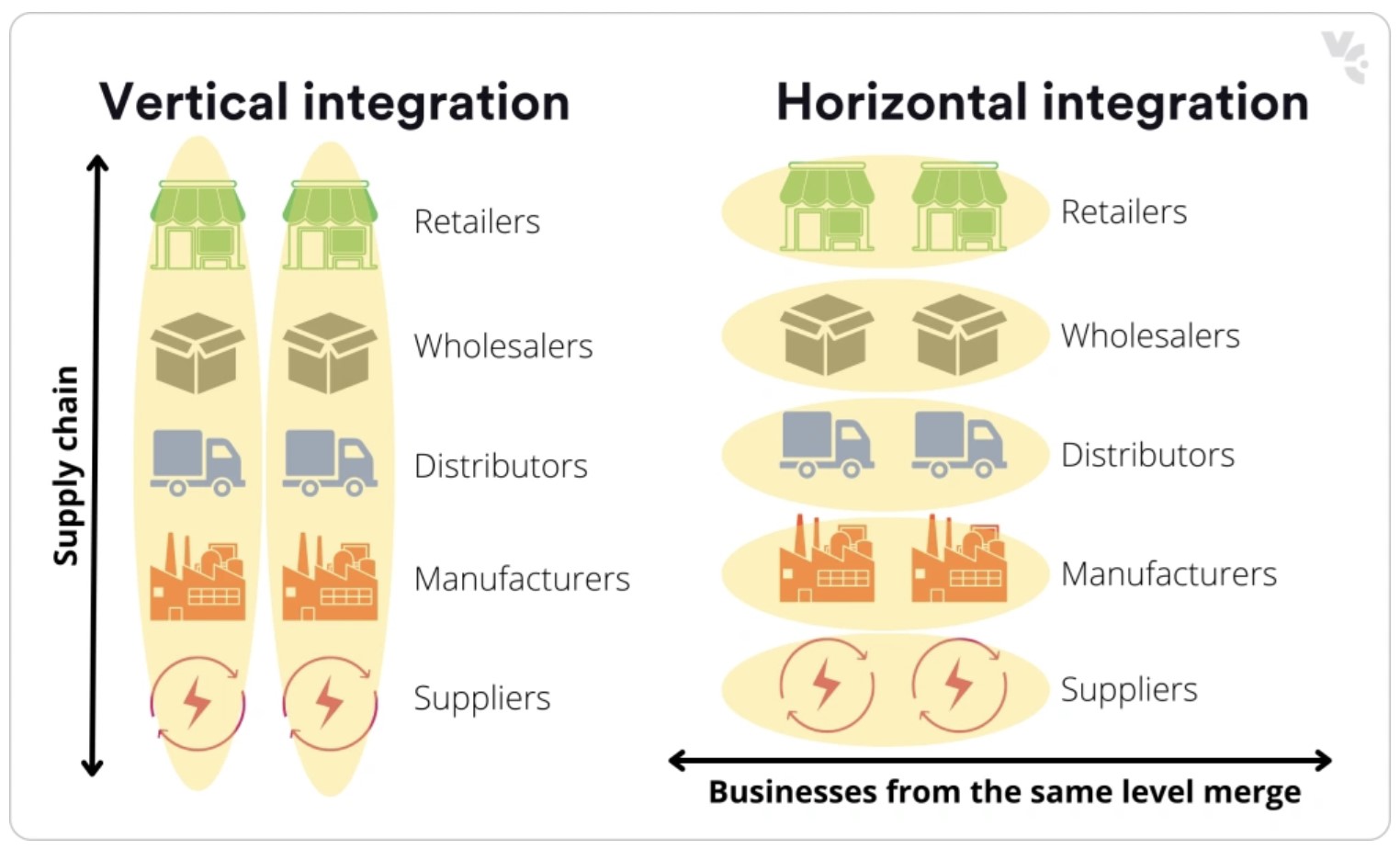

https://www.semrush.com/analytics/overview/?searchType=domain&q= .com

That’s the ‘competitor’ map for Techopedia’s ostensible competitors. Directly through Finixio and Clickout Media or indirectly through other arrangements, the Finixio team owns or controls ReadWrite and cryptonews.com, as well as Techopedia. They’re competing against themselves, in large part.

Their parasite and marketing network is huge, even to foreign-language sites in Czech, Dutch and other minority languages. And a 2022 Danish TV documentary brought in a former Finixio employee to point to a foreign-language network of sites including a heavy French presence.

But they own far more than that.

One name you’ll often see connected to Finixio is Clickout Media, the ostensibly separate company that they offloaded many of their businesses onto a couple of years back. In particular, Clickout handles marketing for Finixio’s assets (even though Finixio is itself supposed to be a marketing company).

I’ve seen communications Finixio that identified Clickout and Finixio as basically the same company, but what I haven’t been able to get hold of is formal ownership records.

Until now.

The Finixio team also own Clickout through shell companies

While it’s been possible to show in many ways that they’re connected I had to go around the houses a bit to get the receipts.

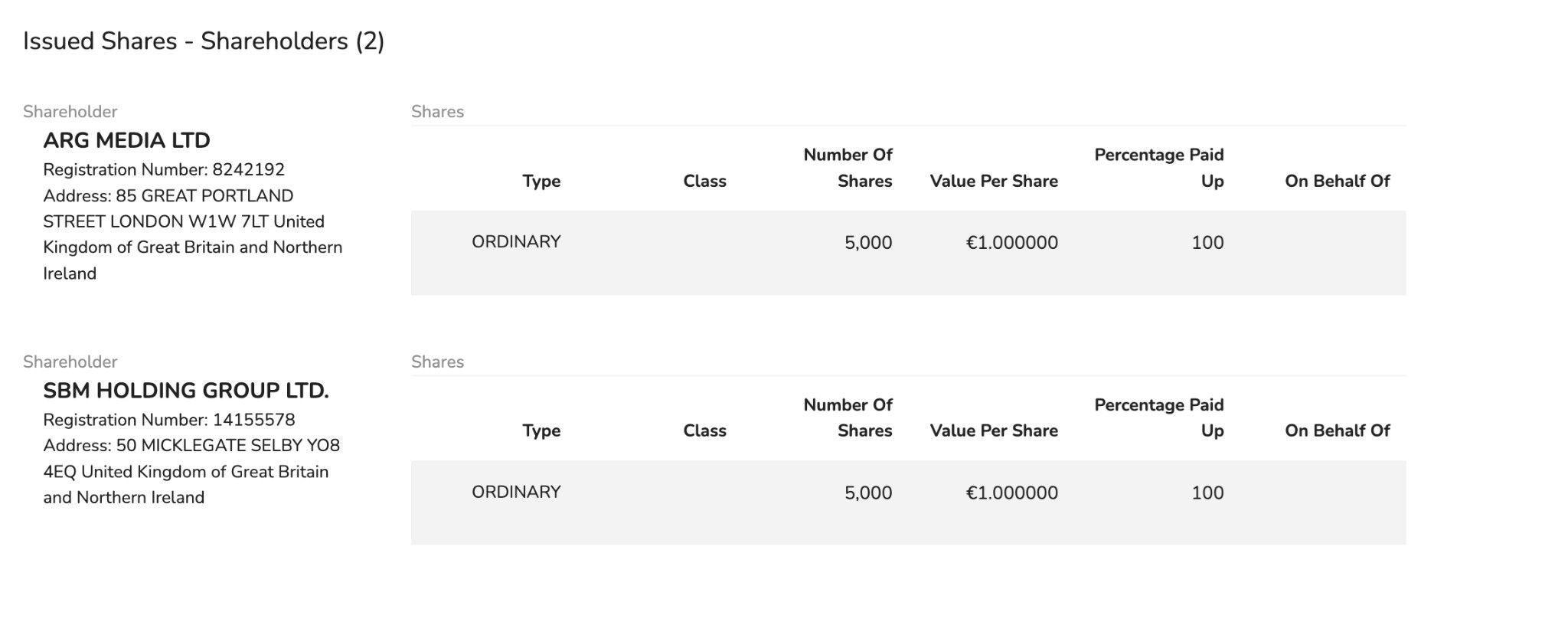

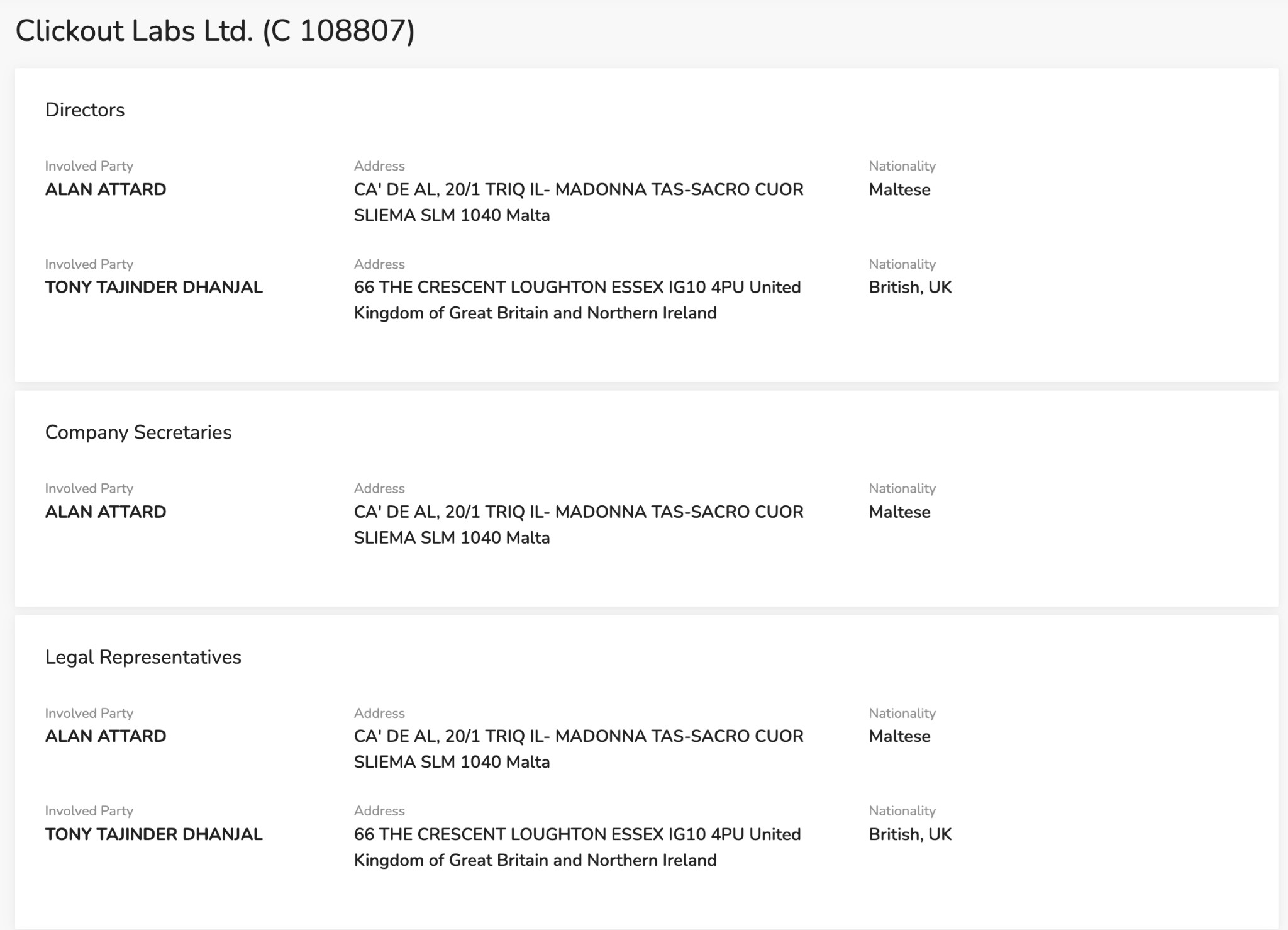

Direct from the Maltese Business Registry, these are Clickout Media’s two shareholders:

These are familiar.

ARG Media is a shell company for Adam Grunwerg. SBM Holdings is a shell company for Samuel Miranda.

They are the shareholders in Finixio too:

https://find-and-update.company-information.service.gov.uk/company/11705811/filing-history

This is Finixio’s 2023 confirmation statement. Shareholders are ARG Media (Grunwerg as a shell company), SBM Holding Group (Miranda as a shell company), and Grunwerg and Miranda as themselves. Grunwerg and Miranda are listed as the only people with significant control.

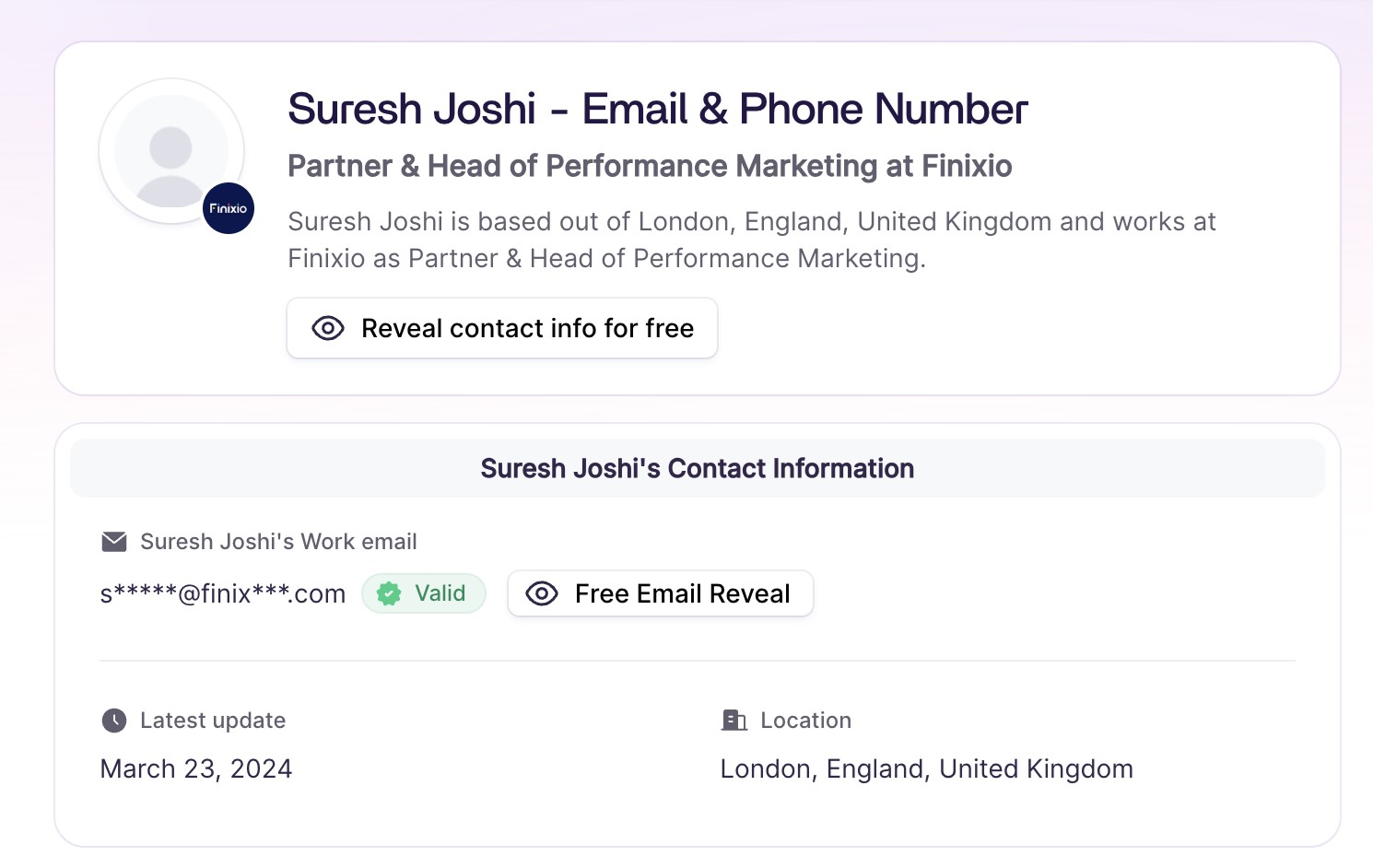

There’s also Suresh Joshi, Finixio’s head of performance marketing…

https://wiza.co/d/finixio-ltd/fcad/suresh-joshi

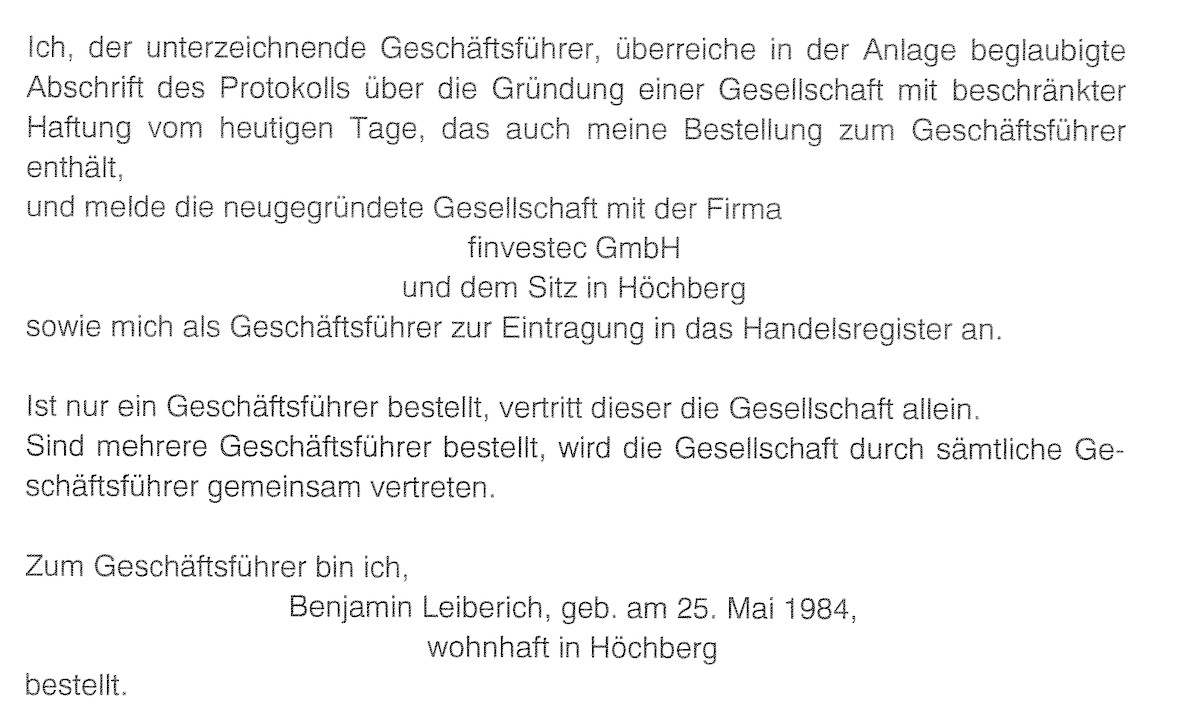

…and a German marketing company, Finvestec.

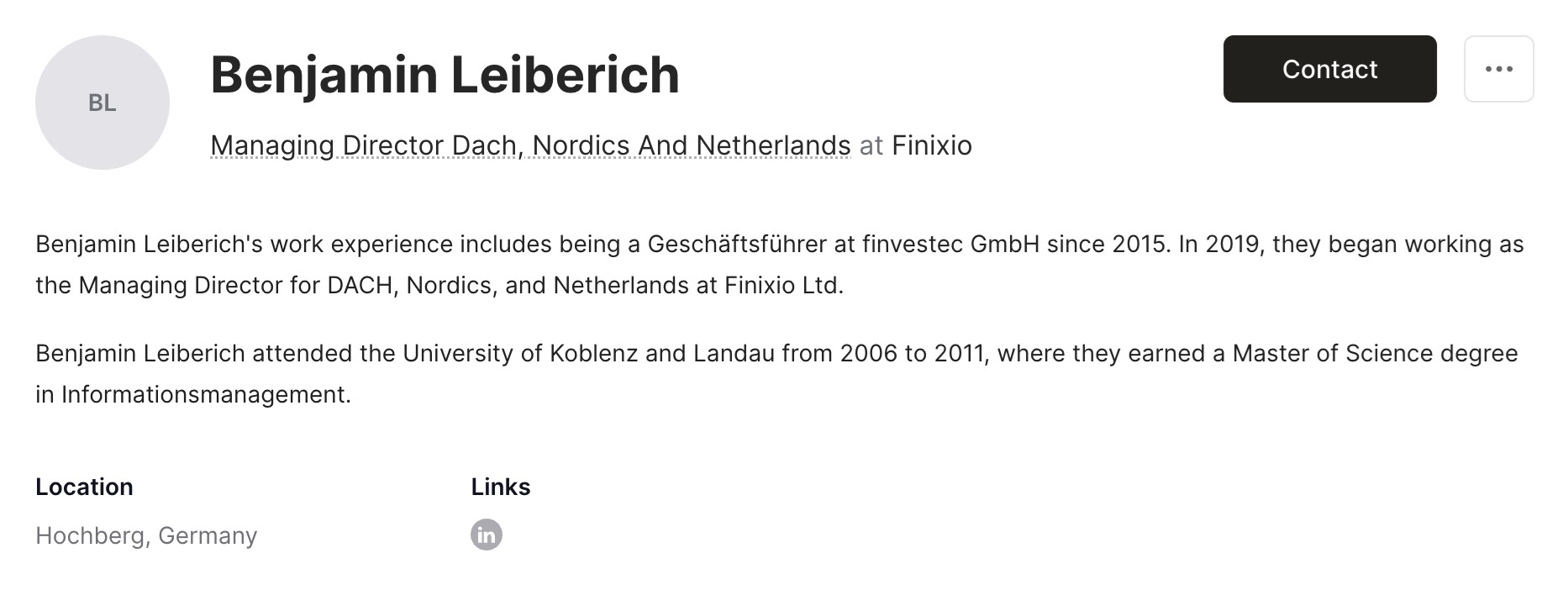

That merits a closer look: Finvestec’s Search Engine Optimization Manager, Elvis Selimovic, is also Search Engine Optimization Team Lead at Finixio — and for good measure, Search Engine Optimization Team Lead at ClickOut Media. Richard Hopp, calisthenics fan (I am not making this up) and SEO at Finvestec GmbH, is also Head of SEO at Kryptoszene.de, revealed by the Danish TV documentary ‘Det Graenselose Bedrag’ (The Borderless Deception) to be a Finixio asset. The company’s registered owner is Benjamin Leiberich:

He has been Finvestec’s owner since 2015; since 2019, he’s been Director for DACH, Nordics, and Netherlands at Finixio.

This ball-of-string relationship between ownership and employment, in which people own the company that owns the company that employs them, is a recurring theme with the Finixio team’s operations.

https://theorg.com/org/finixio/org-chart/benjamin-leiberich

So much for the shareholders. There’s a minimal supporting cast but the core — Grunwerg and Miranda and a couple of others — is the same.

Who’s running the show?

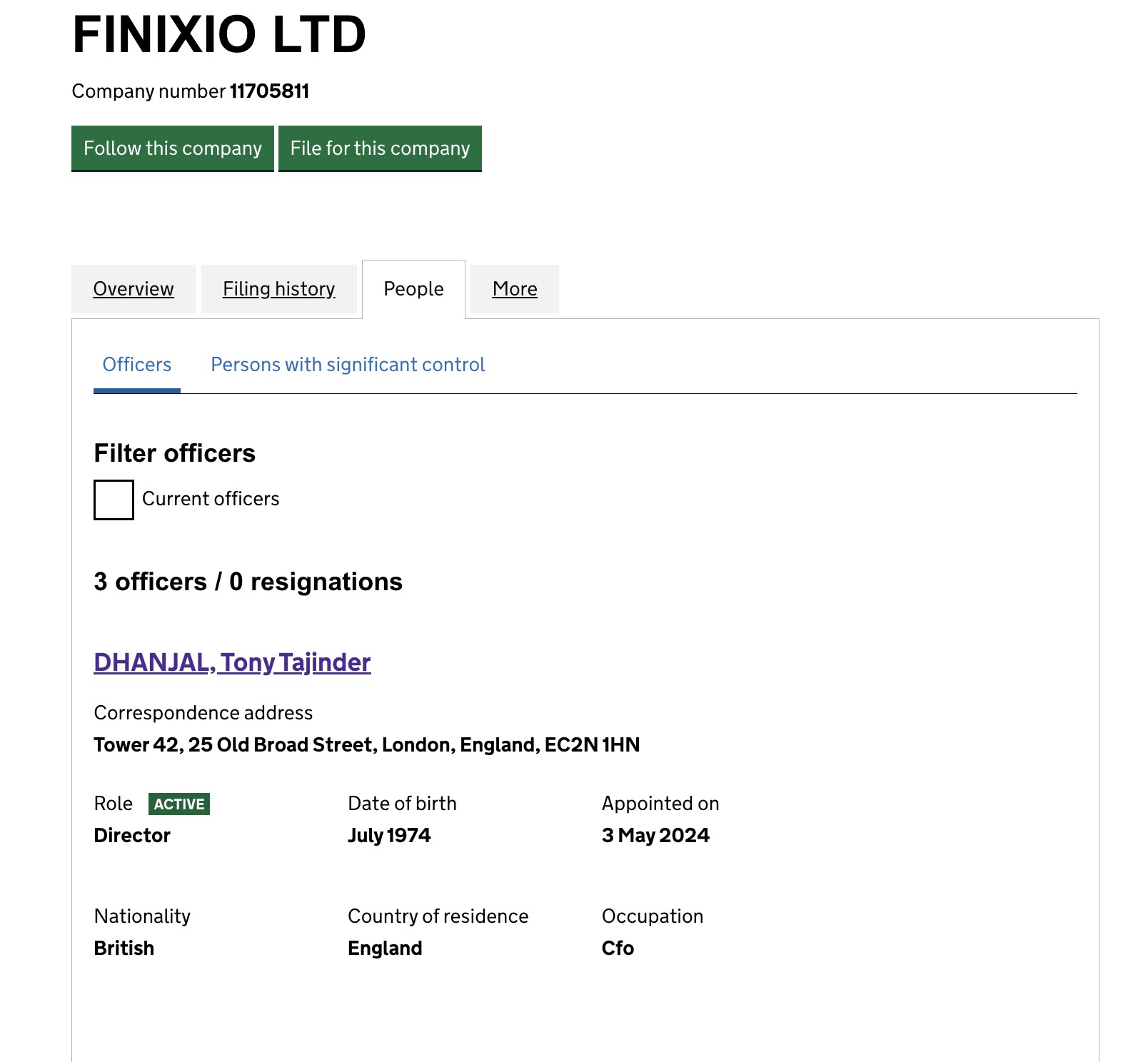

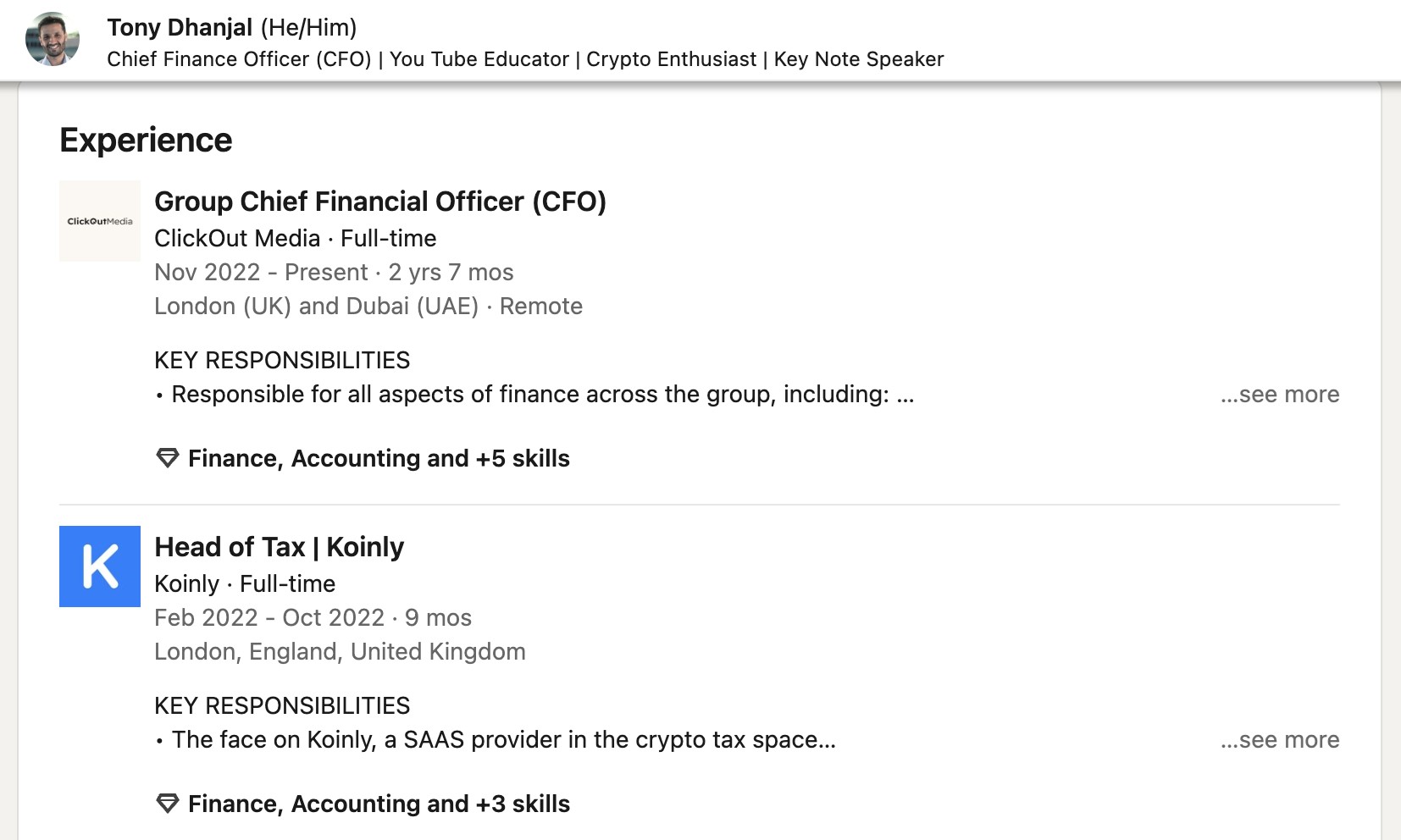

Tony Dhanjal is, amongst his other commitments, CFO of Finixio:

https://find-and-update.company-information.service.gov.uk/company/11705811/officers

Until 2022, he was also Head of Tax for a crypto SaaS platform.

https://www.linkedin.com/in/tony-dhanjal/ /

Meanwhile, we know about Finixio’s media empire. And we now know conclusively that Clickout is just Finixio with sunglasses on. It’s the same guys, plus a Maltese registrant.

But where does all the content for the websites come from?

I was lucky enough to meet someone who used to work for them. He agreed to be interviewed off the record.

Inside Finixio’s content production system

We have information from a former employee that Finixio’s outsourced content provider is effectively directly operated by the Finixio team, and has access to multiple sites in the space. Our source, whom we’ll call Evan, identified Techopedia, Business2Community, and CryptoNews, as well as some local or language-specific sites.

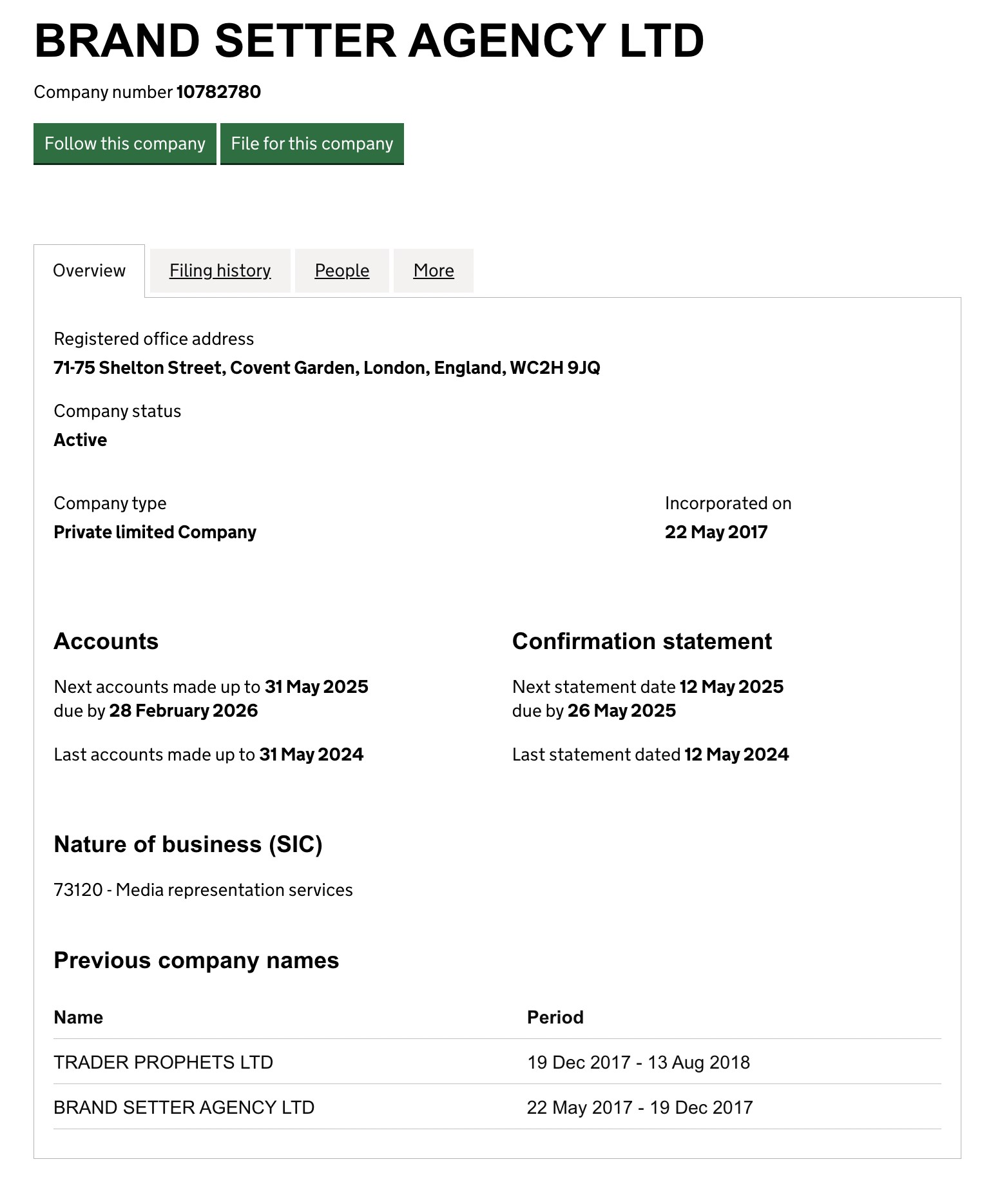

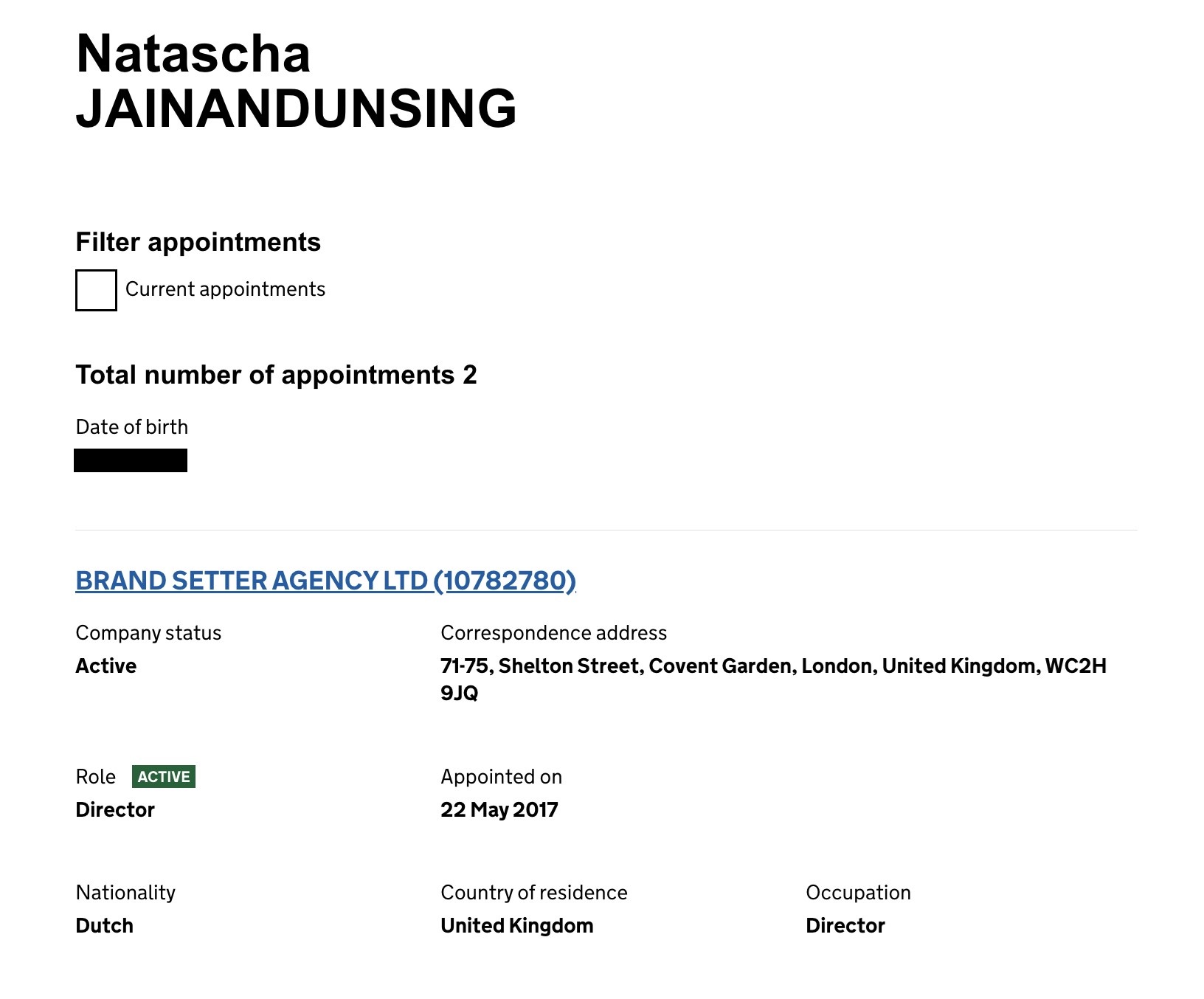

Evan worked for an ostensibly separate company, Brand Setter, registered in the UK:

https://find-and-update.company-information.service.gov.uk/company/10782780

But his email address ended in @finixio.com.

On weekly content calls, he’d be given tasks by Brand Setter’s owner-director, Natascha Jainandunsing.

She never referred to the moving roster of new memecoins the company promoted through Finixio-owned assets as belonging to Finixio, or being related to each other. But Evan strongly got the sense that they were.

I thought, ‘all these people are gonna go to jail sooner or later,’ he told us.

Evan described a fast-paced work environment headed by a highly-competent, attentive ‘micromanager’ who he acknowledges gave him valuable training as a writer and editor. The underlying approach was to use news or mention of famous crypto coins, tokens, and projects to attract clicks and traffic, then creatively insert mention of the coins they were tasked to promote, in order to confer the appearance of legitimacy.

‘More than half’ of the content Evan was tasked to write promoted memecoins, and they changed rapidly:

‘Each presale, we’re only working on these coins one, maximum two, weeks. We’d move on to the new coins before it [the last project] even launches.’

That tallies with what we’ve heard from other sources, including crypto expert Darren Jackson who told us that at their peak, the Finixio team would launch a new coin or project ‘every couple of weeks.’ It also matches the patterns we’ve identified in promotion across channels, and in price graphs, something we’ll cover more in episode 3 of this series.

When they got a new coin, Evan recalls, they were careful about ‘insulating’ it — even as Natascha referred to Sam (Miranda) and Adam (Grunwerg) on a casual, first-name basis when discussing business and content strategy with her team.

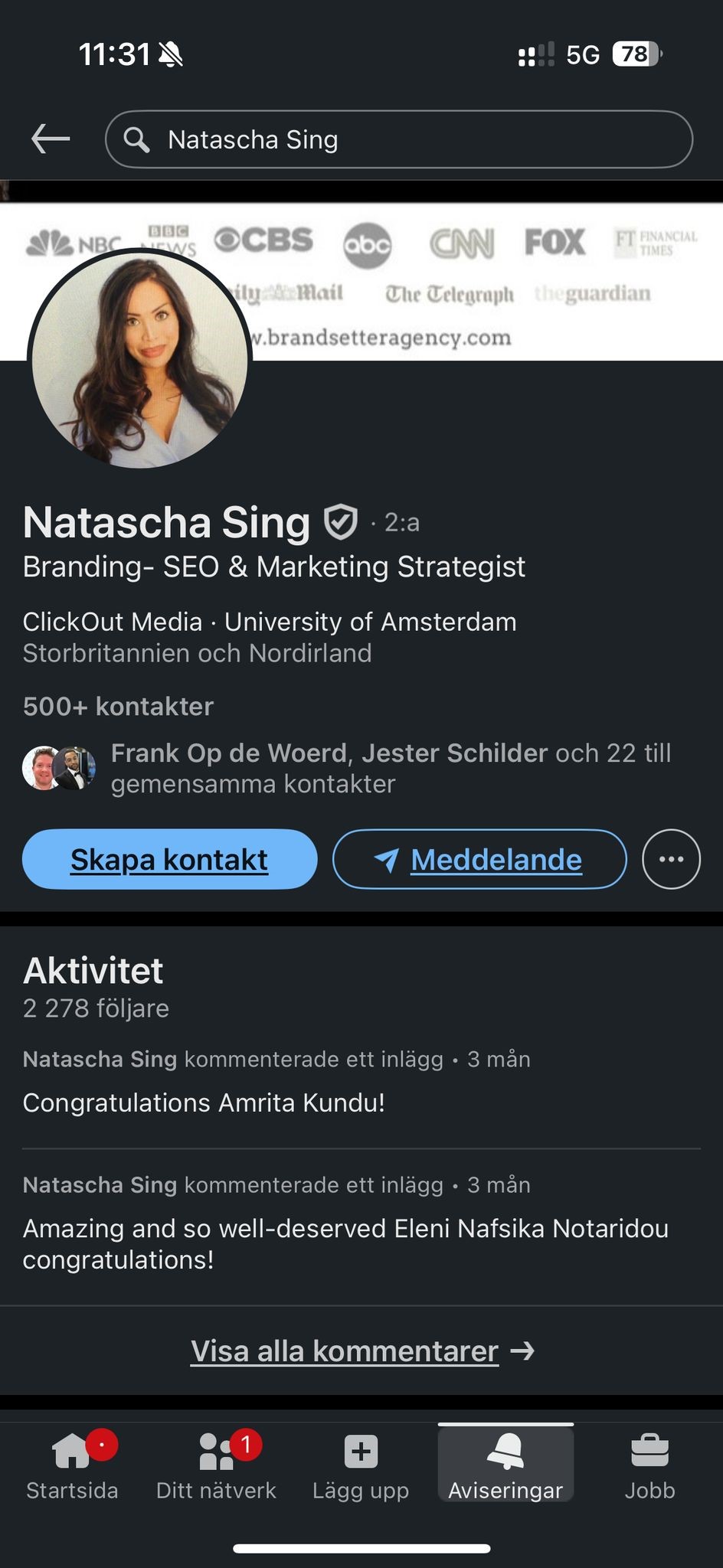

Maybe that’s because under the name she uses for business, Natascha Sing, the head of Brand Setter is also…

https://www.linkedin.com/in/nataschaj/

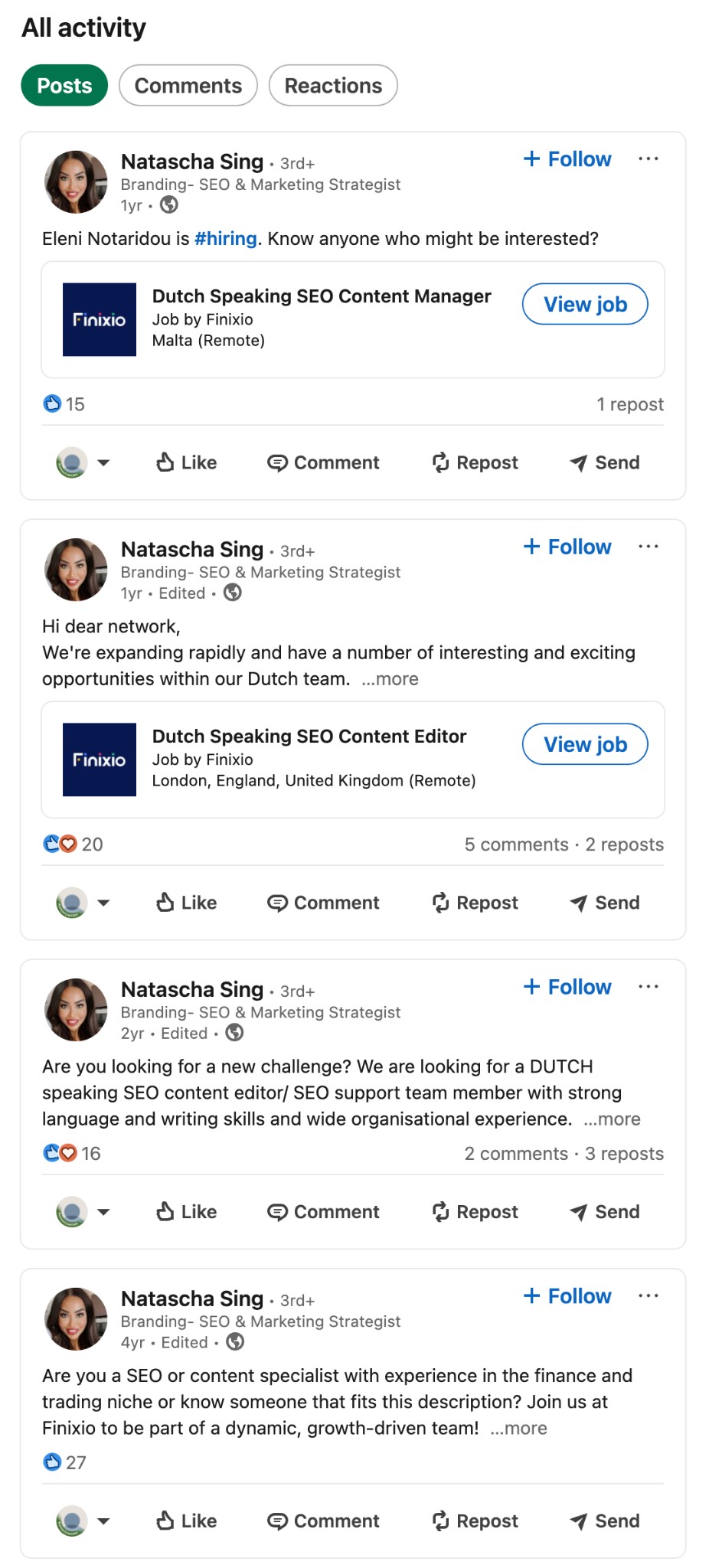

If you’re looking, they’re hiring:

https://www.linkedin.com/in/nataschaj/recent-activity/all/

‘They say they are just a marketing company,’ Evan recalls, ‘but there are too many signs of them making these coins.’ It may have been obvious to Evan and his team, but there were no official connections. ‘They’re not stupid, they can keep stuff separated in a legal way.’

Comparing different coins he was tasked with promoting, Evan recalls,

‘they looked like iterations, it was too obvious.’ When Natascha and the rest of the team would discuss previous coins they’d promoted, ‘they’d talk about iterations. “We only made a few hundred thousand on this coin, but maybe next time we can do something different, like base it a more popular meme, or get on a more popular platform.”’

It’s worth bearing in mind that iterative, profit-oriented approach, in which making a few hundred thousand dollars in a week or two from a project that left its investors out of pocket was only a failure because the payoff wasn’t big enough.

It’s an approach that tracks with what our research has uncovered: a pattern of more ambitious projects, promising more, and using more advanced crypto concepts — and pulling in more money.

Pepe Unchained offered an Ethereum layer 2 scaling solution for memecoins, something that has drawn increasing interest from the conventional blockchain sector as a solution to the slow speeds and/or high costs of blockchain transactions. (Layer 2 means a separate layer of blockchain on top of the main blockchain, one that can allow transactions to link blocks in the Layer 1 chain easier and faster.) Meanwhile, Crypto All-Stars uses a ‘meme vault.’

These innovations are largely vaporware in this context, but they show an effort to expand beyond mere memecoins and offer more apparent value.

(As we’ll find out, these projects are also getting significantly more financially ambitious, that is, greedier.)

Evan’s comments also fit with the wider pattern of informal control we’ve discovered.

On paper, Brand Setter and Finixio have nothing to do with each other.

In practice, they all know each other and they’re all working together through a network of businesses they control and direct.

Ownership: The Finixio team’s web of assets

The Finixio team don’t just own casinos, crypto projects, and a media empire.

The wallet

There’s also Best Web3, which owns Best Wallet, a crypto wallet app available on the App Store.

https://apps.apple.com/se/developer/best-web3-inc/

Best Wallet also has a website, which lists Best Web3 as the holder way down at the bottom of the page.

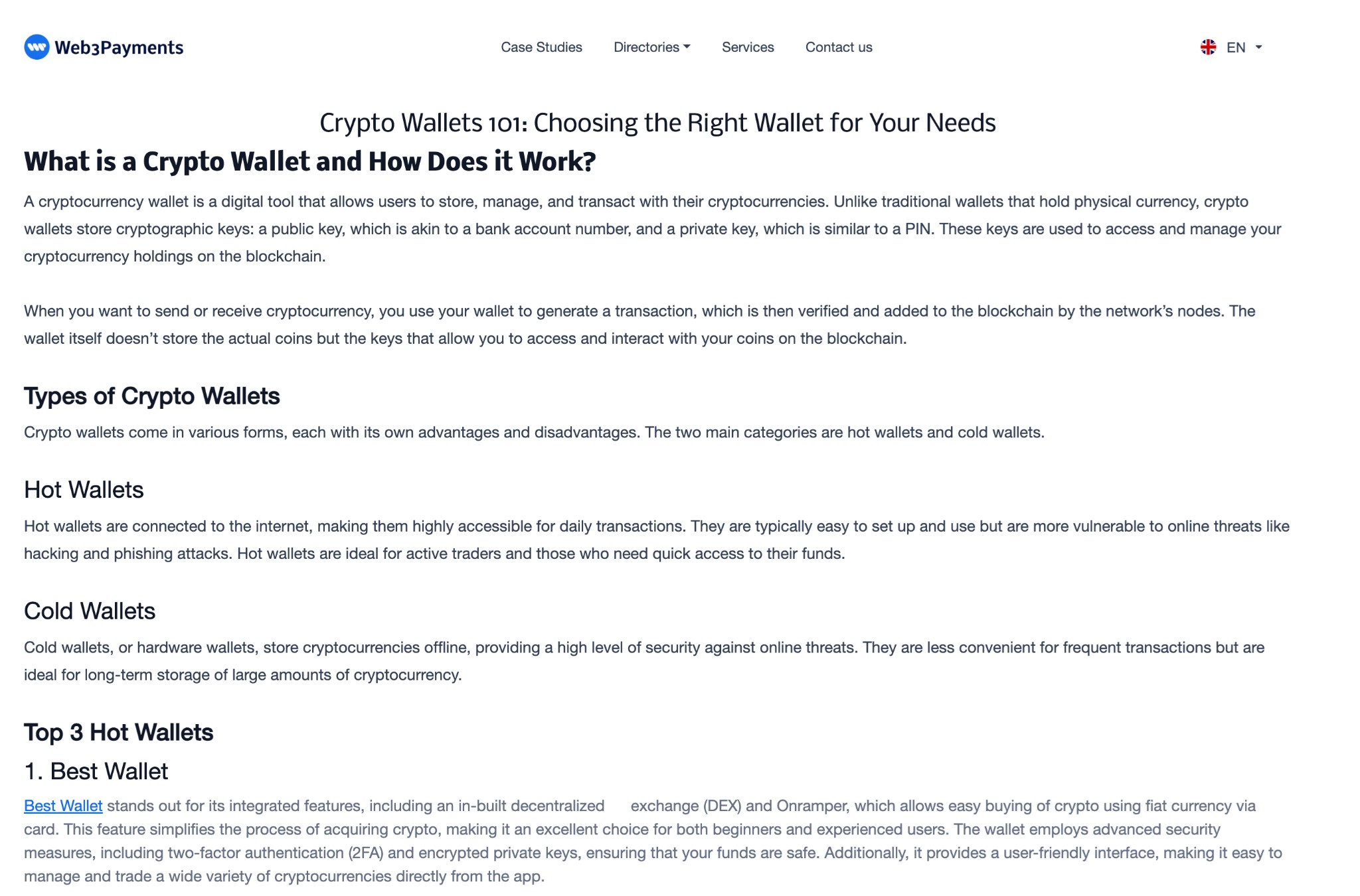

Best Wallet is usually listed as the preferred wallet on memecoins that are traceable to the Finixio/Clickout team or their assets. In guides to the best crypto wallets on Finixio team assets it’s usually at the top. It even gets a place in seemingly-unrelated content that appears on websites the Finixio team own or control. Despite the headline, about two thirds of the wordcount in this article is devoted to advertising Best Wallet:

It’s the wallet that appears in how-to-buy guides on the web pages of the Finixio teams coins.

Best Wallet isn’t just a wallet. It’s a wallet that’s unauthorized by the Financial Conduct Authority (FCA).

https://www.fca.org.uk/news/warnings/best-wallet-bestwalletcom-bestwallettokencom

It has its own token, which has been criticized as a scam marketed through an affiliate network, and the wallet itself has been accused of users’ funds and being involved in deliberate scams.

However it is still enthusiastically promoted by Finixio including 99 Bitcoins.

The payment bridge

There’s a good chance the Finixio team owns (or, you know, someone who owns Finixio also owns) a payment bridge.

This is the payment tool that’s usually offered to customers on their memecoin projects.

The tool is called web3paymentsolutions.

No, not that one…

https://www.web3paymentsolutions.com/

This one:

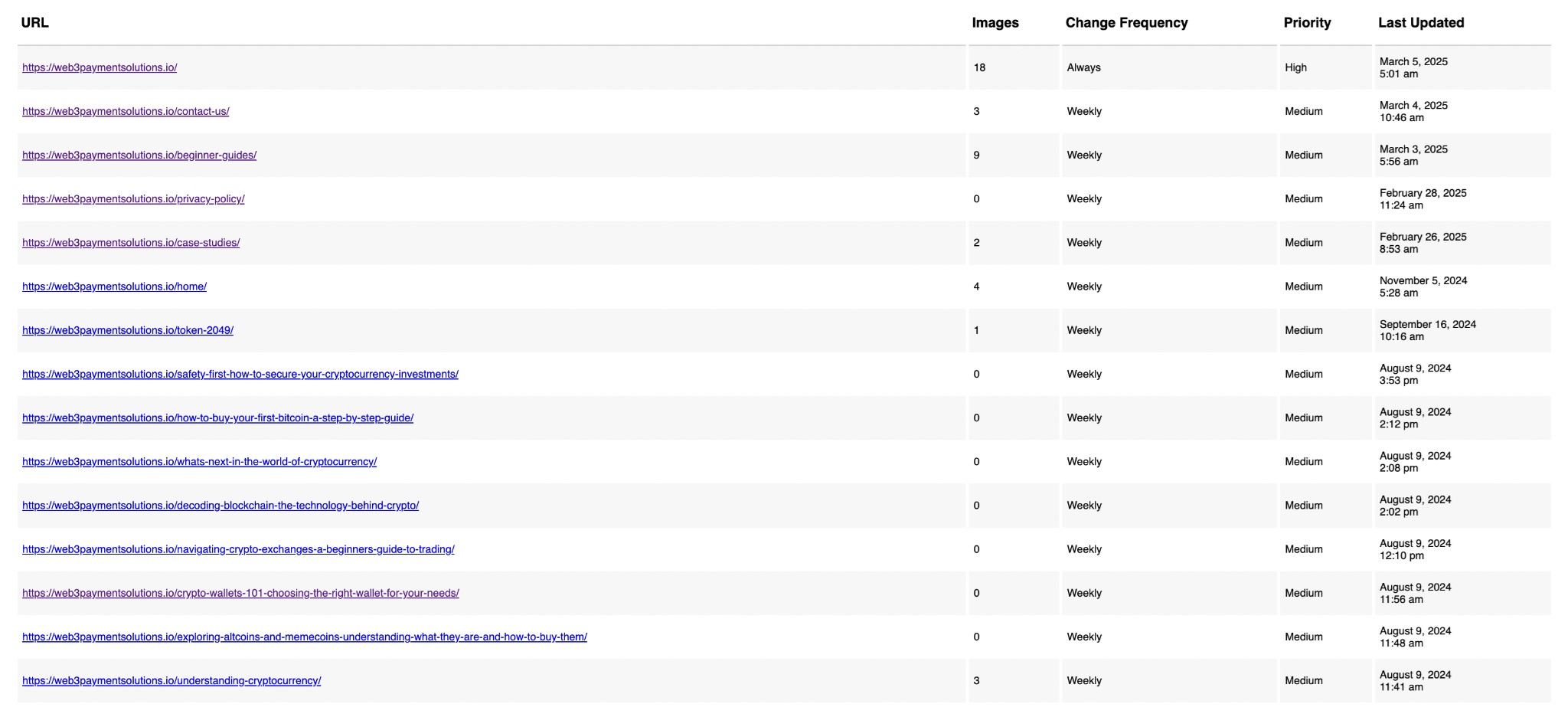

There are a couple of fishy things here. First, check out their sitemap:

https://web3paymentsolutions .io/page-sitemap.xml

It wasn’t very big in March, before they scrubbed it. There was virtually no high-level content — no white papers, ebooks, just a handful of tiny, bare-bones blog posts and guides posted within a couple of months of each other. (Now it’s even smaller, with just six URLs.)

Here’s one of the posts, chosen at random:

https://web3paymentsolutions.io/crypto-wallets-101-choosing-the-right-wallet-for-your-needs/

https://web3paymentsolutions.io/crypto-wallets-101-choosing-the-right-wallet-for-your-needs/

You literally don’t have to get down below the fold before they’re shilling the wallet we’re pretty sure is the Finixio teams. (Look, I’ll level with you. We’re 100% sure. You just have to wait til episode 5 of this series to see the evidence.)

The developer

Which is a bit weird because…

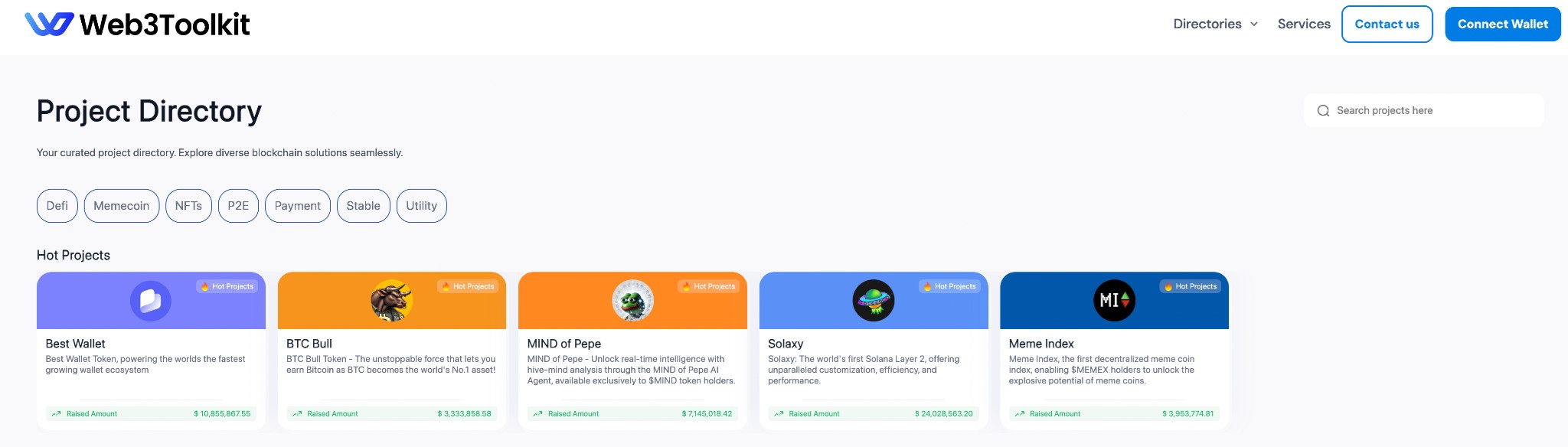

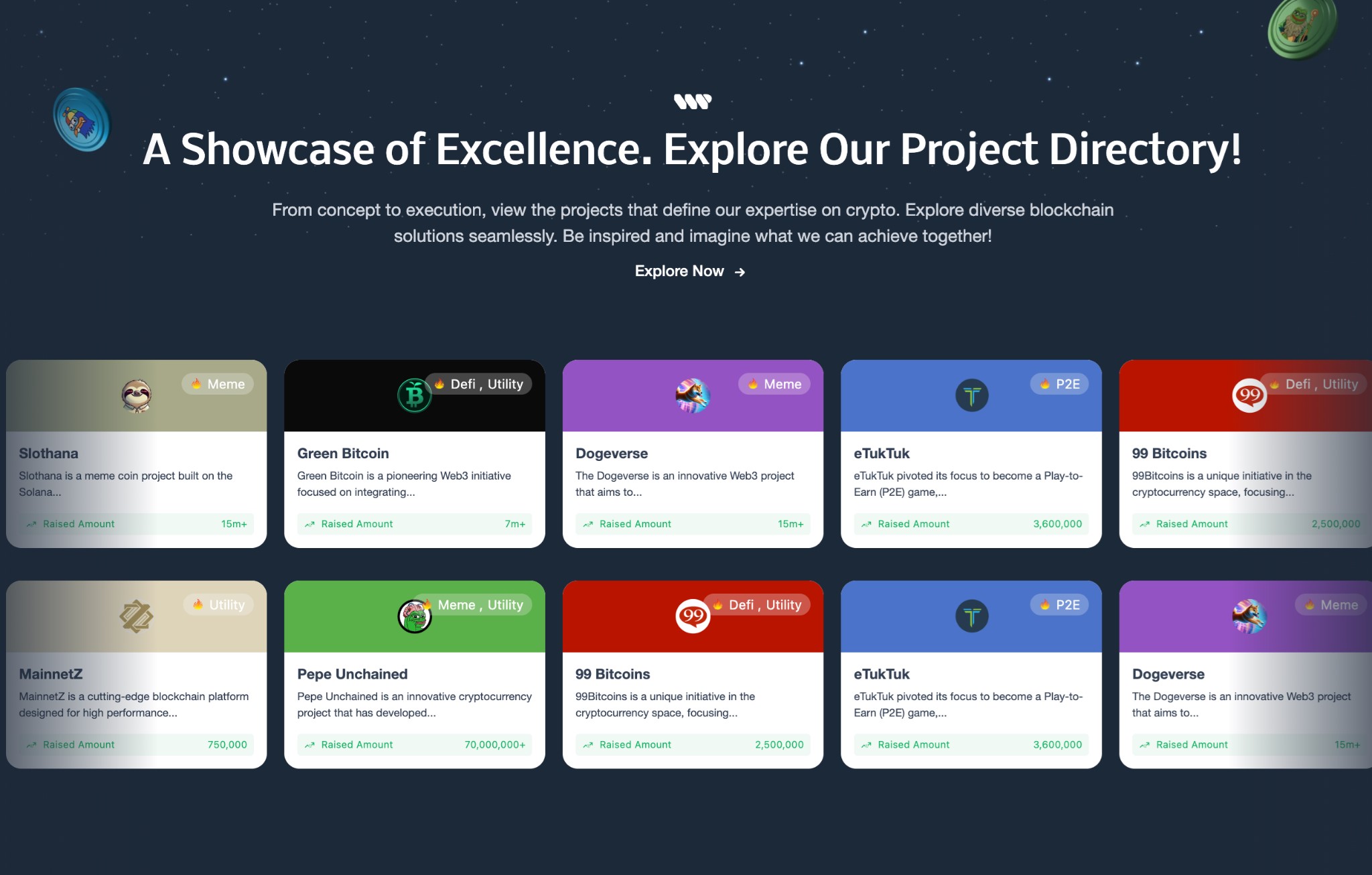

https://web3toolkit.com/en/project-directory/

It kinda looks like they’re the developers.

I wonder what else they’ve developed?

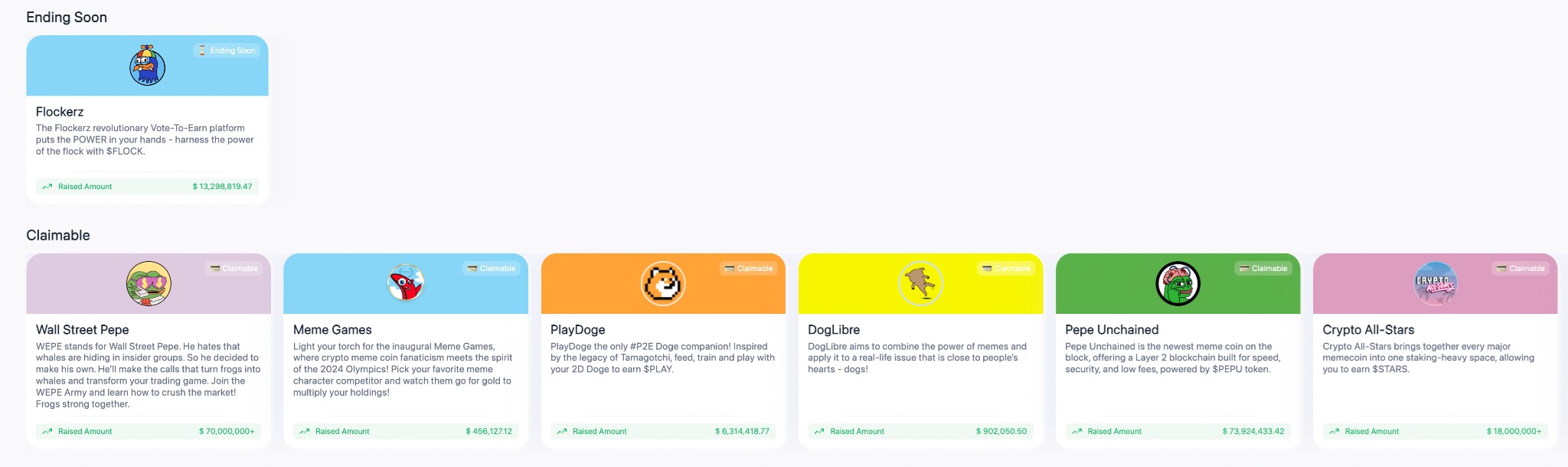

https://web3toolkit.com/en/project-directory

Flockerz, Wall Street Pepe, Pepe Unchained… it’s looking a lot like the same old faces.

(Remember, two of these are linked to Finixio through James Fennel, initially listed as co-founder for both Pepe Unchained and Flockerz.)

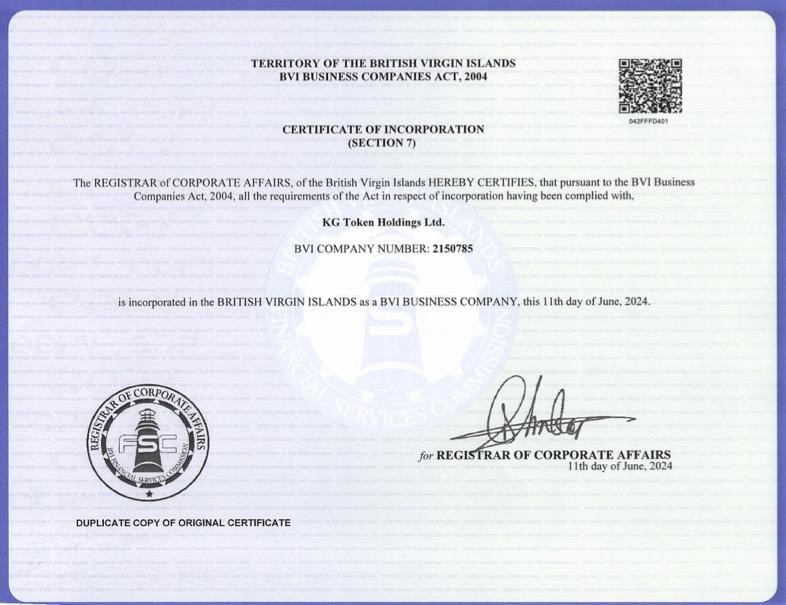

This company is registered in the British Virgin Islands.

https://web3paymentsolutions.io/privacy-policy/

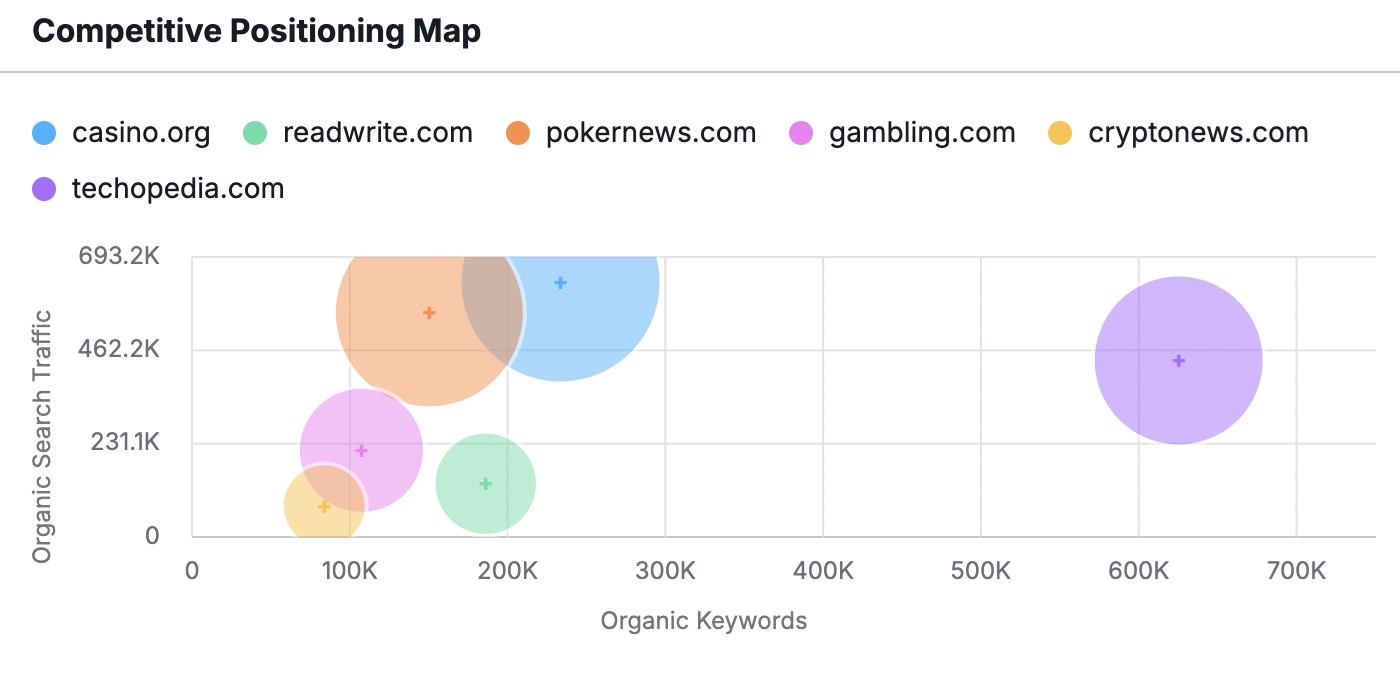

Why would so many of these companies be in the British Virgin Islands? Maybe it’s because there’s virtually no information publicly available from their business registry. If you want to see even the most basic information you have to apply, you have to wait, and you have to pay.

It’s a far cry from the transparency of countries like the UK or most European nations.

The schedule of fees looks like this:

I paid up to see what they had, and here’s what my $75 bought me:

Yes, they’re registered in the British Virgin Islands. No, there is no information on ownership available.

I contacted the business registration authority to ask which document I needed to order to see who owned the company. Here’s the text of their reply:

[Name redacted] (BVI Financial Services Commission)

Mar 12, 2025, 9:31 AM GMT-4

Dear Sirs,

Kindly contact the registered agent of the company to confirm whom the owners of the said company is.

Kind regards,

BVI Financial Services Commission

There are 106 agents for overseas companies registered in the British Virgin Islands, and they act for over 650, overseas companies registered there since 1984. To me this sounds like the place you’d choose to register a business if you wanted minimum transparency, but obviously that’s just my impression based on these facts.

Even without the British Virgin Islands’ help with ownership information I can still show that Web3 Payments is involved with the Finixio team’s memecoins and gambling operation.

In fact this appears to be the digital ‘chop shop’ where these projects are built.

Here’s their contacts page where they showcase these projects:

https://web3paymentsolutions.io/contact-us/

Dogeverse, 99 Bitcoins, Pepe Unchained.

The accelerator

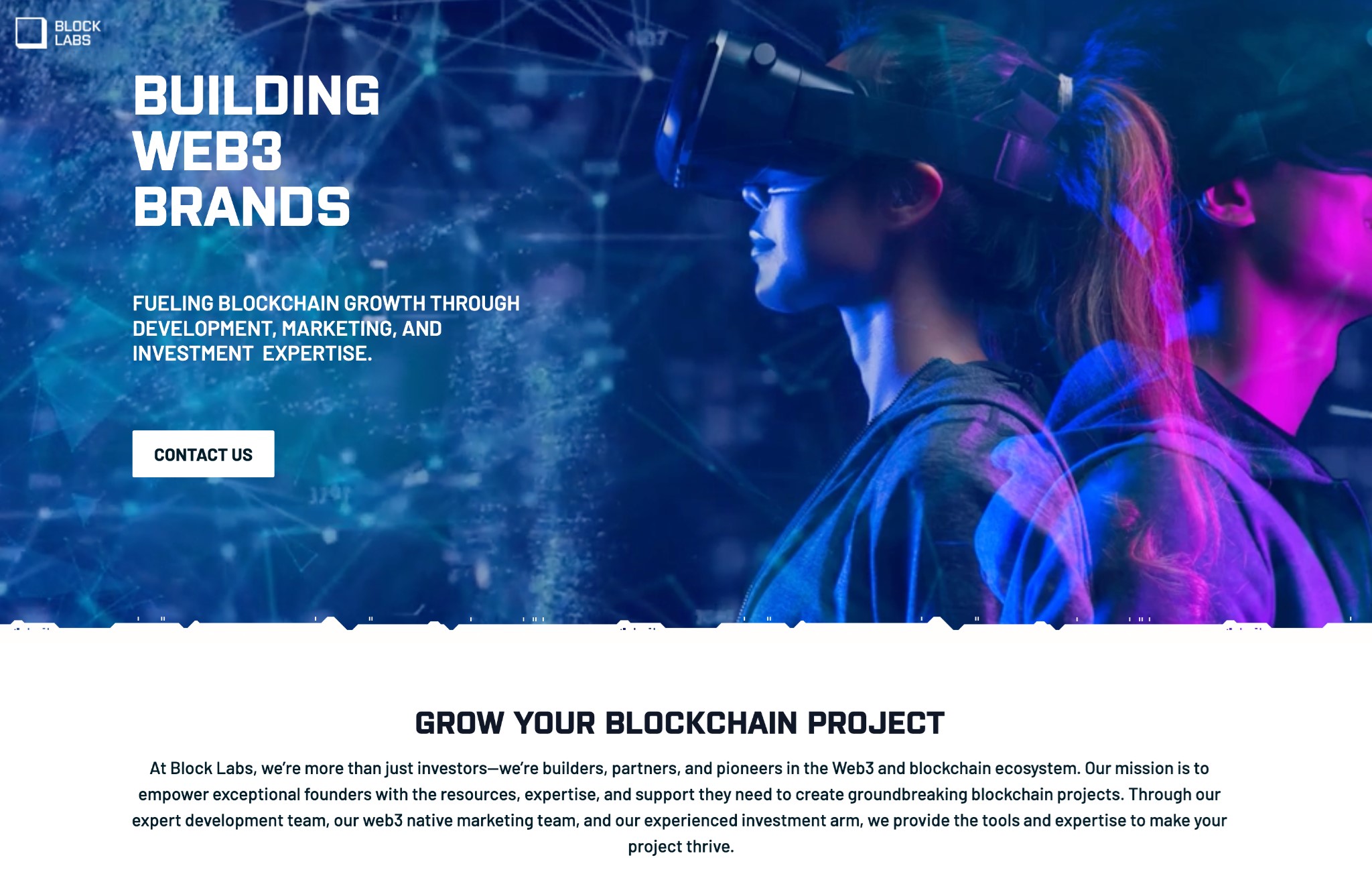

It’s not the only such shop the Finixio team owns. There’s also Block Labs.

I know Block Labs is a Finixio team property: their recruiter told me in a message when she tried to get me to work with them (!):

Imagine fumbling your secretive network of marketing and gambling sites this badly.

This seems to blow a few holes in the ‘technically unrelated’ idea.

(Oh, I also have the official paperwork to prove it… but that’s a post for another day.)

Stop it you guys: the cease and desist lawyer who gave the game away

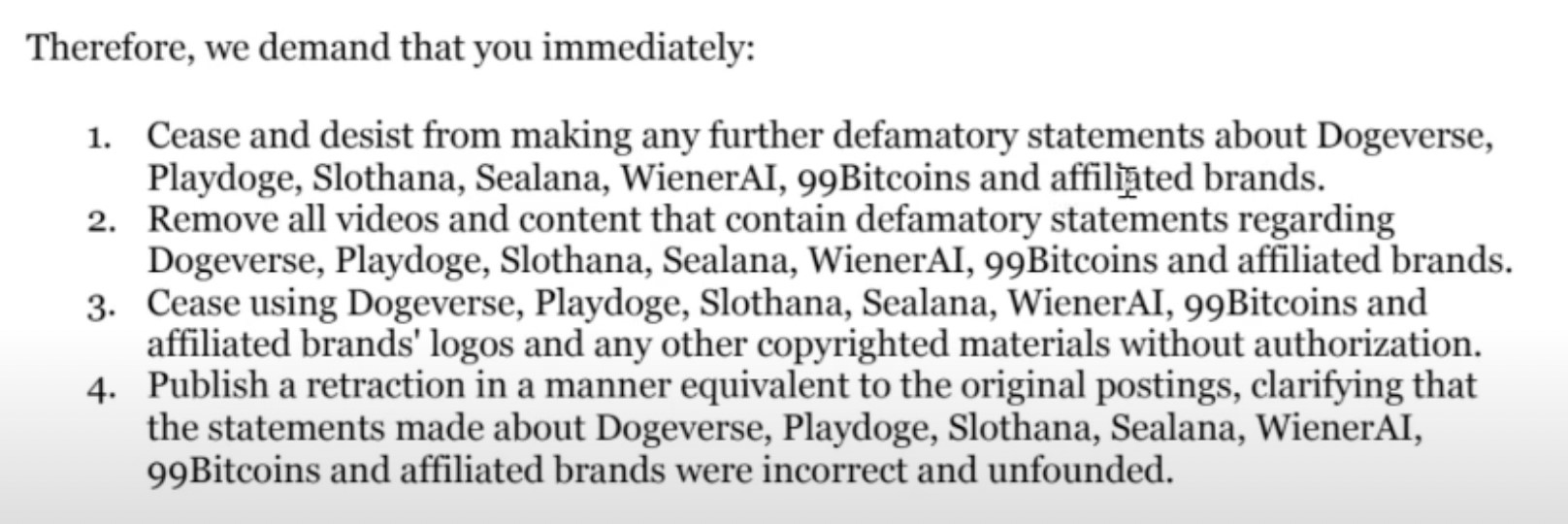

One of the coins advertised by 99 Bitcoins, Dogeverse, was the subject of an investigation by the Net Crypto Youtube channel:

https://www.youtube.com/watch?v=Uoff7gUCpQQ

He found the same lawyer represents all these coins!

This is the lawyer’s office: https://friisadvokatfirma.dk/

They have a presence in Denmark and Dubai.

This law firm knows who’s behind all these coins: their clients.

In the Cease and Desist that Net Crypto received from this law firm, guess who gets a mention?

99 Bitcoins, right there in the mix. They’re ‘affiliated’ with all these coins that they’re promoting on their site and Youtube channel. (Hold on to that; they’re starring in the next episode.)

Like Net Crypto says, it’s great that an actual lawyer is out here cease-and-desisting. Because there are people who have lost their shirts on these scamcoins and need some kind of recourse: as Ben Solwin out, ‘In the long run, none of these tokens have performed well.’ He goes on:

Regarding Dogeverse, something interesting happened. Most, if not all, were unable to claim their ETH-based Dogeverse tokens for hours to days after the launch on Dex. Allegedly, it was an error in the DApp. I strongly suspect it was a strategy like the late airdrops with Sloth. Intentionally creating buy pressure without sell pressure, allowing the price to rise while they sell the first bags from their wallets. I can’t prove it, but it seems like a deliberate pattern.

If you’re not familiar with crypto (like I’m not!):

- ETH-based Dogeverse tokens are tokens that exist on the Ethereum blockchain.

- Launch on DEX: when the token is released for trade on decentralized exchanges, which are easier to get listed on, have no centralized oversight, and have lower liquidity. Their security comes from the blockchain rather than a centralized entity.

- dApp: a decentralized application, a program running on the blockchain.

So, what Ben’s saying here is that it looks like the organization behind Dogeverse has sold tokens in advance, then deliberately held them back while blaming a technical fault. Then, because tokens had been bought but could not be claimed and then sold, a higher-than-expected percentage of the tokens was spoken for; that means the price of the remaining tokens goes up, and thus so does the reputation of the project. This allows the developers to point to the project as a success story, even while investors experience it as a frustration at best, a loss at worst.

To conclusively prove that this had happened, you’d need access to the communications of the team behind the token, or clear traces of the financial transactions that took place off-chain during the presale.

We don’t have that.

But we have evidence of wrongdoing that goes way beyond the circumstantial or the speculative.

This post is the first of a six-part series that explores the Finixio team’s gambling and crypto network in intensive, some might say excruciating, detail. Stay tuned for evidence suggesting financial wrongdoing, terrible Youtube channels, financial shenanigans on-chain and off, the official ownership records for the key business units in the Finixio network, and their tens of millions of Euros in profits.